Assurant’s hurricane Ian losses erode lower-layers of reinsurance

US specialty insurance group Assurant revealed that its losses from hurricane Ian have eroded the lower two layers of its reinsurance tower, with at least $80 million set to be recovered from its panel.

Assurant experienced “elevated catastrophe losses” during the third-quarter of the year, President and CEO Keith Demmings explained.

Reportable catastrophe losses reached $124 million pre-tax for the quarter, which the firm said was “primarily related to hurricane Ian.”

This figure includes Assurant’s full $80 million retention that sits at the bottom of its reinsurance tower, as well as $35 million of associated reinstatement premiums for replenishing cover that is now expected to be eroded.

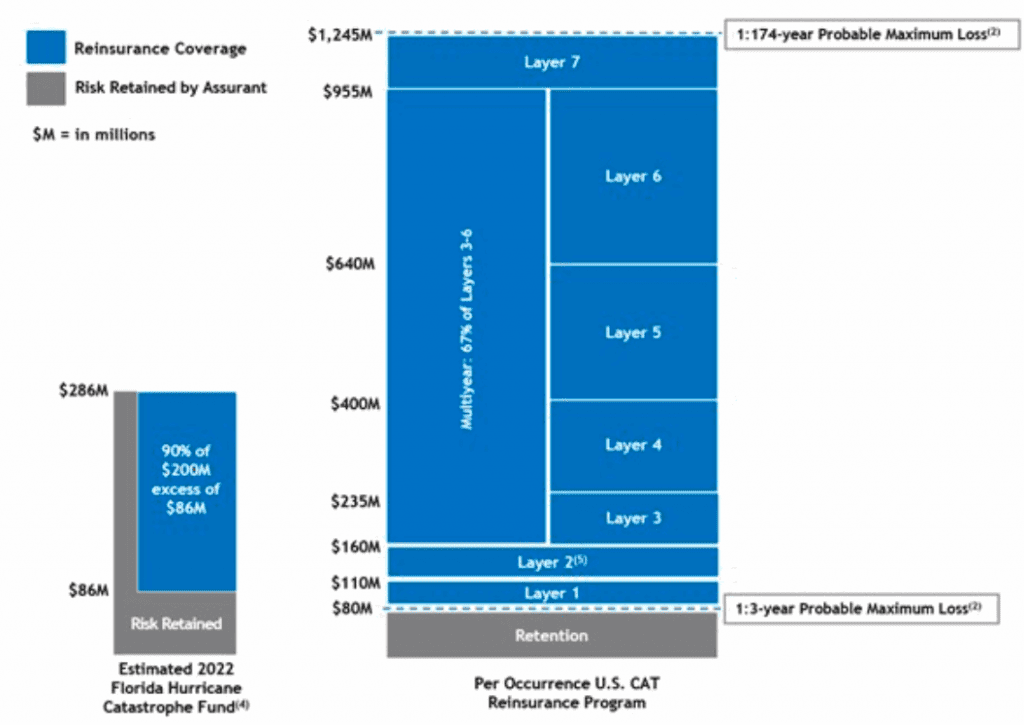

Assurant renewed its catastrophe reinsurance tower at the middle of 2022, extending the top of its catastrophe reinsurance tower to cover a gross Florida loss of as much as $1.34 billion.

Hurricane Ian appears to have been a far smaller event than that for Assurant, as the company said that, on its reinstatement premiums, these were to “restore up to Layer 3 of the company’s U.S. catastrophe reinsurance program.”

Looking at Assurant’s catastrophe reinsurance tower, which you can see below, above the $80 million retention there is a $30 million layer one and a $50 million layer two.

Both of those layers of the reinsurance tower are set to be exhausted by Assurant’s losses from hurricane Ian, implying at least an $80 million recovery is due.

However, Assurant implied it has likely eaten into the third layer, to a degree, as well, which means there could also be some erosion of that layer that covers 50% of losses from $160 million up to $235 million, as well as some erosion to the multi-year reinsurance arrangement that sits alongside it.

So, it seems Assurant’s reinsurance recoveries will come in some where between the top of layer two at $80 million, to $155 million depending on how far into layer three the losses from hurricane Ian run.

At that level, Assurant will also have tapped its FHCF backed reinsurance protection as well, it appears.

The company also recognised “higher catastrophe reinsurance costs” that are affecting its business, but said that this can be largely offset by “higher average insured values and premium rates.”