How telematics is shaping usage-based insurance

On many fronts, the digital insurance industry looks vastly different than it did five years ago.

One of the biggest changes is the continued rise in usage-based insurance (UBI) models, which use data from each particular driver — for example, how fast they go, where they go and how often they drive — to determine their car insurance premium. The UBI industry is expected to be a $175 billion industry by 2028, up from $48 billion in 2023.

Of course, UBI isn’t possible without telematics devices. The technology for tracking driver behavior is getting cheaper, sleeker and more convenient for both insurers and their customers — one of the big reasons the sector is growing so quickly.

That’s why it’s crucial for providers to understand where the telematics industry is headed and what benefits and challenges those changes present.

The telematics revolution

The term “telematics” dates back to the 1970s, but the technology wasn’t mainstream until much more recently, as GPS technology became a ubiquitous part of our lives. Now, these devices are extremely accurate when it comes to knowing where someone is, how they’re driving and how inherently risky their driving behavior may be.

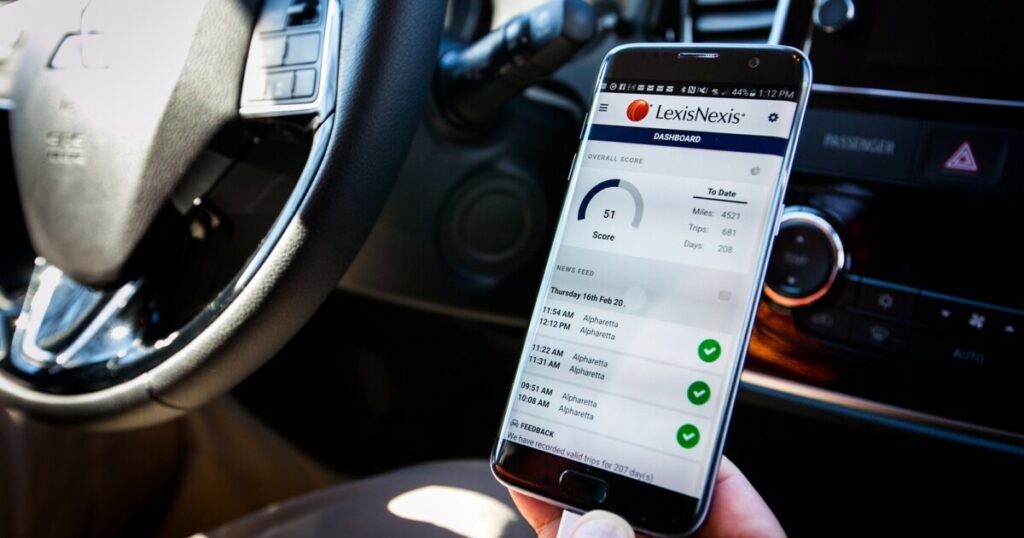

Telematics devices are now widespread. Many car companies — like BMW and Tesla — install data-transmitting directly into their vehicles, and drivers can also share information straight from their smartphones. It makes sense that UBI programs nearly doubled in popularity from 2016 to 2021, as many of these technologies were taking hold.

But with UBI still not accounting for anywhere near a majority of the plans on the market, the question becomes, what’s next? Because telematics offers a clear advantage for many customers — especially good drivers — it seems clear that more insurers will be going all-in on telematics-based offerings as the competition takes hold.

The biggest benefits

It’s easy to see why UBI is expected to surge in the coming years.

For one thing, it offers massive benefits to customers, many of whom can get discounts as a reward for their good driving. It’s easy to understand why many drivers would jump at the chance to have greater control over what they pay.

And those savings aren’t just imagined. In 2022, Progressive said that drivers who switched to telematics-based programs saved an average of $146 during the previous year.

That’s a benefit in itself for insurers, as it allows providers to stay competitive and offer better rates than their peers. But for providers, the even bigger advantage is the data.

Telematics devices don’t just measure speed and driving time, they can also track everything from seat belt usage and idling time to harsh braking and various vehicle issues. Those capabilities can be transformative for risk assessment, as it lets providers avoid big losses by setting rates that truly match a driver’s behavior and situation.

Plus, this plethora of data can help expedite the claims process, with insurers immediately able to access information describing how an accident occurred and what factors played a role in it. It can also help prevent fraudulent claims.

A few challenges

Like any emerging technology, telematics isn’t without its drawbacks.

For one thing, some customers don’t like the idea of giving so much data to an insurance company. There’s been increased frustration about the amount of information cars collect in general, with some going as far as to call vehicles “wiretaps on wheels.”

To address this concern, providers need to ensure they’re using telematics data responsibly. From there, it’s about educating potential customers on how and when their information is shared. It also rests on insurers to emphasize the pros over the cons, leaning into the flexibility and potentially massive discounts on offers.

However, there’s the flipside of those benefits, which is that customers will be understandably upset if their driving behavior leads to higher rates instead of lower ones. That’s where providers must be ready to set expectations accordingly and make it clear to their customers how they can work to improve their risk factors and receive a better rate.

All in all, telematics presents some key challenges — largely in the realms of customer service and marketing — but its benefits aren’t even fully realized yet. As the UBI industry continues to grow, the most successful providers will be those who can adapt to the changes and keep up with new trends before they fully blossom.

See more:

How to revitalize auto insurance coverage with telematics

Telematics class action: Law and legal news