Six Technology Hurdles to Insurance’s Customer-Friendliness

Published on

November 10, 2022

In the full realm of digital retail, where even groceries can be ordered and delivered online, Trader Joe’s stands out as a unique business. There is no web ordering, no shipping, no delivery, and no plans to change like other grocery stores.

Someone who has not visited Trader Joe’s might then wonder, “How can they buck the trend when Walmart, Whole Foods, and Target are fully committed to multi-channel order and delivery?”

Trader Joe’s, however, has an intangible, powerful formula for loyalty. I should know as it is where I go for very specific things and love their seasonal items — like all their pumpkin stuff this fall! They have many products you can’t get anywhere else in the friendliest retail environment on earth. They also have some seriously friendly people whom all seem to be genuinely interested in each person who comes into the store. Somehow, the culture has crossed nearly all 500+ stores. No matter which one you walk into, your experience is likely to be the same. A person who loves their job will make you feel glad you walked in.

Insurers (fortunately or unfortunately) can’t afford to skip the digital experience. They must meet prospects and customers at the points of most-likely contact. They must pursue multi-channel experiences with every service they can muster.

However, even though digital-ready insurers can’t act like Trader Joe’s employees, the idea of friendliness isn’t that far off the mark. Can insurance processes and next-level technologies place the ‘friendly’ back into customer-friendly? Can they replicate the caring and welcoming feeling by transitioning their data and frameworks into tools for knowing customers? Anticipating their needs? Can insurers create touchpoints that have always been a hallmark of the traditional agent or agency?

And, can the customer experience transformation be designed to improve loyalty, retention, customer lifetime value, and Net Promoter Scores®?

Catching up to customer expectations with consistency

Technology says a lot about a company. Does an insurer want its customers to do the work of the business? Does it want to facilitate every customer interaction possible? Does it want to meet somewhere in the middle on the bridge to service — looking conciliatory and offering some excellent services, but leaving other experiences and products back in the 2010’s? This is what has happened most recently in P&C, where many insurers have made quoting and buying easier. In many cases, FNOL has been made easier. But we still have areas of difficulty like digital payments and dealing with complex claims scenarios such as cat events or other large losses.

The great news is that insurers largely know that they must improve their customer-facing systems, no matter what. In a Majesco-sponsored Customer Experience report developed by SMA, many gaps were highlighted between the desire for customer experience transformation and fully realizing the vision of “Customer 360.”

“SMA research indicates that 94% of commercial lines carriers and 100% of personal lines carriers have a strategic initiative to improve the customer experience. Personal lines are farther along in the journey, but they are still in early stages relative to other industries. Small commercial lines has a great amount of new customer-centered activity. 72% of carriers serving the small commercial market are in the strategy or initial activity phases of their customer-focused initiatives, signaling great opportunity to differentiate.”

The imperative wouldn’t be so strong had it not been for the pandemic. The pandemic accelerated the need for change. It widened the gap between customer needs and expectations, and insurer capabilities. Suddenly insurers were faced with a population that was increasingly loyal to convenience. Changing customer demographics and the temporary avoidance of bricks and mortar relationships fast-forwarded the digital mandate. Insurers were faced with double-digit changes in customer service preferences. Research firms, such as Gartner, were putting numbers to the theories, such as 44% of millennials preferring no human interaction.

The difficulty was not so much in the acceleration of change but in the inconsistent application of digital. Insurers weren’t prepared to transform all aspects of service at once. The situation seemed (and still may seem) monumental. Insurers need to plan for a unified digital experience across all interactions in the value chain. This may require internal transformation. It may require reaching out of the organization into new ecosystems that will enable a broader customer experience. The strategy and methods will vary by insurer, but the end results should be an organization that is infinitely more friendly and far more ready for the future of insurance.

The 360-degree view of the customer. Which hurdles stand in the way?

When does a transaction officially become a great experience? It may be the moment when a customer completes a specific transaction like payment, is able to do a different one like update authorized drivers on a policy, and then also gets a copy of their insurance card digitally. They realize that it was easier than normal, they did not need to go to different portals or apps to do each one, as it accomplished what they needed holistically with no hassle. In today’s world, customers want us to make their lives easier and in doing so we become customer-friendly.

With that notion in mind, insurers must think in terms of a 360-degree view of the customer. A true 360-degree experience will allow customers to address all of their needs in one location (across multiple channels). Rather than having different apps, portals or user interfaces for separate functions, such as quoting/sales, billing, payments, claims, and policy service, the customer should be able to access all of them, plus value-added services, from a single customer engagement platform.

The idea of the 360-degree view has been around for many years, but the typical insurance customer experience is still transactional and hasn’t reached the full 360-degree potential. When looking at the common insurance system structure, it’s easy to see why only the surface has been scratched.

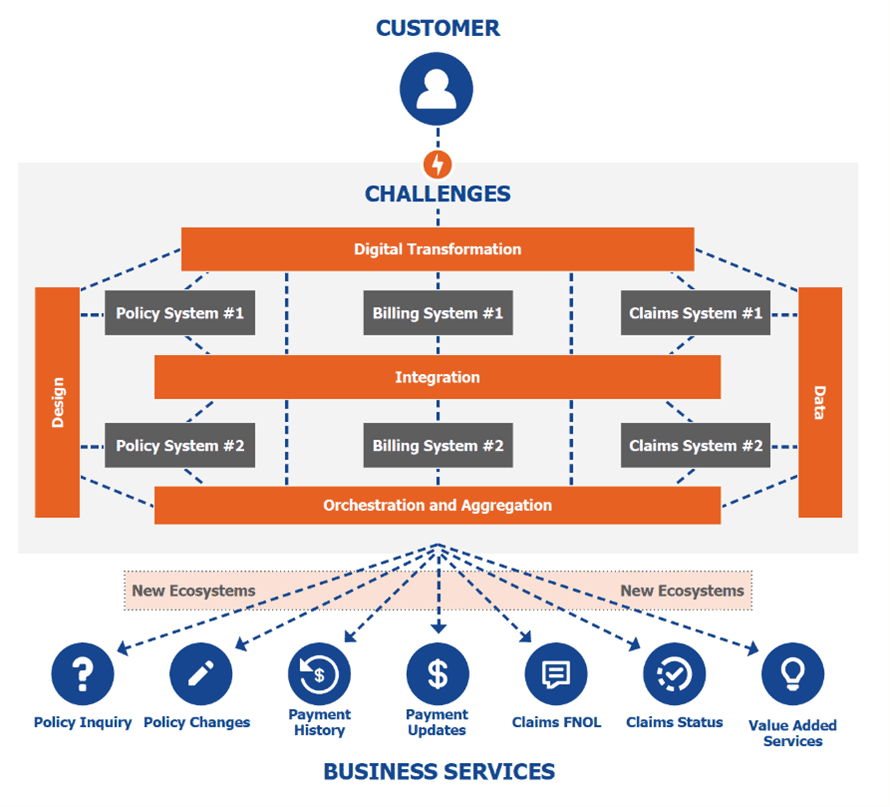

Figure 1: Challenges Faced by Insurers for Customer 360

The SMA Customer Experience report identifies six technology-oriented challenges that insurers must overcome before they can deliver on the Customer360 experience:

Digital Transformation

Data

System Integration

Ecosystem Integration

System Design

Aggregation and Mediation

Technology Hurdles Related to the Digital Experience

It’s easy to provide a list of hurdles, but much more difficult to grasp each one in the context of the full system and its need for transformation. Let’s look briefly at the hurdles and touch on its vital relationship to providing an excellent customer experience.

Digital Transformation

Core systems are vital. Though they may be supplemented with new, cloud-based core systems or have cloud supplemental systems appended to the insurance system framework, they need real work and updates to extend their value into the digital realm. Often these systems are so complex that planning around them is a major hurdle.

Data Transformation

Customer-oriented data is a major insurance challenge. Insurers traditionally hold a wealth of data, but its integration into the transaction workflow isn’t easy. Its ability to be used in real-time is a hurdle. The application of analytics on the data holds great promise but hasn’t yet reached its full potential. Insurers that have strong capabilities to capture, define, route, organize and manage data on behalf of their customers are well-positioned to move toward the Customer 360-degree vision.

System Integration

Insurance systems are engines of connection. They must facilitate flow, provide data security, standardize and clean information where appropriate — and they are best when they integrate easily. Modern system architecture contains features like APIs, microservices, cloud-deployment capabilities, and other methods for easing common integration burdens. Customer service is at a great disadvantage when it has to contend with system silos. Transformative integrations can improve everything from the back-end to the front-end.

Ecosystem Integration

The new customer experience represents not only improved transactions but a new set of customers! Ecosystem integration will expand the insurance product space into embedded insurance and new channels opened by new partners. How partner-friendly and ecosystem-friendly are yesterday’s insurance frameworks? Tomorrow’s growth will be hampered by a lack of ecosystem readiness. Insurers need to prepare to give great service, not only to their direct customers but to their partners’ customers as well.

System Design

Nearly any perspective on monolithic systems will give you an understanding of their weaknesses. They are tremendously functional, but their architectures aren’t built for flexibility or speed. Component-based architectures, including a microservices approach to building and assembling capabilities results in a more flexible, adaptable system. Modern component designs are better suited to enable faster speed to market for new products, adding partners, adding channels, and incorporating today’s advanced technologies.

Aggregation and Mediation

How does it all work together? The consistent customer experience will be tied together in clean, uniform methods for data and communication orchestration. This may be an exercise undertaken for better customer understanding, but in reality, all business users will benefit from the effort. Reporting will become easier. Product development will improve. Every area that depends upon data will enjoy a renewed ability to view, understand and analyze the business.

Every effort tied to the customer should end with efficiency across the entire enterprise. This is where the promise of the insurance culture can pay off. As insurers get excited about the possibilities for customer experience transformation, they will be paving the way for their own user experience to improve dramatically. The satisfaction on the inside will be shown through the experience on the outside.

This customer 360 concept is the foundation of Majesco Digital Customer360 for P&C solution, an accelerator designed through the customer lens to enable easier and more seamless interactions across service, billing and claims – an intentional upgrade from the typical transactional experience through separate portals and applications. This new, innovative solution simplifies the interactions for customers on a single platform including policy inquiry, policy changes, payment history, payment updates, FNOL, connect to service providers such as repair networks, claims status, value-added services and integration with core solutions. Majesco Digital Customer360 for P&C provides that next-gen customer experience that compares to today’s leading digital companies in other industries.

In part two of our discussion on customer experience (more on that below), we’ll look at specifics. What needs to happen to improve the customer capabilities of insurance systems and what do the first steps look like? How do we make sure that all of the important details are addressed, such as the support for advanced data, Artificial Intelligence, and API libraries? Are there right ways and wrong ways to bring a consistently excellent customer experience to life?

Until then, take advantage of Majesco’s media opportunities, such as our Thought-Leadership reports (read Core Modernization in the Digital Era) or sign up for one of Majesco’s industry webinars and hear from today’s most sought-after insurance industry analysts.

[part two will be…]

Digital Customer Experience: The New Tools of Engagement