NZ insurtech JAVLN raises capital for international expansion

The deal, which is Bombora’s first in New Zealand, makes JAVLN one of the first New Zealand-based startups to access the Australian pre-IPO market as a precursor to a future listing on the Australian Stock Exchange (ASX).

With the new capital, JAVLN can expand its presence internationally, beginning with Australia before gradually moving into other Asia-Pacific markets through organic growth and acquisitions. JAVLN’s leadership and development team will remain based in Grey Lynn, Auckland.

According to JAVLN, which was privately funded since its founding in 2014, it sought new capital to expand as insurance providers undergo significant digital transformation. These providers, including underwriters and brokers, face new reporting regulations in addition to raised customer and staff expectations for user-friendly online experiences, JAVLN said.

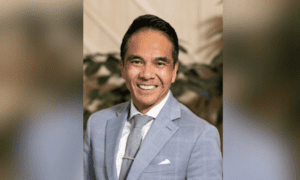

“To compete with global firms, we need to scale our team and technology,” said Dale Smith (pictured above), founder and CEO of JAVLN. “Partnering with Bombora brings greater experience and capital to our business, helping us capture new opportunities in Australia and making it easier to attract further investment in the future.”

Bombora partners with high-growth, pre-IPO businesses, providing both capital and expertise to prepare these companies to be listed on the ASX. As part of the deal, Bombora appointed Kerry McIntosh as JAVLN’s incoming chair.

“JAVLN is very well positioned to grow as insurers, underwriters and brokers adopt modern, cloud-based, integrated software solutions to improve efficiency, compliance and customer experience,” McIntosh said. “One of the key attractions for us was the quality of the management team led by founder and CEO Dale Smith, who is an experienced and successful serial entrepreneur. The quality and nature of the investment opportunity resulted in an oversubscribed private offer despite challenging capital market conditions.”

“Bombora sought to invest in a high-quality New Zealand start-up with the objective of creating a pathway to listing on the ASX,” said Emily Mohan, investment director of Bombora. “We are pleased to be partnering with JAVLN, which meets our investment criteria – including a mission-critical application with low churn, an attractive and defensive industry vertical, high growth and low cash burn.”