Medicaid Managed Care Plans Can Help Enrollees Maintain Coverage as the Public Health Emergency Unwinds – Kaiser Family Foundation

Why will MCOs be important with PHE unwinding?

Medicaid managed care organizations (MCOs) deliver care to more than two-thirds of all Medicaid beneficiaries nationally. Medicaid MCOs (also referred to as managed care plans) may be in contact with enrollees as they provide care coordination and other member services (e.g., health education and promotion, call center support) and may conduct periodic outreach to promote appropriate use of care (e.g., to encourage prevention, wellness, and early intervention). Throughout the pandemic, states have worked with managed care plans to respond to changing public health conditions and new developments, including to promote the take-up of COVID-19 vaccinations.

Medicaid MCOs have seen growth in their membership during the pandemic that tracks overall Medicaid enrollment trends. Enrollment growth reflects downturns in the economy due to the pandemic and provisions in the Families First Coronavirus Response Act (FFCRA) that require states to ensure continuous enrollment for current Medicaid enrollees to access a temporary increase in the Medicaid match rate during the Public Health Emergency (PHE) period. It is expected that the PHE will be extended through at least mid-July 2022 since the Biden administration indicated it would give states 60 days-notice before the PHE is terminated or is allowed to expire (the current PHE is set to expire in mid-April). If the PHE ends in mid-July, the continuous enrollment requirement would expire at the beginning of August 2022.

Medicaid managed care plans can assist state Medicaid agencies in communicating with enrollees, conducting outreach and assistance, and ultimately, in improving coverage retention (including facilitating transitions to the Marketplace where appropriate). After the PHE ends, state Medicaid agencies will need to complete a large number of eligibility and enrollment tasks and actions, including processing renewals, redeterminations (based on changes in circumstance), and post-enrollment verifications. Current CMS guidance indicates states must initiate all renewals and other outstanding eligibility actions within 12 months after the PHE ends. Medicaid managed care plans have a financial interest in maintaining enrollment, which could also prevent disruptions in care for enrollees, including prescription drug benefits. Four for-profit parent firms that account for about 40% of Medicaid enrollment nationally (Anthem, Centene, Molina, and UnitedHealth Group) reported on Q4 2021 earnings calls that they expect modest enrollment declines in their Medicaid membership after the continuous enrollment requirement ends. However, these firms also indicated expecting to pick up/capture many individuals who transition from Medicaid through their other lines of business (i.e., the Affordable Care Act Marketplace and employer sponsored insurance (ESI)). Managed care plans have long cited lack of continuous eligibility, or churn, as a key challenge in ensuring access to care and for care continuity.

How can states engage MCOs to help individuals retain Medicaid coverage or transition to other coverage?

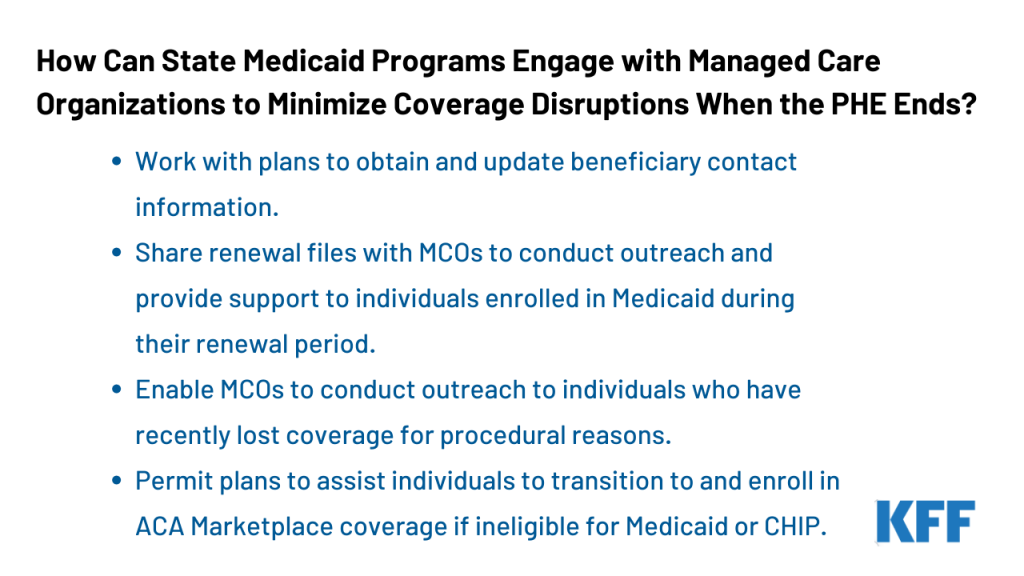

CMS released guidance for state Medicaid agencies on resuming normal operations including outlining strategies for working with managed care plans to promote continuity of coverage when the continuous enrollment requirement during the PHE ends. In the guidance, CMS notes that the federal Medicaid managed care marketing rules (42 CFR 438.104) do not prohibit plans from providing information and conducting general outreach on behalf of states. States must develop an “unwinding operational plan” to document their comprehensive plan to resume normal operations in their Medicaid and Children’s Health Insurance Program (CHIP) programs. CMS is encouraging states to gather input on their unwinding plans, including from managed care plans. Key strategies from the CMS guidance include:

Working with plans to obtain and update beneficiary contact information. States may direct MCOs to seek updated contact information from enrollees. Plans must confirm the accuracy of updates received from a third party (e.g., provider) with enrollees directly. MCOs may share this information with the state or may instruct or assist individuals in providing their updated contact information to the state. States may accept updated enrollee contact information from MCOs including mailing addresses, telephone numbers, and email addresses provided the state complies with certain beneficiary notice requirements (to confirm the accuracy of updated contact information) or the state receives a waiver of such requirements from CMS. While guidance expects plans to help in updating contact information, plans have historically cited difficulty reaching members and inaccurate member contact information as key barriers to engaging enrollees in care coordination activities. While state plans are evolving, as of January 2022, about half of states reported working with managed care plans to update beneficiary mailing addresses before the end of the PHE.

Sharing renewal files with MCOs to conduct outreach and provide support to individuals enrolled in Medicaid during their renewal period. States can provide monthly files to MCOs containing information about beneficiaries for whom the state is initiating the renewal process, or beneficiaries who have yet to submit renewal forms or other documentation and are at risk of losing coverage, to enable plans to conduct outreach and provide assistance with the renewal process. Prior to sharing information with managed care plans (e.g., renewal files), states may need to identify and address possible systems or operational challenges, including to ensure data accuracy.

Enabling MCOs to conduct outreach to individuals who have recently lost coverage for procedural reasons. States can provide MCOs monthly termination files to enable plans to conduct outreach to individuals terminated from Medicaid for procedural reasons (e.g., not returning renewal forms timely). CMS notes states may need to expedite review of plan outreach messaging or may want to consider developing standard language to be used by Medicaid managed care plans to ensure compliance with federal marketing requirements as well as any state-specific laws or contract requirements that may apply. Within two months or less after Medicaid coverage loss, managed care contracts must provide for automatic re-enrollment into an enrollee’s original plan. However, during the PHE unwinding period, CMS will approve state waivers to extend this automatic re-enrollment period up to 120 days.

Permitting plans to assist individuals to transition to and enroll in ACA Marketplace coverage if ineligible for Medicaid or CHIP. States may encourage MCOs that also offer a Qualified Health Plan (QHP) in the ACA Marketplace to share information with their own enrollees who have been determined ineligible for Medicaid to assist in the transfer of individuals to Marketplace coverage (which has higher income eligibility thresholds than Medicaid). To avoid gaps in coverage, managed care plans may reach out to individuals before they lose coverage to allow them to apply for Marketplace coverage in advance. CMS notes that federal Medicaid managed care marketing rules (and Exchange regulations) do not prohibit Medicaid managed care plans that offer a QHP from providing information about the QHP to enrollees who could potentially enroll in the QHP due to loss of eligibility; however, plans must comply with state-specific laws and/or contract requirements that may prohibit this activity.

In addition to strategies identified in the CMS guidance, Medicaid managed care plans may also consider adding staff to help manage the unwinding process. Additional staff could work proactively to identify members at-risk for disruptions in care and disenrollment (e.g., individuals with limited English proficiency, people with disabilities). Managed care plans can also work in partnership with providers (including community health centers) and community-based organizations to further bolster efforts to reach and assist members to ensure coverage retention or transitions to Marketplace coverage.

What to watch?

Understanding how managed care plans are involved in the development of state unwinding operational plans and what is included in the operational plans themselves will be key areas to watch. When continuous enrollment requirement ends, states will begin processing renewals and redeterminations and millions of people could lose coverage if they are no longer eligible or face administrative barriers during the process despite remaining eligible. The significant volume of work that states face will place a heavy burden on eligibility and enrollment staff and could contribute to coverage loss related to procedural errors. Medicaid managed care plans may be well positioned to assist states in conducting outreach and providing support to enrollees who will need to navigate the renewals or redeterminations.

As mid-April approaches, additional information about the timing of the end of the PHE may become available. The Biden administration indicated it would give states 60 days-notice before the PHE is terminated or is allowed to expire. The current PHE is set to expire in mid-April. On February 8, 2022, the Medicaid Health Plans of America (MHPA), a national trade association representing more than 130 MCOs, sent a letter to Congressional leaders asking Congress to provide at least 120-days lead time before the end of the continuous enrollment requirement. States are developing unwinding operational plans but it is not clear that these plans will be made publicly available. The policies adopted and the implementation of strategies to promote continuity of coverage will vary across states and plans and will have major implications for Medicaid and broader coverage as the PHE unwinds.