Capital to support reinsurers through hurricane season. Retro still limited: Fitch

Capital strength will support global reinsurance firms through the 2022 Atlantic hurricane season, according to Fitch Ratings, but a significant loss or number of major events could make things more challenging, something that the still limited amount of retrocession in the market could exacerbate, it seems.

While the mid-year June and July reinsurance renewals are set to be particularly challenging for property and casualty insurers, Fitch Ratings noted that reinsurance firms themselves are still quite well-positioned.

“The June/July mid-year 2022 reinsurance renewals will be challenging for Florida primary underwriters with reduced reinsurance supply, reflecting recent adverse loss experience,” Fitch said.

Adding that, “Rate increases are expected to easily reach the double-digit levels, with many reinsurers limiting capacity in Florida to curtail volatility.”

Rate increases could, “Potentially surpass the up to 30% increases experienced at the June/July 2021 reinsurance renewal for Florida property loss hit business,” Fitch also said.

However, the “Capital strength of (re)insurers should allow them to absorb near-term large insured losses from an individual hurricane or other catastrophic event, but a confluence of large events in a short period may lead to capital reductions and ratings pressures,” Fitch said.

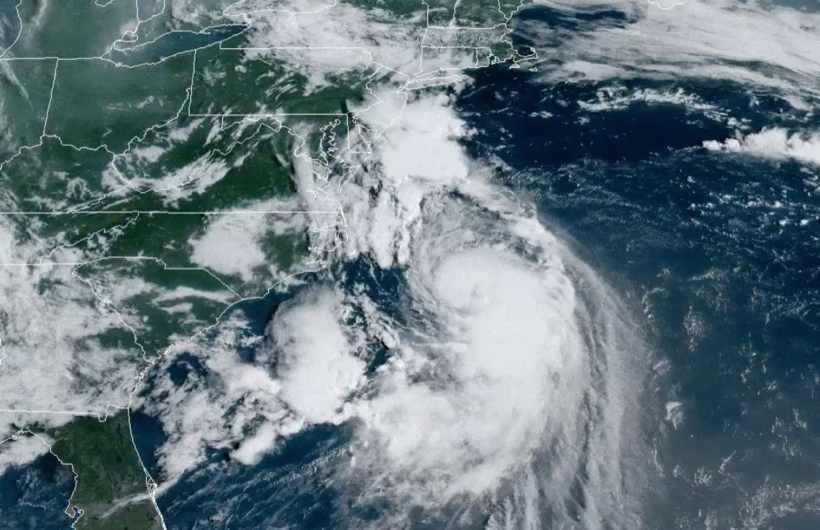

Forecasts are suggesting another active Atlantic hurricane season ahead in 2022, but the rating agencies all appear aligned on believing the industry is actually pretty well-placed to come through it relatively unscathed, unless a really significant loss event, or number of smaller events, occur.

While global reinsurers have been pulling back on some peak hurricane zones, like Florida, the capacity available appears likely to be sufficient to complete reinsurance renewals for the majority of carriers, with those failing to fill programs likely to be the under-performers.

Fitch said, “Reinsurers still willing to provide capacity to the market are demanding increased retentions by cedants and will continue to bifurcate risks, offering capacity to the higher quality accounts at the expense of poor performers, which will struggle to secure coverage at any price. Lower layers that have been hit more frequently in recent years will face very limited capacity, with pricing up much more than remote upper layers that were not affected by losses.”

Which could make it very interesting this year if we had a major hurricane loss event, as seeing where losses fall and how they are shared, across traditional reinsurance and insurance-linked securities (ILS) markets, will be intriguing to see and provide some insight into how disciplined markets on both sides are really being in 2022.

“Global reinsurance market capital supports a substantial portion of Florida property exposure, although appetite for additional Florida hurricane risk generally decreased across the sector in 2022. Reinsurers demonstrated the resilience of their balance sheets as capital remained robust despite significant catastrophe and pandemic-related losses in recent years. Reinsurers experienced declining results in 1Q22, resulting from higher natural catastrophe losses and reserves established for the Russia-Ukraine war, but capital positions broadly remain robust,” Fitch explained on current market dynamics.

As ever, something to watch through hurricane season is losses falling outside of the reinsurance limits bought by carriers, if a major landfall event occurs.

Retrocession availability remains dented though, which also has a bearing for global reinsurers, as some may not have as much retro in place as they would have in past years, while certain retro products still remain less-available than they were say five years back.

“Retrocession supply is constrained, particularly on harder hit lower layers, as collateralized quota-share reinsurance and sidecar retrocession vehicles have pulled back from the market following another year of above-average catastrophe losses in 2021 and trapped capital,” Fitch confirms.

This is another dynamic to watch as the industry moves through the 2022 hurricane season, as any loss activity could provide some telling insights into which reinsurers have opted to carry less retro protection and therefore more risk this year, as well as which reinsurers have ceded more to their third-party capital and ILS structures.

There is a lot going on across reinsurance, ILS and retrocession this year, with a dynamic marketplace, with significant changes in where protection lies, how it is structured and also how it is priced.

At the same time, rising deductibles, higher attachments, and restructured aggregates and second-event covers, will all also respond very differently and could make storm impacts on certain companies, or market segments (such as traditional versus ILS market) quite different to before.

All of which means the outcome of a major hurricane loss event in 2022 may not be the same as some recent years, making for a potentially fascinating season ahead.