Most Diverse Insurance Companies | 5-Star Diversity, Equity & Inclusion 2023

Jump to winners | Jump to methodology

The DE&I boom

“There is an absolute expectation across the world and in every sector, in every industry and in every country that we operate in globally that diversity, equity, and inclusion (DE&I) programs be implemented,” says industry expert Heather Price, founder and co-CEO of Symmetra.

That’s why, across Australia and Aotearoa, DE&I is such a burgeoning issue. What was a global DE&I market of US$7.5bn in 2020 is expected to more than double to US$15.4bn by 2026, according to McKinsey.

“DE&I has become the ‘S’ in the ESG, and this is innovative and important, and many of the organisations now are stepping up because of this upsurge in expectations. So overall, the industry will show progress because there’s pressure on those who haven’t had their own initiative and they’re now getting questions from stakeholders of every kind – this is investors and employees, boards and society at large – and because they’re getting pressure from stakeholders in all directions, you will see every industry across the globe paying more attention to DE&I and the insurance industry is not an exception,” says Price.

Price lists the requirements for a successful DE&I program:

a clear vision strongly linked to organisational and business strategy

executive commitment across the top of the organisation

meaningful ways of measuring diversity and inclusion

inclusive leadership capabilities

a way to address whether systems, policies and procedures are inclusive

a means of ensuring middle management and frontline workers adopt the agenda

consistently and persistently providing a safe space for employees

“Equity and general equality are actually really important for everyone, and it doesn’t just elevate women or one particular group; it actually elevates everyone”

Liberty NewlandsZurich Insurance

What makes a 5-Star DE&I program?

Each winner has crafted their own internal policies to earn the reputation of being among the most diverse insurance companies in Australia and New Zealand.

Zurich Insurance stands out by:

offering four weeks of leave for gender-affirming care

providing 12 months of unpaid leave

maintaining a competitive parental leave policy

establishing the same rights for primary and secondary caregivers

volunteering with a mental health advocacy group

“When we look at our investment in charities, we don’t just provide investment to charities in the countries we work in,” explains Liberty Newlands, New Zealand market manager. “We actually do it in countries that we don’t have a footprint in.

“So, it’s not a marketing exercise for us. It truly is to elevate the community as a whole – not just our business and not just our employees.”

Regarding quantified gains, Zurich Insurance:

maintains a 51% female workforce

has an executive leadership that’s over 50% female

achieved a net promoter score of 76 in 2022

Deb Gibson, the client director at fellow winner Aon, says, “It is not uncommon for our whole team to have the day off to volunteer in a particular area, and we have such breadth of partners in our charitable foundation that we can work with whatever desire we have to make a difference. You can work at Aon and find a group of people who are like-minded, and you can go work your best to affect change.”

Aon is noted for:

ensuring that the top leaders of the organisation know what’s happening at the local level

offering employees best-in-class workplace benefits

maintaining a commitment to solidarity throughout the entire global organisation

engaging in enormous amounts of charity work

While Elliott Insurance Brokers not only maintains gender equality at every level but has also been recognised by:

striving to connect the company with diversity in the broader community

encouraging and supporting employees to make a positive impact locally and globally

offering a fundraising challenge, with winners getting to volunteer in Kenya in a sustainable village with orphans

facilitating participation in local community programs

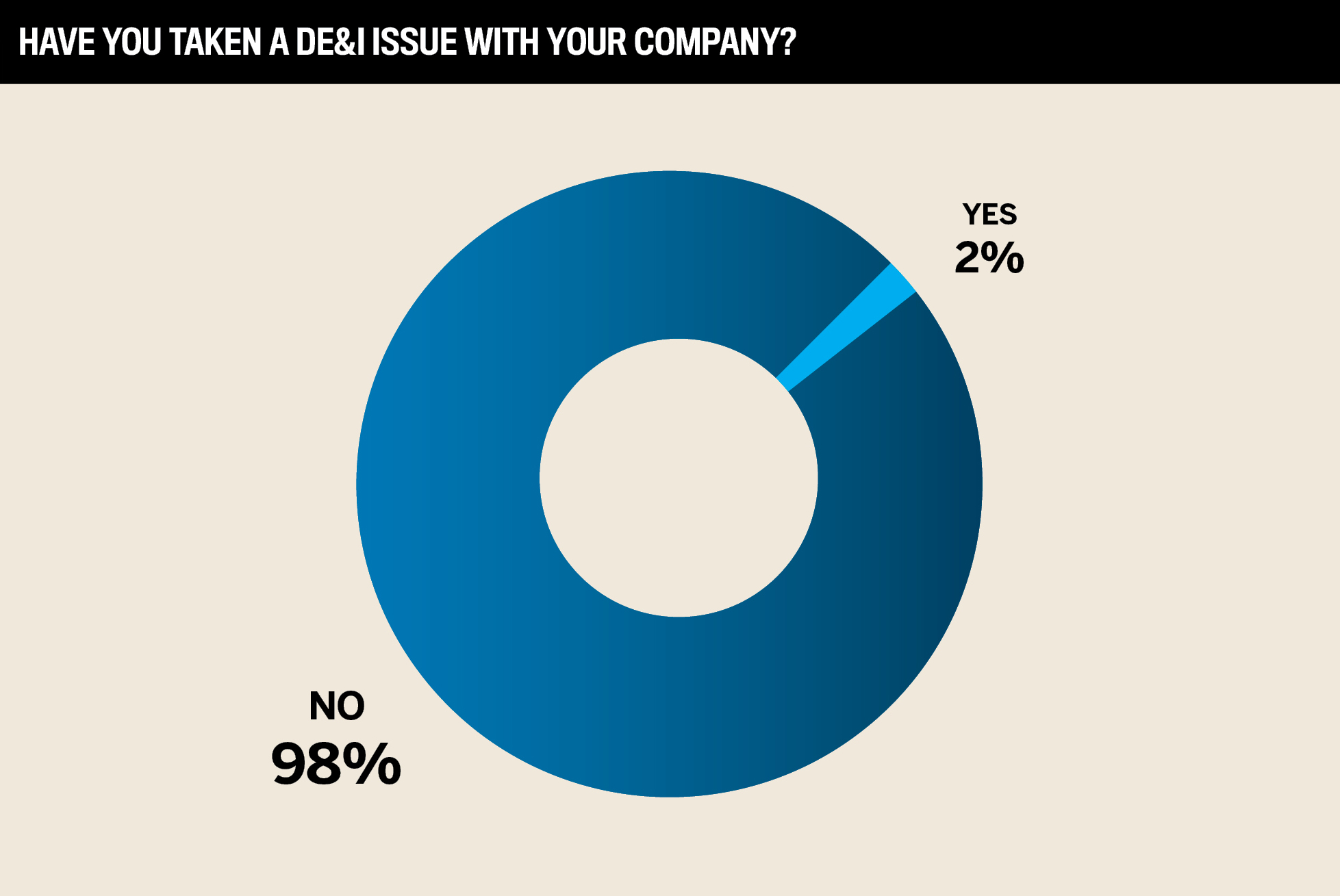

For the 5-Star Diversity, Equity and Inclusion 2023 awards, IB sought out the most diverse insurance companies in Australasia. Nominees were evaluated, and then their employees were queried. One question posed was, “What is the most important to you that a company should do and/or include to enhance its DE&I program?”

Challenges surmounted

While all winners are leading exponents of excellent DE&I, there are unexpected barriers to becoming the most diverse insurance companies.

For Elliott Insurance Brokers, the challenge is implementing new practices.

“It’s just ensuring that we get buy-in across all levels of the company, from the most junior to the most senior,” says founder John Elliott. “For a small organisation like Elliott, there’s no place to hide. You get real reactions from every single staff member on a daily basis.”

To help overcome this, the firm conducted training sessions to engage employees, along with anonymous conversations with their people to promote the concepts.

For Newlands, the challenge at Zurich Insurance is gender pay equity.

“A lot of people think Australia and New Zealand are really progressive in the space, but it’s just not the case. What we have done is create a leadership guide to dispel some of those misconceptions.”

And she explains how the initiative is of universal benefit to the company.

“Equity and general equality are actually really important for everyone, and it doesn’t just elevate women or one particular group; it actually elevates everyone,” she says.

Unconscious bias is the key element that Gibson has focused on at Aon.

“Collectively, it is our unconscious bias and how we educate ourselves and how we keep reminding ourselves about it that is important. Unfortunately, how we’ve been brought up and what we’ve seen in our early lives is our natural starting position for interaction with people different from us,” she says.

This is all echoed by industry expert Price.

“One of the critical success factors for embracing an inclusive culture is that you have a very clear vision as to why you’re doing this, and it’s clearly connected to optimising business performance and that you have complete executive commitment and buy into this, coupled with meaningful measurement and inclusive leadership capability,” she says.

Pushing DE&I programs further

As expected, the 5-Star winners aren’t resting on their laurels and intend to drive their DE&I programs further to continue being the most diverse insurance companies.

Price explains how this extends beyond box-ticking.

“You can’t simply put people through training on diversity, equity and inclusion and state that you are now committed to it and set some targets; you have to also deal with this on a systemic level. You have to align your systems policies and procedures and ensure they are equitable, fair and cutting-edge.”

This is something Zurich Insurance has adopted in its model.

“We concentrate on doing the right thing and making sure every employee comes to work feeling safe to be the person that they are,” says Newlands. “But we’re just taking people on the journey, and we’re educating them in the space where a lot of the rest of us are.

“Plus, in New Zealand, we have a very interesting relationship with our native people. When we engage with our native counterparts, we want to do it in the most respectful manner possible.”

Gibson says that there are no real reservations at Aon. Over the past 10 years, the focus has been on gender equity, but there is so much more to the DE&I journey.

The firm is now implementing a voluntary self-ID program, and while it initially received questions about privacy, the confidential data will be used to help Aon measure its progress in creating an inclusive and diverse workplace as well as implementing strategies that support all colleagues.

“You can work at Aon and find a group of people who are like-minded, and you can go work your best to affect change”

Deb GibsonAon

What employees want from their DE&I programs

Also, as part of the 2023 5-Star Diversity, Equity and Inclusion awards, IB posed the question below to the employees of the nominated firms.

“Is there anything you believe your company could do better to foster DE&I within your company?”

Sample responses included:

“Could implement gender neutral bathrooms”

“The composition of senior management doesn’t quite reflect the good DE&I policy of the company”

“More activities to celebrate diversity would be great”

“More networking opportunities across the wider business to foster inclusivity”

“Create job roles targeted at minorities”

1-99 employees

Dixon Insurance Services

DUAL New Zealand

Elliott Insurance Brokers

Innovation Group

Solution Underwriting

Zurich Insurance

100–499 employees

Belron NZ

BizCover

CHU

Clyde & Co

DUAL Australia

Honan Insurance

RGA

500–2,499 employees

Sparke Helmore Lawyers

Tower Insurance

2,500–9,999 employees

Allianz

Crawford & Company

To determine the insurance companies with the most effective DE&I programs, the Insurance Business research team first invited firms in Australia and New Zealand to share the DE&I initiatives they had focused on over the past 12 months. During a 15-week process, the team conducted one-on-one interviews with DE&I professionals to gain a keen understanding of the industry standards for DE&I and find out which companies had met or exceeded those expectations. After receiving nominations for DE&I initiatives, the team reached out to the companies’ employees to gauge the effectiveness of these programs. The companies that scored 4.0 or higher on a scale of 1 to 5 were recognised for having 5-Star DE&I programs.