MGIC upsizes Home Re 2023-1 ILS to provide $330m of mortgage reinsurance

MGIC Investment Corporation has successfully leveraged investor demand to upsize its latest sponsorship of mortgage insurance-linked securities (ILS), securing $330.2 million of reinsurance for its Mortgage Guaranty Insurance Corporation unit through the Home Re 2023-1 Ltd. issuance.

Reflecting much-improved conditions for issuance of mortgage insurance-linked securities (ILS), MGIC saw its latest deal upsize from its initial target of $290 million.

All four tranches of mortgage insurance-linked notes that were offered have been upsized, demonstrating investor demand across the risk spectrum that was on offer with this deal.

For MGIC, this is the seventh time it has successfully taped capital market investor appetite to secure reinsurance for its Mortgage Guaranty Insurance Corporation unit through a Home Re mortgage ILS issuance.

Read more about this latest mortgage ILS from MGIC in our Deal Directory entry.

Mortgage ILS issuance has picked up recently, with now four transactions launched in just a few months.

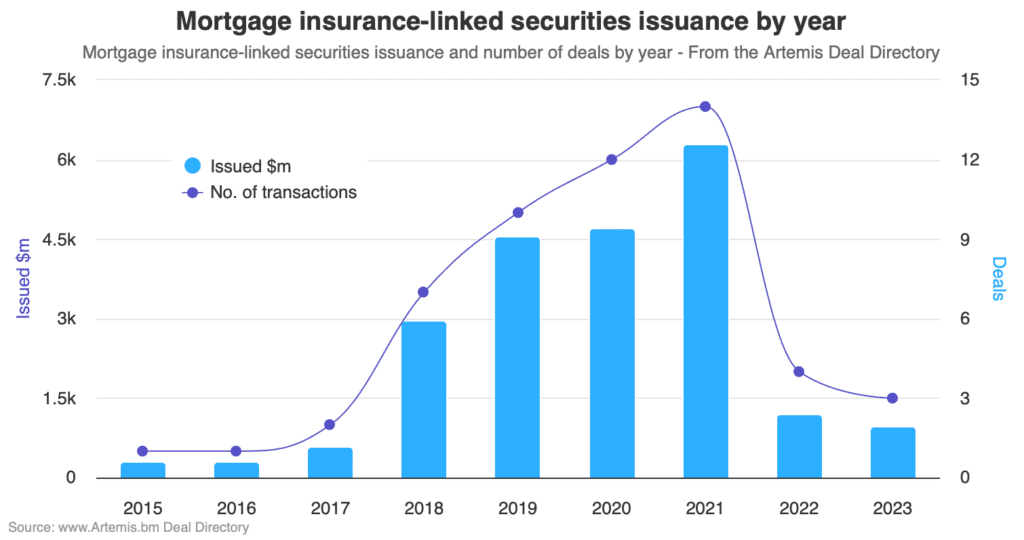

As a result, issuance of mortgage insurance-linked securities (ILS) in 2023 is now catching the annual total from last year.

However, as you can see from the chart above (which you can analyse an interactive version of here), issuance of mortgage insurance-linked notes remains far below the levels seen in 2021 and years prior.

For MGIC, the completion of its latest Home Re mortgage ILS now means the company has secured almost $2.65 billion of mortgage reinsurance from the capital markets through the HMIR series of deals.

With investor appetite for mortgage insurance-linked investments clearly risen in recent months, it will be interesting to see how much activity there is over the coming months.

The resurgence of activity in the mortgage ILS space has been driven both by a calming in certain capital markets, after a period of volatility, as well as the fact recent issuances have priced more keenly and upsized, which is now helping interest to build again amongst sponsors, as the spread to pay for capital markets backed mortgage reinsurance is perceived to have fallen somewhat.

At the same time, for investors, these offer a floating rate investment opportunity and an alternative fixed income instrument, which at this time is viewed as attractive on a relative basis.

You can read all about the Home Re 2023-1 Ltd. mortgage insurance-linked securities transaction and every other mortgage ILS deal in our specific directory of mortgage ILS deals, as well as in our all-encompassing Artemis Deal Directory.