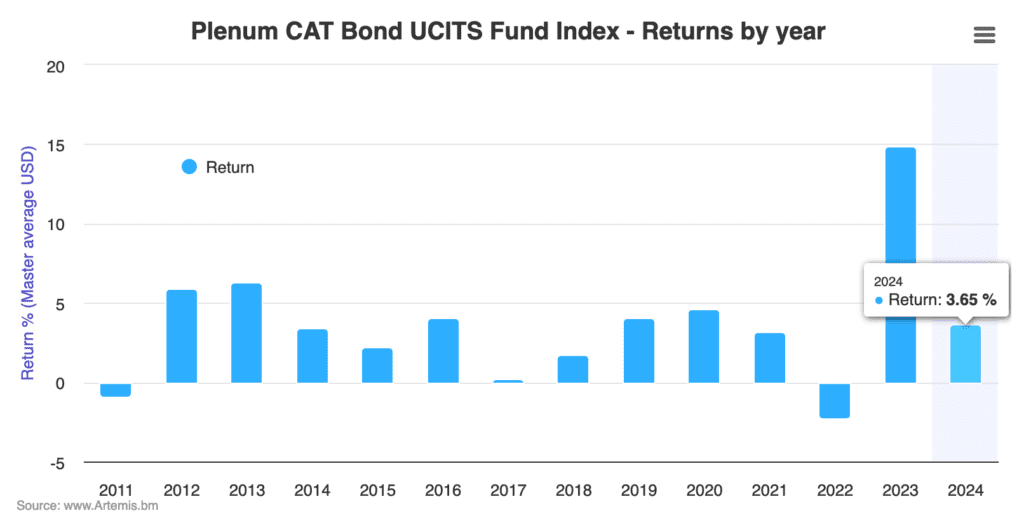

Catastrophe bond funds deliver 3.65% average Q1 return in UCITS format

For the first-quarter of 2024, catastrophe bond funds in the UCITS format have delivered their investors a 3.65% return, while the trailing 12-month cat bond fund return is running at 14.55%.

It represents a slight slow-down from the first-quarter of 2023, when the average UCITS catastrophe bond fund return reached 3.95%.

But, at that time these cat bond funds were benefiting from a strong recovery of values in positions that had been negatively affected with mark-to-market movements after hurricane Ian, something not repeated this year.

Although, there are some less-typical for the time of year price effects in the secondary market for cat bonds, as the continued strong demand from investors has been driving prices higher and this has benefited cat bond fund returns through the first-quarter of 2024.

The Plenum Investments Index that tracks the returns of catastrophe bond funds in the UCITS format, the Plenum CAT Bond UCITS Fund Indices, has risen strongly through the first three months of 2024.

Up to and including March 29th, the Plenum UCITS cat bond fund Master Average Index is now up 3.65% so far this year.

Analyse cat bond fund performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format and provides a broad benchmark for the performance of cat bond investment strategies. Click the chart below for an interactive version and index development by week.

While the Q1 return of these UCITS cat bond funds a year ago was a little higher, 2024 is still the second-highest first-quarter return for these cat bond funds, representing a strong start to the year for those investing in cat bond fund strategies.

The lower-risk group of UCITS cat bond funds delivered a 3.48% return to March 29th, while the high-risk group were at 3.76%, bating the Master Capital weighted version of the Index at 3.74%.

For March, all four of the Indices were above 0.95% for the period.

It’s interesting to also look at the rolling 12-month return, to March 29th 2024 for these UCITS cat bond funds.

The rolling 12-month return for the Master Average Index was 14.55%, for low-risk funds 14.15%, for high-risk funds 14.84% and on a Master Capital basis it was 15.6%.

The full-year 2023 return of the Master Average of these UCITS catastrophe bond fund indices was 14.88%, so a slight deceleration is evident, but this is still a very strong 12-month period for cat bond returns, again boding well for investor returns from the cat bond asset class through 2024.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.