Biden's Billionaire Tax Would Punish Long-Term Investors

This isn’t a mere technicality. It goes to the heart of what a progressive tax system is trying to accomplish. To the extent someone keeps her wealth in investments, instead of spending it, she is providing the economy with the tools and equipment it needs to increase productivity and wages. That is precisely the kind of behavior a capitalist system should encourage.

The current system encourages this by not taxing investments; instead, the more ostentatious their lifestyle, the more taxes the wealthy pay. The theory is that it is better to tax this largely unproductive consumption than to tax capital gains, even if they allow great wealth to accrue.

Other Features

Biden’s proposal undoes that trade-off, but awkwardly. Even liberal economists acknowledge how punitive strict enforcement of a 20% tax would be on the longest-term investors.

The only virtue of this approach is that it would prevent the ultrawealthy from avoiding capital gains taxes entirely, as many do now by holding on to their assets until they die.

At that point, their assets are subject to the inheritance tax — but so are any cash gains that have already been realized. The loophole to the estate tax is that if the heirs then sell their inherited assets immediately, they owe no capital gains tax. They pay capital gains only on the amount the asset increased in value since they inherited it.

This feature, known as the step-up in basis provision, encourages heirs to liquidate their inheritance rather than keeping it invested in the economy.

By eliminating this provision, Congress could reap most of the benefits of Biden’s proposal without further complicating the tax code and discouraging long-term investment strategies. This is the approach Congress should take.

Karl W. Smith is a Bloomberg Opinion columnist. He was formerly vice president for federal policy at the Tax Foundation and assistant professor of economics at the University of North Carolina. He is also co-founder of the economics blog Modeled Behavior. Reach him at [email protected]

***

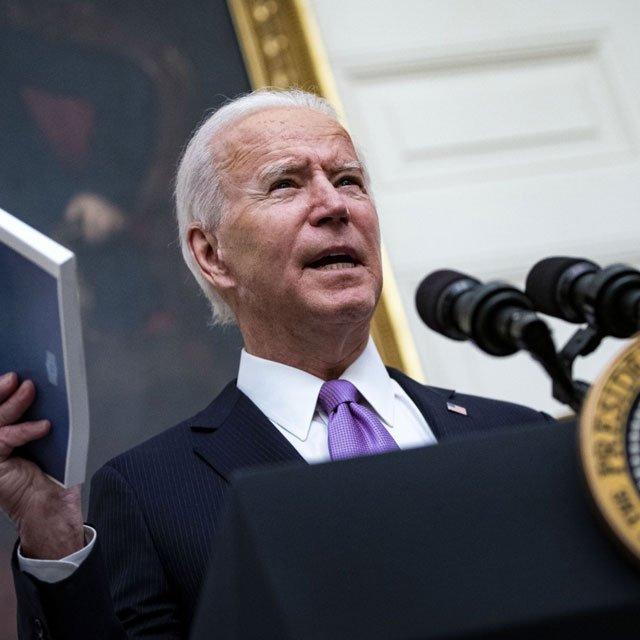

(Photo: Al Drago/Bloomberg)