The intersection of benefits and technology: How brokers can position themselves as true partners – BenefitsPro

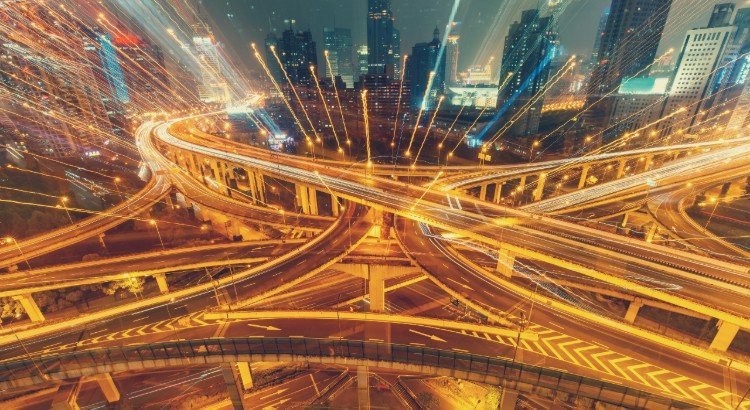

We live in an always-connected world. We have computers in our pockets and nformation and news can be shared worldwide within minutes. According to Pew Research, more than 85 percent of Americans have a smartphone.

The world is rapidly changing and frankly, the insurance industry hasn’t always kept up. Products, services and business models that have worked for decades are no longer the most efficient option. Sometimes, it feels like the whole industry is behind by a decade or two.

Consumers have more control of their investment choices, want seamless digital experiences, and demand transparency when it comes to their insurance coverage. The days of blindly accepting what is available and choosing between two to three insurance policies no longer works for many employees. They expect options that fit their unique situations and they want them presented where they already live — digitally.

Bentech is a new term in the benefits industry, capturing the intersection of technology and benefits and it’s a critical factor in evolving our industry to better meet the needs of those we serve.

Employer groups that have always offered traditional health insurance benefit plans for their employees and are used to the conventional way of comparing carrier rates, plans and making purchase decisions, may be hesitant to change. But now is the time to introduce something new — something that, until a year ago, was seen as non-traditional. An offering that will help them manage the never-ending health benefit cost increases companies are facing. Now brokers can show their innovative thinking and knowledge of where the industry is headed. So, where is the industry heading?

The answer is individual coverage health reimbursement arrangements (ICHRAs), an employer-funded, tax-advantaged health benefit used to reimburse employees for individual health insurance premiums and other qualified medical expenses. They entered the marketplace on January 1, 2020, so they may be unfamiliar to many, but they’re already revolutionizing the industry.

Some brokers have been hesitant to introduce ICHRAs because they may not immediately see where they fit into the equation. But the good news is brokers can use ICHRAs to position themselves as innovative, solutions-oriented partners for companies looking to bring their insurance options into the future. With seemingly endless options, employers are looking for a partner who truly understands their business and how best to serve their employees. By offering an ICHRA, brokers can do just that. Plus, the hiring landscape is competitive, and employers are looking for more ways to recruit top talent. Great insurance benefits are a strong driver.

I see the future of benefits living digitally — everything from quotes to plan comparison tools to plan options to purchasing. As a true partner for their clients, brokers increase trust, build a strong advisor relationship and move away from simply being transactional.

The world is changing, and we need brokers who can keep up. Following are three ways brokers can use technology to position themselves as industry leaders, innovators and true partners for clients.

Elevate what you bring to the table

Clients want to know that they’re working with someone who is the best at what they do. By presenting innovative options, brokers provide better client service, become more nimble when regulation changes are announced, deliver everything electronically, move faster than ever before and find cost efficiencies for clients. Brokers are ready to embrace bentech solutions and are helping reshape the insurance industry.

Create more time for your clients

Technology is a primary driver for improved efficiency. Stacks of paper, overflowing filing cabinets and manual processes can slow down workflows. Technology can greatly reduce all of this, saving clients time and money.

Share information to create transparency

By embracing technology, brokers can display all available insurance options for a client. Showcasing a broader view of available carrier plans and rates can lead a client to make more informed decisions that may lead to cost savings. Ultimately, the broker provides better service and increases trust with the client.

Brokers can stand apart from their peers and have a leg up on the competition by embracing the future of benefits, which we believe includes ICHRAs as a cornerstone. As a society, we no longer work the way we used to; benefits need to keep up and brokers who embrace technology will be better positioned with clients. Brokers can be a true partner by helping clients save time, money, paperwork and in the end, giving them the opportunity to offer benefits that better fit the needs of their employees.

Scib Ebel is the Chief Technology Officer at Nexben. He is responsible for Nexben’s technological vision and implements the technology strategies to support Nexben’s growing business.