What Wall Street Is Saying About the Fed's Rate Hike

Zachary Hill, head of portfolio management at Horizon Investments, ahead of the news conference: “At first blush, the 2 pm release screams hawkish, including the language around ongoing hikes in the statement and the distribution of the 23 dots. But the SEP also increased the amount of cuts in 2024 to 4, which is close enough to the market for the bulls to validate the pricing of a soft landing.”

Oscar Munoz, U.S. macro strategist at TD Securities, on Powell’s comments: “He’s matching what the dot plot is now telling you. He is not downplaying the dots as he has done in the recent past. That is hawkish in itself.”

Jay Hatfield, founder and CEO at Infrastructure Capital Advisors: “The key driver of stock and bond prices before the presser is the dot plot which came in about 25bp above what was priced into Fed Funds futures. We believe that the increase in the dot plot was well signaled so the impact on the bond and stock market is very small.”

Seema Shah, chief global strategist at Principal Asset Management: “The Fed still remains coy about the possibility of recession, but with most Fed officials considering risks to be tilted to the downside, it’s fair to say they are far more worried about the economic outlook than they are willing to admit. This should mark the death knell for the most recent bear market rally. Policy rates have already risen 425 bps this year alone, have further to rise, and will not fall next year – and all this information to digest before the inevitable economic recession sets in.”

Scott Minerd, Guggenheim Partners Global CIO, on Bloomberg Television: “The one piece of historical data I can hang my hat on is that the Fed has consistently been wrong on its projections.”

Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities: “Markets are ready to challenge the Fed here” with 2-year yields well below the Fed’s aim of a 5% policy rate.

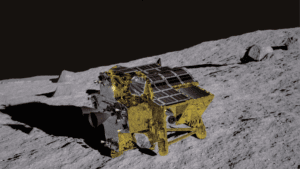

(Image: Shutterstock)