What Happens If I Don’t Pay My Health Insurance Premium?

Your health-care coverage and your national identity card serve as evidence of protection. When you go to the physician, the hospital, or another provider you may use your health insurance card. However, it is a handy guide that shows you how much you may have to spend. Identifying your card will assist you in budgeting for medical bills and receiving the services you need according to your demands. A health insurance card serves as proof that you are covered by health insurance. It includes documents that can be used by your local clinic to obtain payment from your insurance provider. Initially, doctors/ medical consultants will treat you as a patient, they normally make a copy of your insurance card.

A happier employee is a high performer, and having a happy worker is critical to every company’s long-term growth. Any company’s primary goal is to make money, which can only be accomplished if each employee gives all he or she has to his or her work.

Employee health care is no incredibly important; it is also a must for hiring and retaining talented jobs. In reality, the majority of employers agree that health care is the most valuable service provided by their employer. That’s because, for a variety of reasons, many individuals do not work out private health care policies. Many businesses, on the other hand, lack the time or money to do healthcare delivery on their own, which is where we step in.

Insurance providers use your credit ratings to determine whether or not to cover you and how much your premium would be. And the fact that they use your credit history to make assumptions about you, they do not disclose prompt or late transactions to the credit reporting agencies, because insurance payments have no bearing on your credit score.

Mostly during tough COVID-19 disease, thousands of Families have lost their sources of revenue, and with it, their freedom to pay for necessities such as health care. They are facing a lot of problems paying their health premium due to worse conditions. It is still important to have access to health care, but it is extremely significant now.

Not only for preventive care but also for testing and treatment of the numerous diseases like a devastating disease these days. Health insurance covers the range of physicians, nurses, and other health care services you visit. Citizens who are facing serious diseases, such as diabetes and increased blood pressure, should be insured not just as they’re more susceptible to a severe incident of COVID-19, but also because they are more likely to infect people.

Still that 75 percent of recent cases of kidney disease are caused by these chronic illnesses. Insurance is critical for maintaining the quality of treatment and addressing chronic diseases. So we should understand the better policies of insurance and also appreciate them accordingly. Many health care policies have a waiting clause, which allows you to keep seeing your physicians for a certain duration of time until your coverage is canceled. In these situations, you only have a few days after the deadline to pay your fee.

Several countries have gone further to mandate insurers to include grace periods on the health care policies they control, this may include QHPs, small community insurance providers, employer-based health plans, and Medicare supplement plans.

In respect to the lack of government policies and legislations, some counties have issued briefings instructing insurance providers to grant registration requirements, ensuring that a patient’s health insurance will not be canceled due to nonpayment during emergencies. Also, after the emergency finishes, these municipal authorities’ directives usually compel the insured to permit customers to pay back premiums in installments. Check the Association And the national Insurance Collectors’ state website and see if there are any regulations ordered by your state or specific region to the health insurance provider to have a time limit.

Any charges laid within the 1st month of the APTC timeline must be paid. Instead of covering premiums during the second two months of the review period, insurers keep them and advise hospitals that the patient has not paid the payments yet. The insurer will disenroll the patient in the case when the patient has also not paid the fee for 3 months.

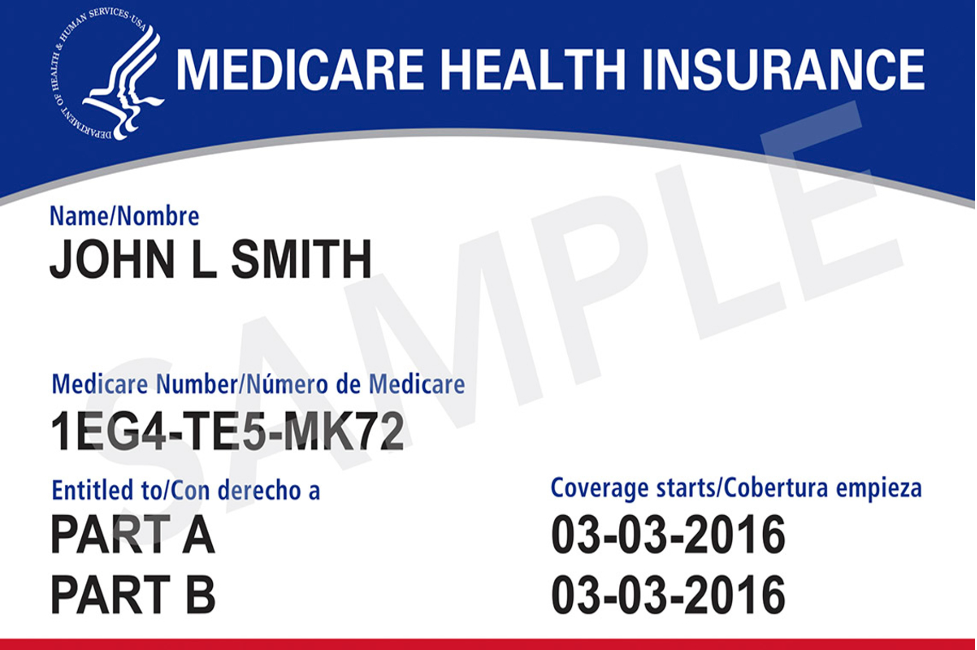

The majority of transplant patients are covered by Medicare. Many will still need a Medicare Supplemental Insurance package to assist it without expenses. Medigap plans for those above the age of 65 are only covered by government patient rights. Multiple facets of Medigap are controlled by the jurisdictions, about whether providers are required to sell certain services to Medical practitioners under the age of 65. So some things are necessary to be noted down when going to ensure premium health care. You must follow the instructions of the respective organizations to secure your insurance.

When your health insurance package was canceled due to late payments, you should know what will occur to your outstanding medical expenses, and the medical insurance subsidy, and your options for finding new healthcare coverage.

When you have your policies, you have a redemption period for past-due payments, but the duration of the grace period is determined by whether you can get a premium tax credit to make you money for the policy you purchased in Affordable Healthcare.

The timeframe is 90 days if you are earning a premium tax refund and have already charged your first insurance payment to begin coverage. If you don’t (that is, if you pay maximum rates for the auction or exclusively through a health insurer), your time frame will be limited to only 1 month.

The insurance settled by you will be canceled in a situation to not able to pay your previous payments before the grace period’s end. If you have a 90-day wait period, your insurance will expire after the 1st day of the month after the closure of your time limit.

Under other terms, you’ll have had a full month of coverage—but keep in mind that the amount will be redelivered to the authority for the insurance subsidy that was billed on your side for that specific month when you file your income.

In other words, you’ll have had such a whole time duration of coverage but bear in mind that the balance will be redirected to the regulator for the premium subsidy that was paid on your behalf for that same month/ days when you submit your expense report.

In this case, there seems to be a risk that any medical bills from your last insurance coverage will be returned to you unpaid. When you earned healthcare benefits when in the 2nd or 3rd month of being behind because of the healthcare premiums, here is what applies, or if you earned medical treatment in those days when your premium health care was too late and you were not getting benefit from receiving the money.

Status of health insurance will be subjected as pending in case when you have failed to pay the previous tax payments of premium insurance. Once you’ve been having trouble paying your health care premium for more than 1 month. Instead of filing and covering these premiums, the insurance firm puts them on track as it intends for you to move ahead on the insurance premiums for the evaluation. When you will not pay enough, your health insurance will be canceled automatically within 3 months. The termination will take effect at the end of each month in which depending upon your premium and its comprehensive overview analysis.

You won’t be compensated for the waiver your old healthcare plan received with the in-network employer when your health insurance was canceled retroactively on the day you were about a month late. When you received the treatment, you became effectively unprotected. Excluding any of the system discounts, the bill could be considerably more.

The same is the situation when you don’t get insurance reimbursement and therefore don’t pay your premium healthcare until the last of the time limit, all of your coverage will send back to you by an insurance agent by the end day. And all appeals you had throughout a couple of weeks’ wait period will be denied.

The most adverse thing you can do if you suspect anything could happen to you is to do nothing. Be positive in your approach. Reach an agreement with your service insurer until your health insurance premium is canceled. Since many lenders send past-due payments to credit card companies, failing to act now could harm your credit history and make it more difficult to obtain credit in the upcoming days.

Stay honest and tell all the things truly about your condition while approaching the insurance agent about the outstanding bill. So your credibility remains on the right track. Several medical professionals would agree to financial arrangements and they will like to be billed gradually rather than not at all. Making deals on a payment schedule can help you avoid having your bill turned over to a finance company. If you obtained treatment from a major institution, such as a doctor, inquire about peer options or some cases talk about charity and other donations.

Several punishments or penalties are imposed for being uninsured from 2014 to 2018 in different regions of the world. The tax was calculated and depends upon the monthly income and financial resources and the number of months you go without health care for a minimum of 1 day. As of 2019, the fine has been dropped to a minimum meaning those who are disabled no longer face penalties on their taxable profits.

You will be included in a grace cycle if you do not pay the bill on time. You will be unable to pay for the health care benefits you rendered after your grace time if not received any reimbursement. Except if your contract has indeed been canceled, we’ll resume service as soon as your invoice is received in total. Between 3 months of the grace period, whether you’re qualifying for and collecting the Accelerated Insurance Tax Credit, the claims would be assessed differently than normal.

Your claim will be paid as normal during the thirty days of time frame.

The cases will be pending for the starting months. That confirms there will be owned by us without being charged or refused. Any arguments from pharmacies will be denied. You’ll have to charge for them yourself.

You’ll be liable for any pending lawsuits if you go for 90 days without paying in total.

Once a service has been conducted and the provider has paid us for this service, a retroactive rejection may arise. When a claim is denied retroactively, it is called a retroactive denial.

Arguments are paused during the most recent months of a waiting period if the participant does not settle their fee in a suggested time limit to manage insurance. For charges denied by the plan, the member would be left responsible for the expense of services.

Signatories are necessary for a facility, but no order for a review to assess clinical need has been submitted.

The profit has been used up and the products have been rendered.

You should have an idea to pay your insurance on time.

In cases where approval is needed, try to ensure your insurance agent has provided the correct documents.

Be sure you understand the advantages and don’t use them until you’re certain your programs are a profit.

You will forfeit your policy benefits if you do not afford your premiums and the grace time on policies provided in a health insurance program has expired.

The Consolidated Omnibus Budget Reconciliation Act gives you the constitutional freedom to stay on an old employer’s collective health care package for a fixed amount of time following a job loss in California and some other parts o Canada. COBRA may be a quick fix, but it comes with a price tag.

When your premium health care premium is due, for a limited period. So this requires a short period of 90 days. If you haven’t paid your bill yet, you have until the end of the period to do so to keep your health insurance.

There is no general ban against covered or plan representatives canceling their health care benefits or inclusion in a health benefit plan. There are no tough rules for these conditions. Aside from that, there are no financial consequences of canceling health care coverage. You will not get the premium service return in case to demolish the policy of health care coverage.

Your schedule will be canceled if you do not comply. In many situations when you are not able to pay your bill in time for your first payment, you’ll get a grace period. By the close of the waiting period, you’ll have to pay for everything you charge. You could lose your insurance policy if you wouldn’t.

The cost of your health care coverage premium is apparent because most people’s pay is based on a month. The contribution you give to your health care provider to keep your policy active is called a fee. Copayments, self-insured, and reimbursements are some of the most visible health care bills.

When you have two insurance plans from two separate firms and you terminate one of them but don’t pay the other, they will most likely refer you to payment authorities and can take actions according to the jurisdiction against you, such as suing you. The conditions will determine whether you will be held accountable. It’s possible that the fact that you “temporarily suspended it later” is contributing to the issue. So you should follow the instruction according to the company liabilities and then follow these rules. Otherwise, you have to face penalties if you are failed to submit the health insurance premium according to the suggested period.