A particularly broad cat bond mark-down this Friday?

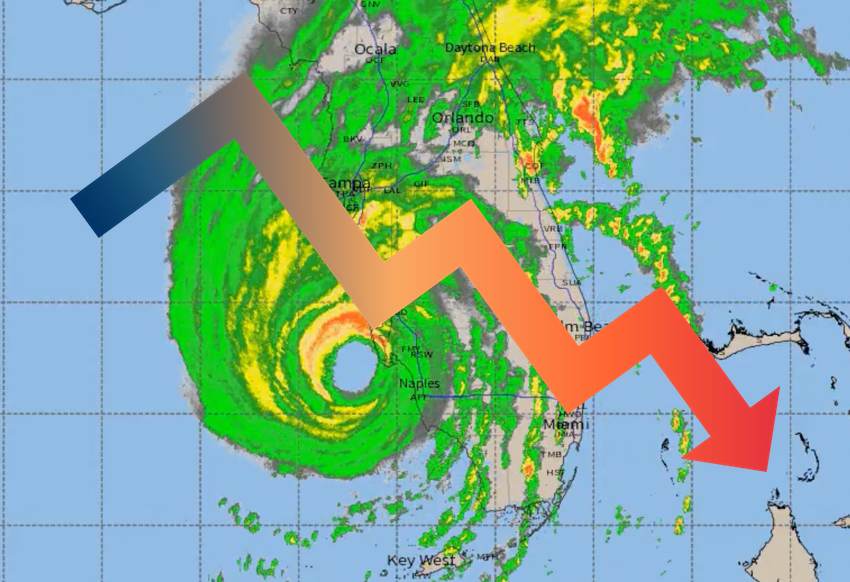

In the wake of hurricane Ian, it’s going to be particularly challenging to have an accurate view of catastrophe bond market impacts in the short-term, which we’re being told could result in a particularly far-reaching mark-down of cat bond names on brokers’ secondary pricing sheets this Friday.

Every Friday, the cat bond broking desks that trade names on behalf of the market go through the current outstanding stock of catastrophe bonds and mark their secondary prices.

This takes into account seasonality, time to maturity, supply and demand factors related to capital, spread sentiment, any elevated or reduced risk, and also the potential or actual impacts of any catastrophe events expected to hit the insurance-linked securities (ILS) market.

After a major hurricane strikes, it can take days, weeks and even months, before it is clearly understood where losses fall in the catastrophe bond market.

This is because losses take time to develop and cedents, or sponsors in the case of cat bonds, may not know their own ultimate losses from a hurricane or catastrophe for months, so cannot report that back to cat bond holders and actually draw-down on the principal, until they have their loss quantum finalised.

As a result, mark-to-market price declines are the order of the day, as the market reduces the value of cat bonds that are exposed to the catastrophe event, with cat bond brokers making best efforts to accurately reflect the risk of default in their secondary market pricing sheets.

With hurricane Ian, the uncertainty is high and the storm has hit right before the end of the month, when many ILS and cat bond funds tend to mark their net asset values.

Yes, there are plenty of cat bond funds that mark weekly, particularly the UCITS cat bond funds, for which we expect a mark-down related decline in the Plenum UCITS cat bond fund Index next week as a result, but many more private cat bond funds are also monthly marks.

Because of the uncertainty related to the eventual insurance and reinsurance market loss from hurricane Ian, which is likely to take months or years to finalise, how close the marking on Friday is to the storm, and the fact some funds need the marks for their end of month NAV’s, we’re told cat bond secondary brokers are likely to take a very cautious approach and this could result in a particularly broad marking down of cat bond names.

More than one source has suggested secondary pricing sheets for cat bonds could be a sea of red at the end of this week, with a significant number of names marked down.

In fact, we’re told this has the potential to be the broadest marking-down of cat bonds ever seen.

As we explained yesterday, there are many billions of dollars worth of catastrophe bonds outstanding with some form of exposure to Florida named storm wind and surge risk.

As hurricane Ian is seen as a historic event for Florida, while the potential for insurance and reinsurance market losses seen as above, to well-above, $20 billion (some modelled event simulation estimates point to far higher, with $50bn even cited), it’s safe to assume the impacts will be wide-reaching for the ILS and cat bond market as well.

Plenum Investments implied as much in its update on hurricane Ian.

In the past, as much as 70% of the outstanding cat bond market has had some level of Florida named storm exposure. Without calculating the same today, it seems likely to be over 60% and that’s in terms of risk capital outstanding.

Which means the number of names that have exposure is significant and so if you did colour the lines in a cat bond pricing sheet red for any price declines this Friday evening, you really might have a sea of red situation.

Uncertainty will be high over hurricane Ian, meaning this has the potential to be one of, if not the, broadest mark-downs of cat bond names ever seen.

Of course, much of that marking down will be recovered back, as clarity on losses emerges.

But the sheets are going to make for painful reading for some this weekend, as they drive home the significant concentration of the cat bond market in Florida named storm risk.