An overview of community insurance

We’ve compiled an overview of insurance specifically for community schemes and their members. While it doesn’t explain the finer details of our policy cover, it’s a handy guide about the disclosure of material facts that could affect your cover, and it includes useful info to help you understand insurance, and the laws and by-laws of our country.

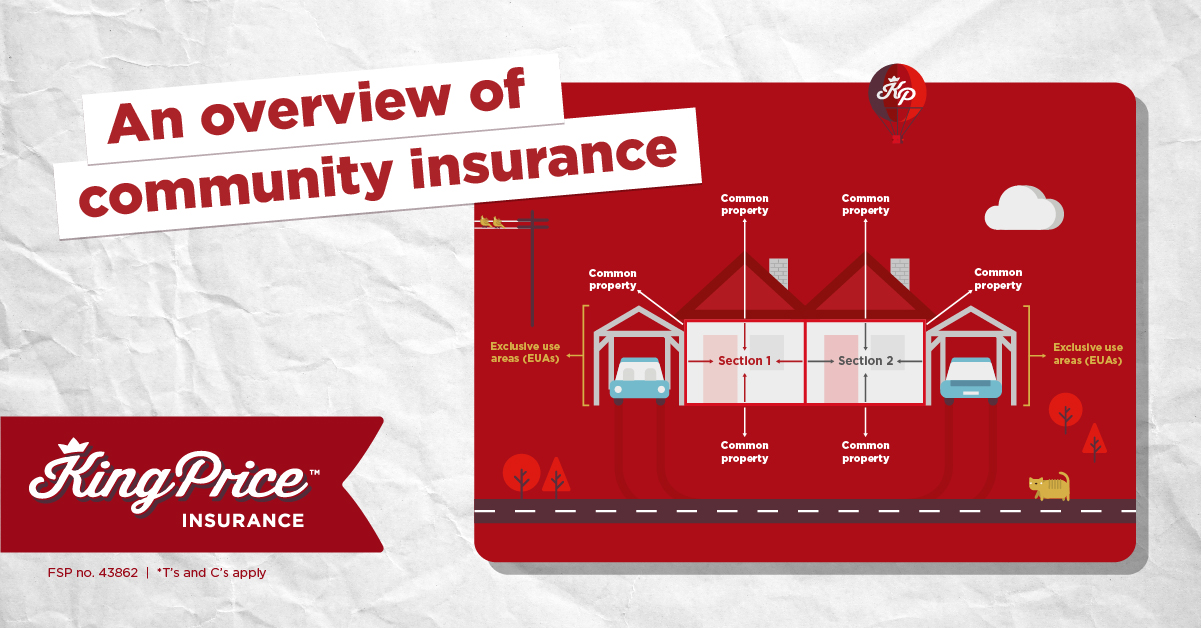

Common property, sections and exclusive use areas (EUAs)

Participation quota (PQ) schedule

Your unit’s PQ reflects your ‘share’ in the common property. We use the PQ share to calculate an individual insurance premium.

Excess and maintenance

In terms of the Sectional Titles Act No. 95 of 1986, unit owners are responsible for:

The excess payment in respect of their sections or EUAs.

Maintaining their sections or EUAs.

National building regulations: Subdivision, consolidation and extension of sections

It’s important that owners follow the steps set out in the Act:

Get written approval from all other unit owners.

Appoint an architect to submit a draft sectional plan to the Surveyor-General for approval.

After approval, submit the approved sectional plan to the Deeds Office to register.

Appoint a professional, certified contractor to do the work, which must adhere to the required building regulations.

Here’s more info as set out in the Act

Section 13.1 (g) addresses for a change in their section or EUA for any other purpose than what it was designed to be and is registered as in the section plan. An example of this would be changing a garage to a living space.

Even if written permission is obtained from all owners and the steps above are followed, the owner needs to submit plans for approval as building regulations are very specific with regards to ventilation when it comes to change of occupancy. For example, changes could result in occupational, fire, or flood evacuation hazards.

Your insurance policy is also affected if there aren’t any approved plans, because this is non-disclosure of a material fact.

South African National Standard (SANS)

Owners are required to obtain a Certificate of Compliance (COC) for any new installation, repair, maintenance, replacement or upgrade, such as an electrical, plumbing or gas installation. This COC must be issued by a registered and qualified contractor.

Once any new installation or upgrade is done, let your chairperson or managing agent know about it as your insurer needs an instruction to amend your policy. As the unit owner, you may be charged for the additional premium on the PQ schedule, and your managing agent may need to adjust your levy.

If you want a quote for your community scheme, click here. We’re eager to assist and give your community the royal cover it deserves.