Is it better to have a copay or deductible?

Is it better to have a copay or deductible?

Copays are a fixed fee you pay when you receive covered care like an office visit or pick up prescription drugs. A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying. In most cases your copay will not go toward your deductible. Jan 21, 2022

What does a 0 dollar deductible mean health insurance?

Yes, a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses. Zero-deductible plans typically come with higher premiums, whereas high-deductible plans come with lower monthly premiums.

Why is my EPO more expensive than PPO?

EPOs are usually cheaper due to the restrictions on which healthcare providers you can visit. Keep in mind that if you visit a healthcare provider from outside your EPO’s network, you will almost certainly have to pay the full cost of any treatment.

What does it mean 10 coinsurance after deductible?

Coinsurance is often 10, 30 or 20 percent. For instance, with 10 percent coinsurance and a $2,000 deductible, you would owe $2,800 on a $10,000 operation – $2,000 for the deductible and then $800 for the coinsurance on the remaining $8000. Nov 29, 2018

What are the pros and cons of an EPO?

Pros and Cons of an EPO Low monthly premiums: EPOs tend to have lower premiums than Preferred Provider Organizations (PPOs), though they’re higher than Health Maintenance Organization (HMO) premiums. Large networks: They generally offer a wider selection of care providers than HMOs.

What is the difference between PPO and POS?

In general the biggest difference between PPO vs. POS plans is flexibility. A PPO, or Preferred Provider Organization, offers a lot of flexibility to see the doctors you want, at a higher cost. POS, or Point of Service plans, have lower costs, but with fewer choices.

What does PPO mean in healthcare?

Preferred Provider Organization A type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan’s network.

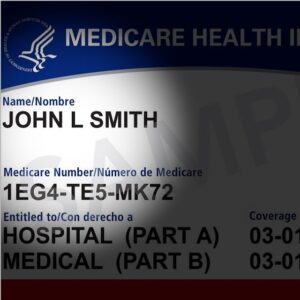

Is Medicare federally funded?

Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Which health care provider is the best?

Compare the Best Health Insurance Companies Company Providers In-Network AM Best Rating Kaiser Permanente Best for HSA Options 23,597 (doctors) N/A Blue Cross Blue Shield Best Large Provider Network 1.7 million A United HealthCare Best for Online Care 1.3 million A Aetna Best for Employer-Based Plans 1.2 million A 2 more rows

What occurs under the terms of an HMO?

An HMO gives you access to certain doctors and hospitals within its network. A network is made up of providers that have agreed to lower their rates for plan members and also meet quality standards. But unlike PPO plans, care under an HMO plan is covered only if you see a provider within that HMO’s network.

What is Blue Care HMO?

The Blue Care (HMO) Solution Provide access to care within a standard managed care design With Blue Care, employees have access to 92% of all doctors and 99% of all hospitals in the state.

How are Anthem and BCBS related?

“In California, Anthem Blue Cross and Blue Shield are actually different companies and are competitors. In most other states, they are the same company and formed an association, the Blue Cross Blue Shield Association. Anthem Blue Cross is a for profit company in California, and Blue Shield is a non-profit. Mar 24, 2021

What is the difference between Anthem Blue Cross and Blue Cross?

Anthem Blue Cross is the trade name of Blue Cross of California. Independent licensee of the Blue Cross Association. ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. Anthem Blue Cross Life and Health Insurance Company is a PDP plan with a Medicare contract.

What states are Anthem BCBS?

Headquartered in Indianapolis, Indiana, Anthem, Inc. is an independent licensee of the Blue Cross and Blue Shield Association serving members in California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, Nevada, New Hampshire, New York, Ohio, Virginia and Wisconsin; and specialty plan members in …

What does 20 coinsurance mean after deductible?

The percentage of costs of a covered health care service you pay (20%, for example) after you’ve paid your deductible. Let’s say your health insurance plan’s allowed amount for an office visit is $100 and your coinsurance is 20%. If you’ve paid your deductible: You pay 20% of $100, or $20.