UCITS cat bond fund returns set new record for strongest start to a year

Catastrophe bond investment funds structured in the UCITS format have reported a record strong start to the year, with the average return across the leading UCITS cat bond funds reaching 1.77% so far in 2023.

The very strong performance of catastrophe bond funds can be attributed to a number of factors, chief among which is the continued recovery of value across certain cat bond positions since last year’s hurricane Ian.

Adding to that, a general recovery of some of the value lost due to spread widening has also helped to buoy cat bond fund returns at the start of 2023, in addition to which there are also some higher-yielding recently issued cat bonds that promise to drive better returns going forwards.

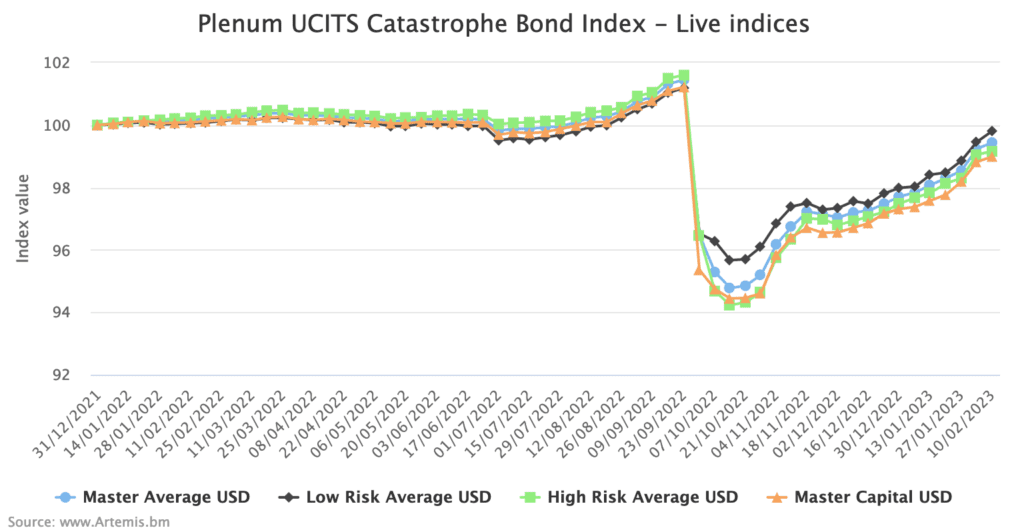

The latest data from the Plenum CAT Bond UCITS Fund Indices shows that the tracked performance of these leading UCITS catastrophe bond funds reached an average of 1.77% for 2023 up to Friday February 10th.

Lower risk UCITS cat bond funds delivered a 1.86% positive return to that date, while the higher risk group of cat bond funds delivered performance of positive 1.71%.

The strong start to 2023, means that these UCITS cat bond funds are now only -1.98% on average since last year’s hurricane Ian, as the recovery continues. Recall that their performance had declined more than -6.5% on average right after that storm.

Click on the chart below to access an interactive version.

These UCITS cat bond funds averaged +0.85% returns for January 2023 and in February so far, to the 10th of the month, they added a further +0.91%, with the average return of these catastrophe bonds funds +1.77% since the last date the Index was calculated in 2022.

The last week saw the cat bond Index averaging a +0.21% return.

Perhaps more impressively, despite the significant spread widening and the impacts from hurricane Ian, the UCITS cat bond fund Index average return is now only -0.72% for the last year.

That’s impressive as the spread widening alone likely accounts for that much of a decline, we’d estimate.

It won’t be long until the Plenum UCITS cat bond fund Index recovers all of the hurricane Ian decline and investors can then look forward to strong returns as spread widening effects continue to be recovered over time, while newly issued cat bonds with their higher spreads increasingly contribute to cat bond market performance.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Analyse interactive charts for this UCITS catastrophe bond fund index.