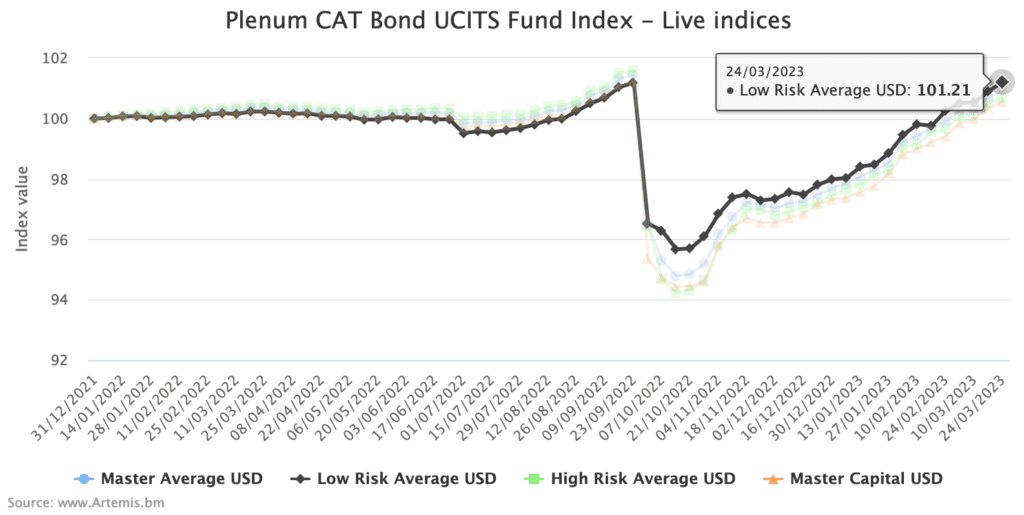

Lower-risk UCITS cat bond fund Index recovers to pre-Ian level

The lower-risk group of catastrophe bond funds structured in a UCITS format have now seen their average returns recover back to levels last seen just prior to hurricane Ian, as the cat bond market continues to deliver strong returns in the wake of that storm.

This is according to the Plenum CAT Bond UCITS Fund Indices, which have now gained 4.60% on average since hurricane Ian, as the recovery in value and the elevated spread environment drive returns higher and faster than before.

Out of the Indices we track with our interactive charts here, it is the lower-risk cohort of UCITS catastrophe bond fund strategies that was the first (as of the March 24th pricing) to see its Index recover back to the level seen just prior to hurricane Ian last September (click the chart below to analyse the data).

The higher-risk cohort of UCITS cat bond funds is now only -0.90% below its pre-hurricane Ian level as well, while the Master Average Index is recovering a little faster, being -0.52% below its pre-Ian mark.

As impressive as the recovery from hurricane Ian has been, the returns since have been even more so.

This UCITS cat bond fund Index has delivered a 4.60% return since hurricane Ian and is now approaching 3.30% just for year 2023 to-date.

That remains a record start to the year, with the highest first-quarter returns ever achieved.

Over a rolling-12 months period, all of the Indices are now in positive territory as well.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Analyse interactive charts for this UCITS catastrophe bond fund index.