First Home Scheme Ireland | Your Plain English Guide

For most of you poor First-Time Buyers, it’s more likely you’ll get the moon before you buy a home.

The housing crisis is that messed up.

The word crisis doesn’t do justice; an effing shitshow is more to the point.

Dublin house prices, for example, Jaysus!

If you’re looking to buy anywhere, especially in Dublin’s Fair City, my heart goes out to you.

We were contemplating buying in Dublin back in 2008 but saw sense and moved to Tullamore – although we bought in 2008 just before the crash, so maybe not that sensible.

But we got through it, have a tracker, and the house value is back to what we paid, so if that’s not an indication of another imminent crash, I don’t know what is.

That ends this blog’s “old-man tells stories about his past” segment.

What about the here and now?

A few schemes are supposed to help first-time buyers take that precarious first step onto the property ladder, such as the Help to Buy Scheme and the Local Authority Homeloan Scheme.

But what’s this?

Instead of building more actual houses, our esteemed leaders have dreamed up a shiny new scheme to help you own your own home!

What is ‘The First Home Scheme’ (FHS)

But what is this supposed white knight, and how does it even work?

Put simply; the FHS will allow you to bridge the financial gap between your deposit, mortgage and the price of your new home.

How do they do this?

To receive funds from the First Home Scheme, you must give the FHS a percentage of ownership in your new home.

So, basically, it’s a shared equity scheme.

You will own some of the house – your deposit.

The bank will own the majority of your house – the mortgage

The First Home Scheme will own the balance (minimum of 2.5% up to a maximum of 30%)

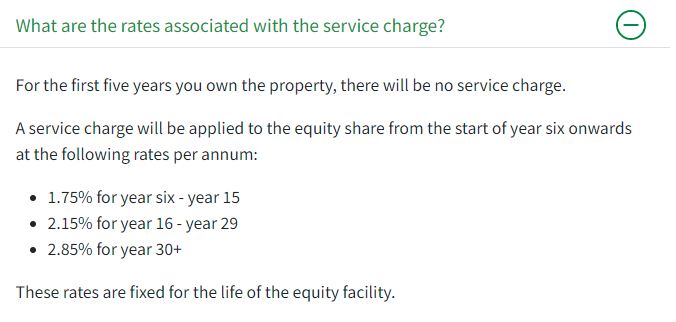

Oh, and once you hit year 6 of this shared equity scheme, you will have to pay a service charge to the FHS towards the maintenance, provision, and servicing of the equity facility.

In other words, the FHS will take ownership of a piece of your gaff upfront and charge you for the privilege after six years.

But you can buy back the part they own at any time by getting a valuation of your property done (at your expense) and paying back at least 5% of the equity owed.

The FHS must be paid off in full if you sell the property.

So, How Do I Join The First Home Scheme?

There are a few boxes you’ll need to tick if you want to use the first home scheme; they include:

Be over 18 years old (lols at the thought of anyone under 30 contemplating home ownership in Ireland)

Be a first-time buyer (There are opportunities for non-first-time buyers also – keep scrolling)

Have mortgage approval from a lender who is participating in the FHS (BOI, EBS, PTSB, HAVEN, AIB)

You must know Adhrán na BhFiann off by heart.

Borrowing the maximum mortgage amount available from your lender

Have a minimum of 10% deposit if you’re a FTB (or 20% for other eligible buyers, see below)

Buying a residential home (not an investment)

You must have played County.

Purchase a property within the property pricing brackets (for Dublin, the max purchase price is €450k for a new build house and €500k for a new build apartment – good luck!)

You can’t avail of the FHS and an income exception from your bank – you must choose one.

If you have ever consumed Avo on Toast, there’s no question: YOU DO NOT QUALIFY.

But the big one is that you can only use the First Home Scheme for new builds. So, if you have your eye on a beautiful 18th-century farm cottage, this scheme definitely won’t help you.

Yup, not gonna lie. That is an insane amount of rules, but if you can put a green tick next to every single one, this could be your chance to buy a home.

What If I’m Not A First Time Buyer?

Fear not; there’s still hope for you!

If you have purchased a home, you may still be eligible for the First Home Scheme.

The Government has something called ‘Fresh Start’.

This means that those who are separated, divorced, or your relationship has ended, meaning you’ve had to leave a home you may have jointly bought, can still apply and will more than likely score a golden ticket for this scheme.

Lucky for you, the First Home Scheme website can remove some of the jitteriness about whether you are eligible or not with their eligibility calculator. 👏

Is the First Home Scheme Guaranteed if You’re Eligible?

No, it’s not a given, even if the magical online calculator says so. The questions it will ask are pretty basic and don’t go into depth, but it’s a good place to start.

Can Two People Apply for the First Home Scheme?

Yes, the First Home Scheme allows joint applications. Whoop!

Does The First Home Scheme Have Any Limitations?

Ah, those sneaky limitations always put a damper on most scheme-related parades.

But, yes, there are some limitations, besides the obvious eligibility issues.

The First Home Scheme can fund up to 30% of the property’s market value. So, if the financial gap between your deposit and mortgage is more than 30% of the property value, well, you’re shit out of luck here, son.

This scheme only goes so far to help the regular Joe, and looking at property prices in Dublin; I’d bet my life – or at least a limb – that are still thousands who won’t find any solace from this housing scheme.

Can I Avail Of The Help To Buy Scheme At The Same Time As The FHS?

Ooh, you’ve done your research.

You can use HTB and FHS in tandem, but if you are using the Help To Buy Scheme to purchase your first home, the First Home Scheme will only fund a maximum of 20% of the property’s market value price.

Is The First Home Scheme A Good Thing?

It will be for some people, but it could wreck the home-buying dreams of others.

Why?

Well, it will put more first-time buyers in a position to buy a home and, in doing so, will increase demand.

If there is an increase in demand without an increase in supply, simple economics tells us that it will raise prices.

Look, our Government, just like many others, have their thumbs up its arses and its heads in the sand when it comes to the difficulties the majority face when it comes to something that should be simple, like owning a home.

The FHS is not a magic wand that will make all the issues many of you first-time buyers experience disappear.

But for some of you, the First Home Scheme opens a door of opportunity.

And if it gets you onto the property ladder and living in your dream home, then even better.

Now, applications have just opened for this new scheme, and I expect an alarming number of hopeful property buyers have already bombarded it. The Government expects that this €400,000,000 (million) scheme, yes, you read that right, will help fund up to 8,000 homes over the next four years.

So, if you’re ready to take a helping hand, get your skates on and get that application in.

Good luck!!

And come back to us for your Mortgage Protection.

😜

Thanks for reading

Nick