Lincoln Financial to Tilt Away From Some Term Life Products

What You Need to Know

Lincoln reported a profit for the latest quarter.

It is not happy with the more competitive end of the term life market.

It still likes the permanent life market.

Lincoln Financial plans to reduce sales of some types of term life insurance to stem the amount of capital flowing into a relatively small part of its business.

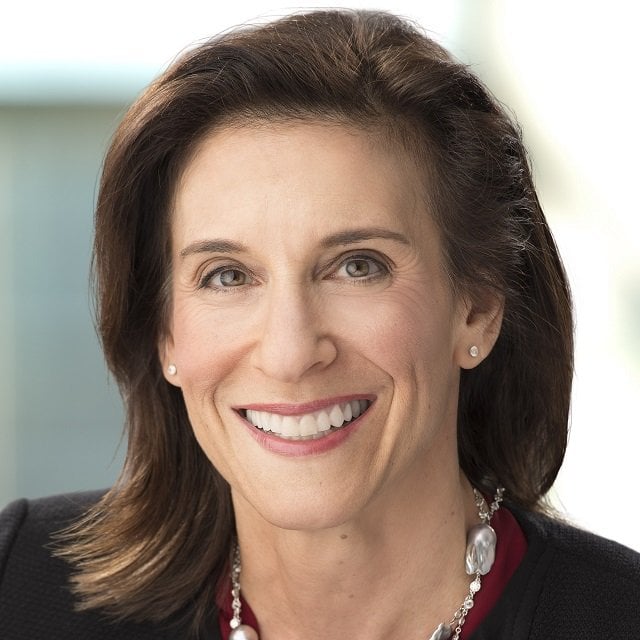

Ellen Cooper, the company’s CEO, said Thursday that it will still write some term life products, with high levels of death benefits and high profit margins, but that it will back away from policies with low profit margins and little appeal to its top distributors.

Randal Freitag, the chief financial officer, cited “a 30-year term product sold on one of the aggregator platforms” as the type of product that will get less marketing support.

Cooper and Freitag talked about term life products during a conference call the company held with securities analysts to go over earnings for the fourth quarter of 2022. The call was streamed live online, and a recording is available on the web.

What It Means

Clients who need relatively modest levels of death benefit protection should consider buying coverage quickly.

Lincoln’s move might be a sign that competition in that corner of the market will be cooling off.

The Earnings

Lincoln is reporting $1 million in net income for the fourth quarter of 2022 on $4.2 billion in revenue, compared with $220 million in net income on $4.6 billion in revenue for the fourth quarter of 2021.

The Radnor, Pennsylvania-based life insurer’s spending on sales commissions increased to $1.4 billion, from $1.3 billion.

Total sales of individual life insurance fell to $186 million, from $254 million, with term life sales dropping to $39 million, from $47 million.