Direct losses from Japan quake unlikely, but damage widespread: Twelve Capital

Catastrophe bond and insurance-linked securities (ILS) investment manager Twelve Capital has said in an update that it does not currently anticipate any direct losses due to the major earthquake in Japan to any positions it holds.

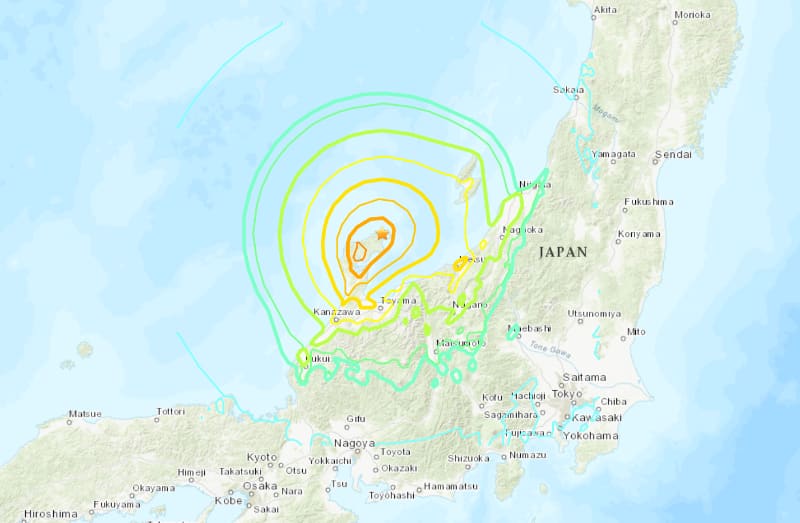

The magnitude 7.5 earthquake struck in Ishikawa prefecture on the west coast of the Japanese main island of Honshu on January 1st 2024, with widespread damage reported and tsunami waves causing inundation for some coastal towns.

With the earthquake striking at night, the amount of damage caused was difficult to gauge at first, but 48 hours after the event it’s now clear that thousands of buildings were damaged, many severely, while impacts to infrastructure are also widespread across the region most affected.

The death toll from the earthquake centred on the Noto peninsula in Japan is now reported to be 65, with more than 300 injured.

Insurance and reinsurance focused investment manager Twelve Capital explained that, “Early reports indicate that the majority of the damage has been experienced in small surrounding cities such as Wajima, Suzu and Nanao, with reports of building collapses, widespread fires, broken water mains and landslides.”

Suzu has been particularly badly hit, with tsunami waves inundating the city and the mayor of the city said that of the roughly 6,000 homes there, between 4,000 and 5,000 of them could be “unlivable” due to damage from the earthquake or the tsunami inundation.

More than 30,000 people remain evacuated from their homes in the Ishikawa region, while access to services such as water, gas and electricity has been disrupted due to damage from the quake and blocked roads make delivering emergency supplies difficult.

So, it’s clear there will be an insurance market toll due to this earthquake event, but still equity analysts at Tokio Marine Holdings had said on Tuesday that they expected domestic Japanese insurers to be able to handle the event.

There are questions over whether reinsurance will attach and in some cases it seems likely, in terms of any quota share arrangements that are in place.

Whether any of the excess-of-loss layers of reinsurance could attach remains more challenging to know at this time, with more granular damage information required for better industry estimates to emerge.

Estimates seen so far by Artemis put the potential insurance industry loss in the single-digit billions of US dollars at this time. They are likely to change as more details on the scope of damage emerges and we could see some official estimates emerge in due course.

Because the damage so far looks to be contained to the region most affected, with larger Japanese cities avoiding too much in the way of impacts from the earthquake and as the tsunami threat also proved less severe than initially feared, Twelve Capital feels its portfolios of insurance-linked securities (ILS) will avoid direct impact.

The investment manager said, “Despite the reported damages, given the event has not materially impacted the larger cities, our expectation is that there will be no direct losses to any Twelve Capital positions.”

Adding that, “The peril Japan Earthquake is a relatively small proportion of the Cat Bond market,” but also cautioning that, “there are aggregate structures that will likely experience some loss erosion, so we will continue to monitor the impact on these positions.”

The aggregate catastrophe bonds, or other private ILS positions and collateralized reinsurance arrangements, with exposure to this earthquake loss event in Japan will, in the main, be providing cover to international reinsurance underwriting companies.

International primary carriers tend to be more exposed to commercial property and industrial losses in Japan, with much of the residential market solely insured by domestic carriers.

As a result, it seems the route to reinsurance market loss from this quake would be via the domestic carriers and any leakage of claims through to their reinsurance panels.

But with excess-of-loss layers seen as attaching higher than current estimates for this quake suggest the loss will run to, right now it does seem like this will largely be a retained catastrophe event where the local domestic insurance market takes most of the burden.

As a result, it does seem ILS market exposure will be limited to zero in most cases, aside from the aggregate erosion. Although, there is always the potential for private quota share arrangements to be exposed, on which there is little transparency available and that can see some losses flow to ILS sources, albeit at minimal levels.

Also read:

– No immediate cat bond impact expected from Japan earthquake: Plenum.

– Japan hit by magnitude 7.6 earthquake, structural damage and tsunami reported.