LIC’s New Plan Bima Jyoti (Plan No. 860)

Bima Jyoti, this is the name of New Plan of Life Insurance Corporation of India, Plan No. 860. Bima Jyoti is a Non-Linked, Non participating, Individual life insurance plan. Premium payment is available for limited-term ie 5 years less than the policy term. Bima Jyoti has the provision of Guaranteed addition of Rs. 50 per thousand basic sum assured throughout the policy term. This plan is available for online as well as offline sales from 22/02/2021. UIN of Bima Jyoti is 512N339V01.

LIC’s Bima Jyoti Eligibility Conditions

Benefits of LIC’s Bima Jyoti, Plan No. 860

The benefits payable in inforce Bima Jyoti policy are

a) Maturity Benefit:

When the policyholder survives till the end of the policy term and all the due premiums have already been paid “SUM ASSURED ON MATURITY” along with accrued GUARANTEED ADDITION will be payable where “SUM ASSURED ON MATURITY” is equal to BASIC SUM ASSURED.

b) Death Benefit:

In case life assured dies before the date of maturity and policy is in force condition then the benefits payable to nominee/assignee is as under

Before the date of commencement of risk: Refund of premium without any interest and excluding any extra premium charged.

After the date of commencement of Risk: “SUM ASSURED ON DEATH” is payable. Here “SUM ASSURED ON DEATH” is defined as the higher of 125% of Basic Sum Assured or 7 times of the annualized premium.

Guaranteed Addition in Bima Jyoti, Plan No. 860

If the premium is paid regularly in the policy, Guaranteed Addition at the rate of Rs. 50 per thousand sum assured is added to the policy at the end of each policy year. In the paid-up policy, guaranteed addition will be added up to the year for which full premium has already received for that year.

Optional Riders in LIC’s Bima Jyoti

There are 5 optional rider available in the LIC’s Bima Jyoti (Plan No. 860). These can be taken by the proposer by paying the extra premium for these riders. Following riders are available in the Bima Jyoti policy

LICs Accidental Death and Disability Benefit Rider, UIN: 512B209V02LIC’s Accidental Benefit Rider, UIN: 512B203V03LIC’s New Term Assurance Rider, UIN: 512B210V01LIC’s New Critical Illness Benefit Rider, UIN: 512A212V02LIC’s Premium Waiver Benefit Rider, UIN: 512B204V03: This rider is only allowed when the life assured is minor.

Other Important terms and Conditions of Bima Jyoti Plan

Mode of Premium Payment: Policy can be taken in Yearly, Half-yearly, quarterly and monthly mode. The monthly mode can only be taken in NACH or salary saving scheme.Settlement Option: Proposers have the option to take the maturity in installments or opt for the death claim to be paid in installments to the nominee.Grace Period: A grace period of 30 days is allowed in yearly, half-yearly, and quarterly mode policies and 15 days in the case of monthly mode policies.Mode and High sum assured Rebate: Rebate of 2% of the tabular premium for year mode policies and 1% for half-yearly mode policies is available. A high sum assured rebate is available for policies having sum assured over and above Rs. 300000.Paid Up value: If 2 full years premium has been paid in this policy, then this policy will become paid up.Surrender: Policies can be surrender at any time during the policy term provided two full premiums have been paid.Revival: Lapsed policies can be revived within 5 years from the First Unpaid Premium (FUP). Know more about revival HereLoan: Loan be taken in this policy at any time during the policy term provided two full premiums have been paid. The maximum loan available is 90% of surrender value in inforce policy and 80% in paid-up policies.Free Look Period: The policyholder has the option to return the policy if he is not satisfied with the term and conditions of the policy. He can return the policy within 15 days of receipt of the policy bond.Assignment and Nomination: Both allowed as per the section 38 and 39 of Insurance Act 1938.

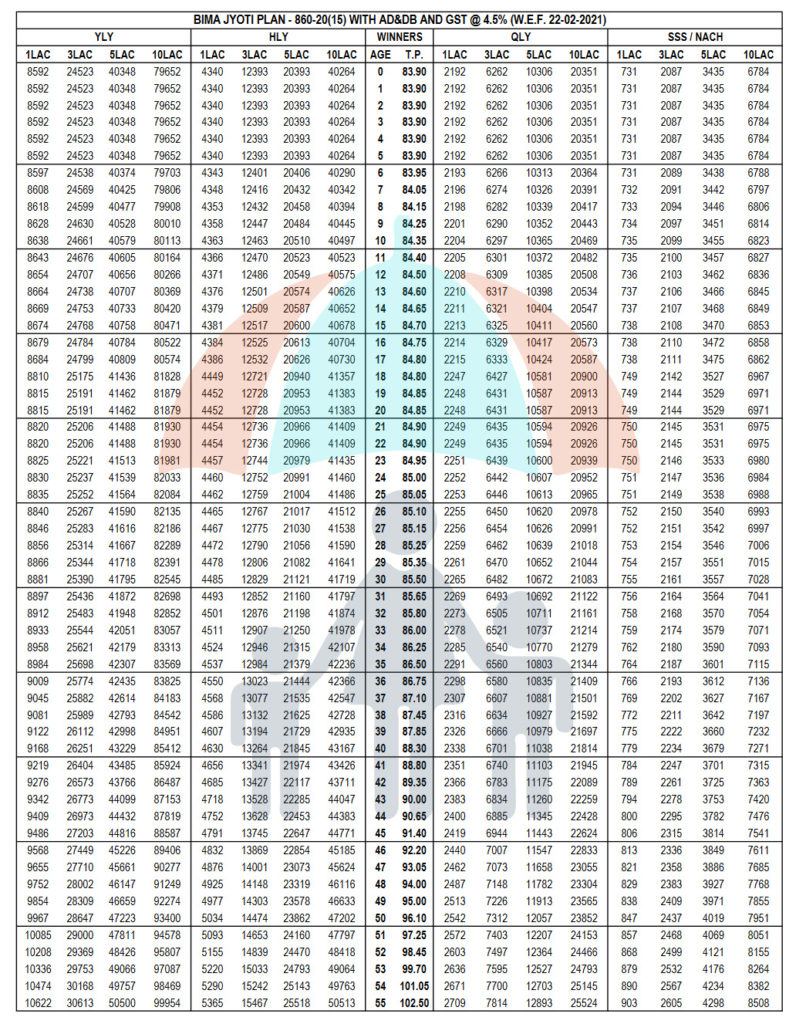

Premium Rates In LIC’s Bima Jyoti Plan

If you have any other questions related to LIC servicing then just mail us at [email protected]. You can also comment below. Share if you liked this information useful because Sharing is caring!