5-Star Carriers 2022

Jump to winners | Jump to methodology

Carrying on

Carriers are the foundation of the insurance market, but according to 44% of brokers canvassed as part of Insurance Business Canada’s 2022 5-Star Carrier awards, the current market is “difficult.”

Andrew Voroney, EVP and COO of award winner SGI Canada, concurs, and labels the market as “turbulent.”

One broker, who took part in our survey, summed up the relationship they want with a carrier, “Make us feel like brokers matter. Don’t pander to us and pay lip service to your commitment to the broker channel. Put your money where your mouth is.”

The 5-Star winners in 2022 are those carriers that are combating these tough times to excel and continually meet the high standards demanded of them by the industry.

“We have long-serving employees and a leadership group that has grown up in the company, which results in decision-making based on the long-term strategic direction of the company”

Andrew Voroney, SGI Canada

So, how are this year’s 5-Star winners rising above the rest?

“Supporting the customer through all their relationships with our broker partners and offering a robust set of options can simplify their needs and allow us to better support their offices in many ways,” says Voroney.

Meanwhile, Paul Jackson, COO of award winner Gore Mutual Insurance, understands brokers’ concerns. “This year has been challenging for the industry on several fronts, including significant weather events and unprecedented supply chain pressures,” he explains. “Our team has worked incredibly hard to stay on top of processing and servicing, and I’m pleased to say that most of our operational metrics are in line with targets, which means most of our brokers and customers are getting the service they expect.

Daniel Andresen, vice president of claims at Peace Hills Insurance, also a 5-Star winner, says the past year has been challenging as businesses have adapted to the post-COVID world. “Inflation has been a factor, as have supply chain issues, rental car shortages and a lack of people resources,” he says. “Throughout this time, we have continued to focus on our policyholders and delivering on our promises to them. We have maintained full staff levels and provided additional digital tools to help our file handlers become more efficient in their processes, whether they are working in the office or at home.

“We have remained empathetic to the frustrations that claimants are faced with following a loss and have tried to look for creative solutions to provide fast and fair settlements, even if it means being flexible in our own processes. Being nimble and able to adapt quickly has served us well and allowed us to make claims processing improvements that will have a lasting impact.”

“In less than three years, we have replaced all our legacy systems and operating models, doubled our workforce and unlocked our ability to scale the business efficiently and fast”

Paul Jackson, Gore Mutual Insurance

Paul Jackson, Gore Mutual Insurance

What makes brokers want to do business?

With the industry enduring tough times, it’s more important than ever for carriers to respond to the needs of brokers.

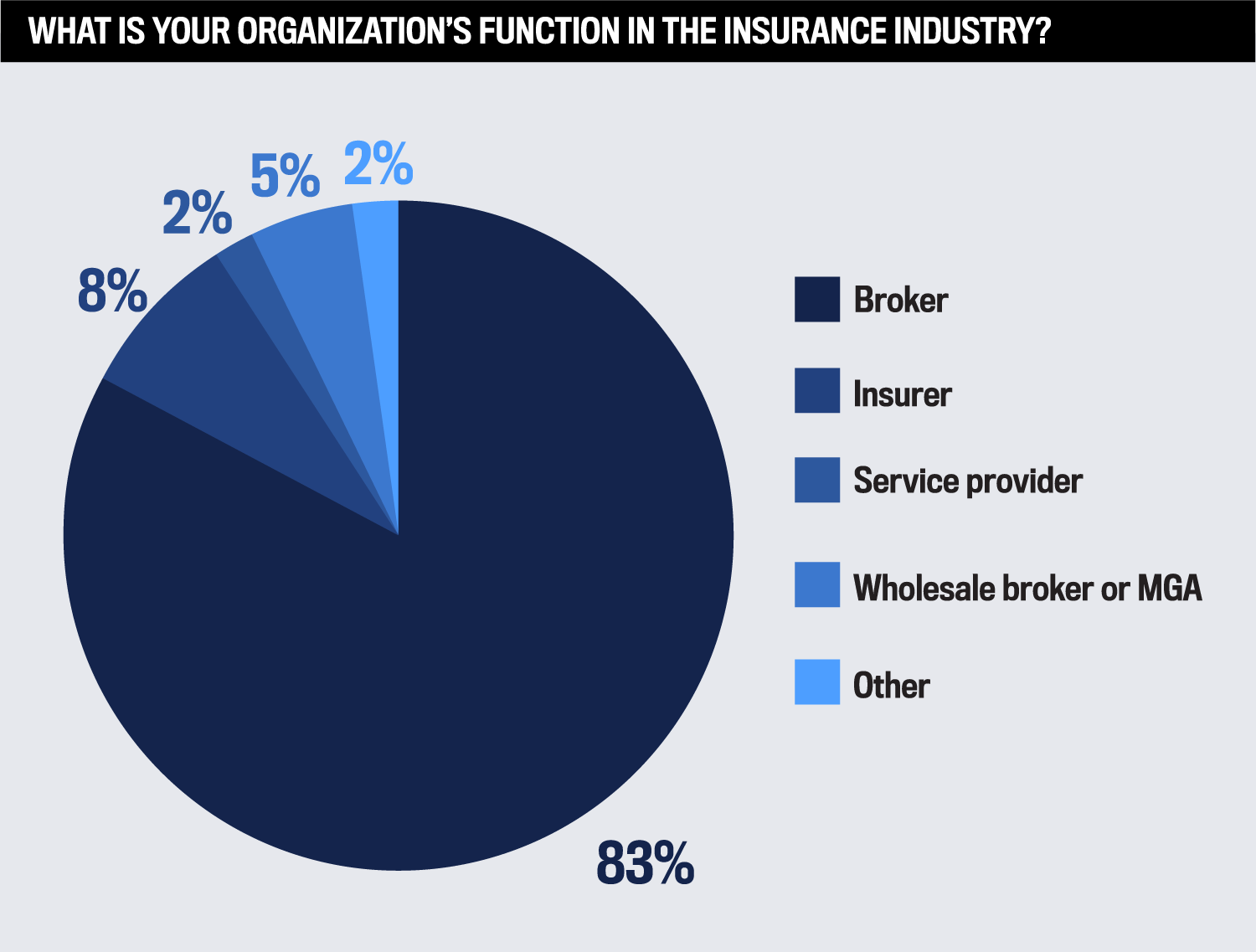

Hundreds of Canadian brokers took part in IBC’s survey and offered their unfiltered views about what carriers can do to keep their custom and also attract other brokers.

One says, “Reduce wait times or give senior brokers at brokerages the ability to help their teams quickly navigate through portal changes that require underwriter intervention.”

While another adds, “Increased service and direct underwriters, so we can call them directly and not a call center.”

Another respondent commented, “Be competitive and respond to brokers faster”.

Other brokers replied to what a carrier can do to retain their business with, “Better communication with underwriters” and “have shorter times for getting back to brokers with answers; the only quick returns I have are on declines from underwriters”.

One broker also asked for more flexibility: “Have an open mind and common sense, and be willing to work with the broker. Have a conversation and listen versus trying to fit each client into a cookie cutter”.

Also mentioned by brokers was the now common remote working environment. One respondent comments, “Not all carriers have handled work from home as well as others, and those carriers’ service levels have worsened”.

Why do the winners stand out?

Commenting on Aviva, a 5-Star winner in product innovation, range of products and overall service level, one of the survey respondents says, “They are a great broker partner with competitive rates and a wide range of products.”

Another broker who deals with Aviva praised the company’s “commercial policy package” as its top product.

Fellow winners Unica Insurance was recognized in seven categories including claims processing, quick quotes and competitive rates. Backing up the firm’s widespread success, another broker says, “The company is great to deal with – from underwriter, claims and accounting. The service is terrific.” Unica was also commended by brokers for its small business owners’ packages.

Pembridge earned recognition from brokers for its home and auto products, whereas Intact was praised by respondents for its offering in commercial property and liability.

Personal lines and home and auto were products that brokers highlighted offered by Travelers, while Intact earned plaudits for its commercial property products.

“Demands for reinsurance capacity have never been higher, and this will come at a cost. The good news is that, generally, most Canadian markets have done very well in 2022 and should be able to take on some of this exposure themselves and avoid passing it all on to the consumer”

Les Chabai, Peace Hills Insurance

Les Chabai, Peace Hills Insurance

What improvements do brokers want?

It’s vital for carriers to appreciate what areas they could adapt in order to be a more valuable partner to brokers.

IBC asked brokers to reveal what they would like to see the carriers they work with do, to make the working relationship even more beneficial.

One broker says, “It would be a wider range of products and a lower minimum threshold.”

Another adds, “It would be more experienced underwriters with expertise” while a broker who deals with 5-Star winners Pembridge says, “They should reduce the servicing and processing time of the files”.

Other comments on general improvements that brokers would like to see their carriers introduce were “[expanding] risk eligibility” and “when doing changes on their system, allowing two changes with [the] same effective date” and also “underwriting management must stop micromanaging”.

A respondent who works with 5-Star winner Travelers adds, “Travelers no longer ‘holds covered’ on some risks, creating additional work for brokers. This is especially frustrating when the change involves their old Policy Management System because one change has to clear in their system before another can be initiated.”

“We have remained empathetic to the frustrations that claimants are faced with following a loss and have tried to look for creative solutions to provide fast and fair settlements, even if it means being flexible in our own processes”

Daniel Andresen, Peace Hill Insurance

Daniel Andresen, Peace Hill Insurance

Competitive differentiators and quants

It’s not only their reactions to industry-wide issues that have allowed our 5-Star winners to stand out. They also have their own internal ways of working that have earned them recognition.

Voroney says his company’s approach is to remain stable, consistent and sophisticated.

SGI Canada adopts a long-term view on profits and growth and is deliberate in its approach to entering new markets. “We have long-serving employees and a leadership group that has grown up in the company, which results in decision-making based on the long-term strategic direction of the company,” he says. “We apply disciplined due diligence before launching new products or entering new markets, and if the results aren’t what we expect, we adjust in a responsible way and time frame for both the customer and broker.”

A national customer survey ranked SGI Canada number two in customer experience compared with the top 10 largest insurance companies in Canada. An internal survey said a record-high 87.4% of brokers were satisfied with their relationships with SGI Canada.

Meanwhile, Gore Mutual Insurance attributes its competitiveness to several factors. “I’m proud of our performance in this survey, and I think it reflects the sheer scale and pace of our transformation,” says Jackson. “In less than three years, we have replaced all our legacy systems and operating models, doubled our workforce and unlocked our ability to scale the business efficiently and fast.

“Our north star has always been to make Gore Mutual Insurance an easy and natural choice for brokers, and that means simple products, competitive pricing and great services.

“This is coming to life already in our personal lines business, where over 90% of transactions are handled without human intervention, and our teams answer most broker calls in 60 seconds or less. In IRCA, our pricing and coverage are competitive, we guarantee quotes in under two hours, and our seasonal property product offers year-round short-term rental coverage.”

Meanwhile, Gore Mutual Insurance had a strong year in 2021 and expects to grow by 12% this year, while maintaining a 64% loss ratio. It has automated over 90% of its transactions, and the company’s call centre answers calls in 60 seconds or less.

Continued drive for excellence

All the signs point to a continued challenging market, but IBC’s 5-Star winners are ready to embrace those difficulties and once again deliver for their clients and brokers.

“Insurance is a resilient industry, but this year is proving to be a challenge for sure,” Jackson says.

“In Canada specifically, the consolidation of carriers and distribution continues at an extraordinary pace, which we expect to continue. There is still fragmentation in the market, and we do see both the strategic and financial benefits of scale and diversification.”

Meanwhile, Chabai remains optimistic about the next 12 months. “The Canadian insurance space is going to see a challenge in 2023,” he comments. “While there are signs of some softening in some commercial spaces, others are not going to see this. Demands for reinsurance capacity have never been higher, and this will come at a cost. The good news is that, generally, most Canadian markets have done very well in 2022 and should be able to take on some of this exposure themselves and avoid passing it all on to the consumer.”

Overall service level

Intact Insurance

Saskatchewan Mutual Insurance

SGI Canada

Travelers

Unica Insurance

Zurich Canada

Product innovation

Gore Mutual

Intact Insurance

Saskatchewan Mutual Insurance

Claims processing

Peace Hills Insurance

Saskatchewan Mutual Insurance

SGI Canada

Unica Insurance

Zurich Canada

Quick quotes

Pembridge

Saskatchewan Mutual Insurance

Unica Insurance

Zurich Canada

Broker communication

Intact Insurance

Saskatchewan Mutual Insurance

Unica Insurance

Wawanesa Insurance

Zurich Canada

Competitive rates

Gore Mutual

Pembridge

Saskatchewan Mutual Insurance

Unica Insurance

Range of products

Gore Mutual

Intact Insurance

Saskatchewan Mutual Insurance

Unica Insurance

Zurich Canada

Online platforms and services

Economical/Definity

Saskatchewan Mutual Insurance

Underwriting expertise

Economical/Definity

Gore Mutual

Intact Insurance

Saskatchewan Mutual Insurance

SGI Canada

Travelers

Unica Insurance

Zurich Canada

Appetite for niche and emerging risks

Saskatchewan Mutual Insurance

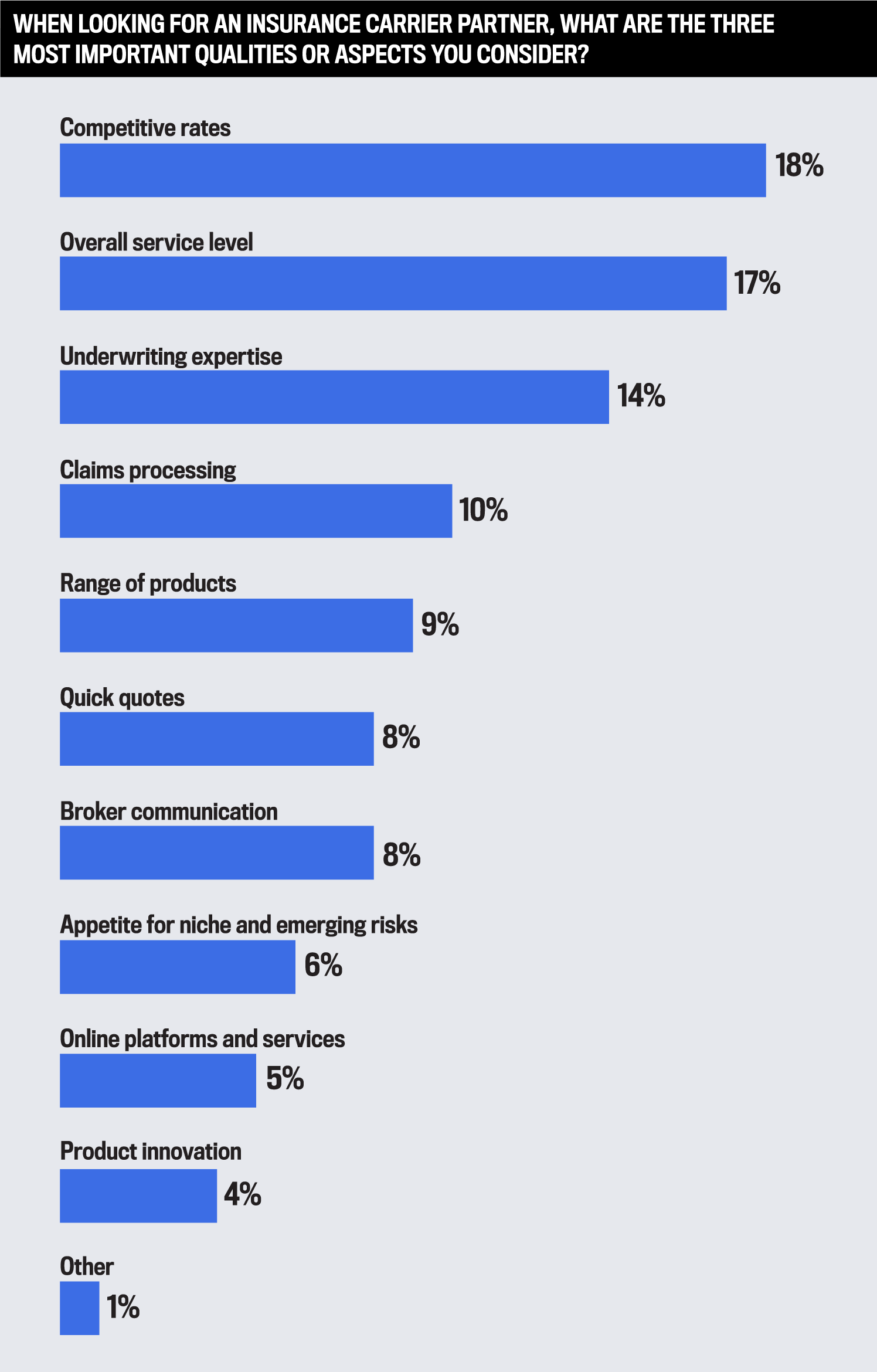

For the seventh year in a row, Insurance Business Canada and Key Media’s Intelligence Unit have extensively surveyed insurance brokers to find out just what brokers look for from their carriers – and how well their carriers do in those categories.

Initial research returned 10 key categories for carriers to be ranked in by the brokers who use those services. Carriers who managed to achieve an 80% or greater score in a category would be awarded 5 Stars in recognition of being outstanding.

This year 15 different carriers were recognized with one of the industry’s leading awards – IBC 5 Star Carriers.