Medicare Posts $12B Loss for 2023

What You Need to Know

Medicare trustees moved the inpatient hospital benefits fund depletion date back to 2036, from 2031.

The trustees continue to believe that the situation is worse than it officially looks.

The trustees now include some assumptions for what life will be like in 2098.

The post-pandemic surge in health care use, the aging U.S. population and health care worker shortages hit Medicare hard in 2023.

The giant U.S. health insurance program lost $12 billion in 2023 on $1 trillion in revenue, compared with an $83 billion gain on $989 billion in revenue in 2022, according to the latest Medicare trustees’ report.

Payroll tax revenue rose 4.1%, to $367 billion. Higher interest rates pushed interest income up 27%, to $10 billion.

But spending climbed to $15,547 per enrollee, up 15% from the 2022 average, and the effects of soaring costs swamped the effects of modest revenue growth.

What it means: Medicare losses will push Medicare program managers and members of Congress to look for ways to cut benefit costs and add revenue.

The Medicare money hunt will put pressure on lawmakers to let the estate tax exemption spring back to the pre-2017 level in 2026 and reduce or eliminate other federal tax breaks.

Any changes could complicate planning for clients but increase demand for the kinds of life insurance products and trust services that wealthy taxpayers use to cope with taxes.

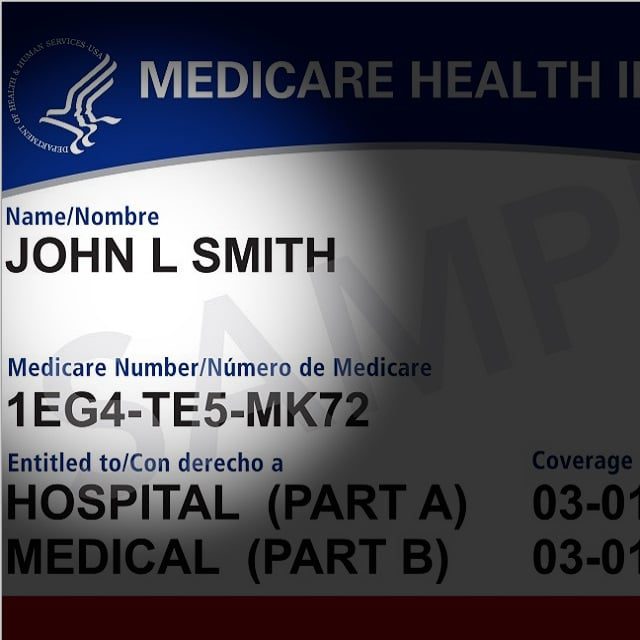

Medicare basics: Medicare is a federal program that pays for health care for 66.7 million U.S. residents ages 65 and older, many people with disabilities, and many people with kidney disease severe enough that they need dialysis or a transplant.

Because of the nature of the laws used to create and expand Medicare, Medicare has three major parts. Each part has its own financing system.

The Medicare Part A program pays for inpatient hospital care for 58.7 million people.

In 2023, it generated $415 billion in revenue, including $367 billion in payroll tax revenue, $4.9 billion in premium payments, $5.7 billion in interest income and just $1.2 billion in federal government subsidies. Subsidies accounted for less than 1% of its spending.

Medicare Part B pays for physician and outpatient hospital services for 54 million people.

It generated $481 billion in revenue, including $131 billion in premiums and $342 billion in federal subsidies. The subsidies paid for 68% of its spending.

The Medicare Part D program pays for prescription drugs for 45 million people.

It generated $128 billion in revenue, including just $19 billion in premiums and $95 billion in subsidies. The subsidies paid for 72% of its spending.