What is the difference between full coverage and liability?

What is the difference between full coverage and liability?

What’s the Difference Between Liability and Full Coverage? The difference between liability and full coverage is that liability will cover damage to other vehicles or injuries to other people from accidents you cause, while full coverage also covers your own vehicle.

Is liability insurance an asset?

All insurance policies become an asset once the plan matures — that is, you have paid for it and are credited with a lump sum.

Is liability insurance the same as car insurance?

Basically, liability coverage is a part of your car insurance policy, and helps pay for the other driver’s expenses if you cause a car accident. It does not, however, cover your own. It’s important to note there are two types of liability coverage: bodily injury and property damage.

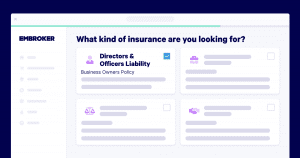

What exactly does an insurance broker do?

An insurance broker is a professional who acts as an intermediary between a consumer and an insurance company, helping the former find a policy that best suits their needs. Insurance brokers represent consumers, not insurance companies; therefore, they can’t bind coverage on behalf of the insurer.

What is the difference between an insurance broker and an insurance company?

Insurance agents, often referred to as “captive” agents, typically represent one insurance company. Insurance brokers, on the other hand, represent multiple insurance companies to ensure that you are connected with the right insurance for you. Jan 26, 2018

Is it worth it to use an insurance broker?

When to use an insurance broker How you buy insurance is a personal choice, but brokers are usually best suited for people who have more complicated insurance needs, like a landlord or small business owner who needs several policies. You might benefit from an insurance broker if you: Have multiple cars or homes.

What should I expect from my insurance broker?

As a result, brokers typically just offer transactional support, like marketing coverage, negotiating terms and conditions, binding coverage, checking policies, and issuing certificates of insurance, and ID cards. In some cases, all but market and negotiating services can be offered by the insurance company. Jul 19, 2017

What is the difference between an agent and a broker?

In real estate, an agent is an individual who is licensed to sell property in their state. A broker is someone who is licensed to own their own real estate firm. May 8, 2019

How do insurance agents make money?

An insurance agent is paid a commission from the insurance company that they place your insurance with. It’s usually a percentage of the total cost you pay for the policy and it’s already built into the price of the insurance. By a commission that is related to the Premium that the customer pays.

What is the time limit for approaching an insurance ombudsman?

Within one year 8) Is there any time limit to approach the Ombudsman? Yes. Within one year of the rejection by the insurer of the representation of the complainant or the Insurer’s final reply to the representation.

Why you should use an insurance agent?

With their connections and their knowledge of the market, agents can often find a better value for your insurance dollar than you might find searching on your own. Agents do the shopping. You do the saving. They find you the right blend of price, coverage, and service.

Which insurance company is best to be an agent for?

Here are some of the best insurance carriers that accept independent insurance agents. National General Insurance. Nationwide Insurance. Markel Insurance. Progressive Insurance. Selective Insurance Group. The Hanover Insurance Group. Travelers. West Bend Mutual Insurance Company. More items… • Nov 3, 2020

Why do I need an insurance agent?

Customers may require their agent to provide information not just on policy, but other concerns as well such as the processing of claims, policy maturity or even lapsation of policies. A well-trained agent must be able to answer a wide range of questions and address their customers’ concerns.

How do I become an independent insurance agent?

How to become an independent insurance agent Get educated. To become an independent insurance agent, a person needs their GED or high school diploma. … Complete requirements for license. Taking the license exam is just one part of gaining a license. … Get a license. … Search for a job. … Advertise. … Continue to learn. … Insure yourself. Mar 22, 2021

What does an insurance underwriter do?

Insurance underwriters use computer software programs to determine whether an applicant should be approved. Insurance underwriters decide whether to provide insurance, and under what terms. They evaluate insurance applications and determine coverage amounts and premiums. Jan 4, 2022