Is the insurer providing Trump’s fraud bond eligible to do so?

Is the insurer providing Trump’s fraud bond eligible to do so? | Insurance Business America

Insurance News

Is the insurer providing Trump’s fraud bond eligible to do so?

Deadline looms today as ex-president heads to court

Insurance News

By

Ryan Smith

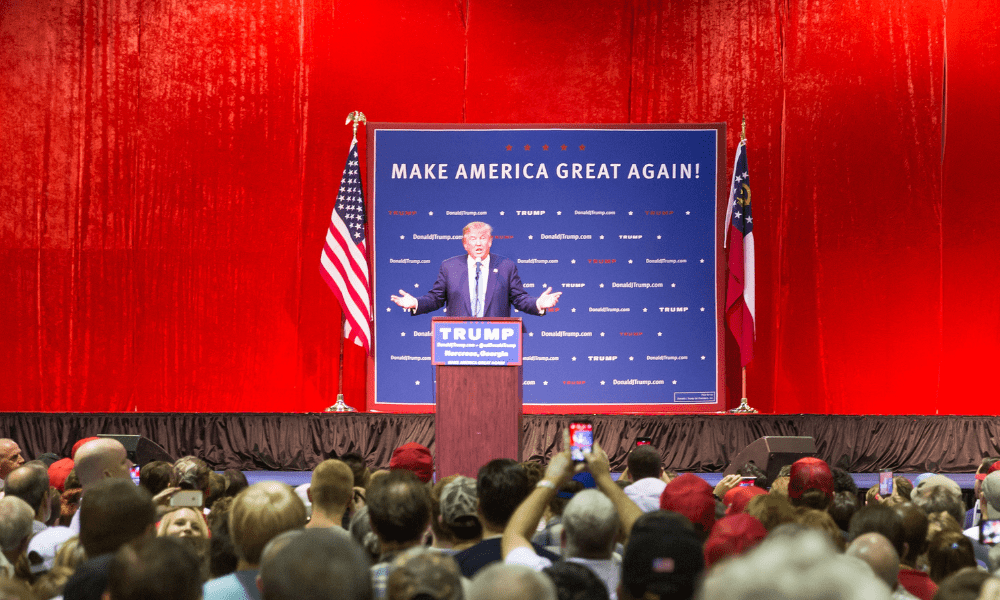

As jury selection begins for Donald Trump’s hush-money trial, the former president also faces a looming deadline related to the recent $454 million civil fraud judgment against him.

Today is the deadline for Trump to demonstrate the adequacy of the $175 million bond he obtained in order to delay payment of the judgment while he appeals the decision, according to a Wall Street Journal report.

Trump was originally required to post a bond for the entire amount of the judgment. However, an appeals court reduced the amount to $175 million after the former president’s legal team said that securing such a large bond was a practical impossibility.

Trump secured the bond earlier this month. However, New York Attorney General Letitia James immediately took exception to the bond, raising questions about the insurer’s financial fitness and qualifications to issue surety bonds in the state of New York. For instance, Knight is not licensed in New York – ordinarily a requirement for issuing surety bonds in the state.

The bond was provided by Knight Specialty Insurance, an obscure insurer that isn’t on the list of federally approved sureties, the Wall Street Journal reported. James demanded that Knight or Trump’s attorneys prove the insurer is qualified to issue the bond – including proving that the insurer is financially solvent and specifying which of Trump’s assets are backing the bond, the Journal reported.

New York Justice Arthur Engoron, who delivered the $454 million judgment against Trump, has scheduled a hearing on the bond issue for April 22. Attorney Adam Pollack, who previously worked in the state AG’s office, told the Wall Street Journal that Engoron could find that the bond doesn’t comply with state law.

“The idea that Trump’s engaging in financial chicanery after being found liable for financial chicanery is something Justice Engoron will have little patience for,” Engoron said.

“Picking a New York surety would have solved a lot of problems,” Brian Ginsberg, partner at law firm Harris Beach, told the publication.

Bond may not meet requirements

Knight is not registered to issue appeal bonds in the state, nor has it obtained a certificate of qualification from the New York Department of Financial Services. Obtaining a certificate of qualification would require the company to show that it is financially solvent and qualified to issue such bonds, the Journal reported.

New York law prohibits a company from making a bond to a single borrower that is more than 10% of its surplus. Knight has $138 million in surplus – which is much less than it’s legally required to have and less than the total of Trump’s bond, the Journal reported. In an early financial filing, Knight included financial information for its parent company, Knight Insurance, which has about $1 billion in surplus. That’s still under the 10% requirement for Trump’s bond.

According to the Journal, there is a process by which a litigant can request an exception in order to obtain a bond from an unlicensed company – but there’s no indication that Trump’s team bothered to undertake that process.

“You show what the collateral is and how it’s held, then provide quarterly updates on the collateral account,” surety bond agency boss Neil Pedersen told the Journal. “The court has to choose to accept it or not.”

If Trump fails to meet the Monday deadline for showing the fitness of the bond, the New York attorney general could begin enforcing the fraud ruling, the Journal reported. That could include seizing the former president’s assets to satisfy the judgment.

Have something to say about this story? Let us know in the comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!