5 Stock Hurdles for 2023

What You Need to Know

After an $18 trillion rout in 2022, here are the key factors that could determine how next year plays out for global equity markets.

More tech tantrums. China’s Covid surge. And above all, no central banks riding to the rescue if things go wrong. Reeling from a record $18 trillion wipeout, global stocks must surmount all these hurdles and more if they are to escape a second straight year in the red.

With a drop of more than 20% in 2022, the MSCI All-Country World Index is on track for its worst performance since the 2008 crisis, as jumbo interest rate hikes by the Federal Reserve more than doubled 10-year Treasury yields — the rate underpinning global capital costs.

Bulls looking ahead at 2023 might take solace in the fact that two consecutive down years are rare for major equity markets — the S&P 500 index has fallen for two straight years on just four occasions since 1928. The scary thing though, is that when they do occur, drops in the second year tend to be deeper than in the first.

Here are some factors that could determine how 2023 shapes up for global equity markets:

1. Central Banks

Optimists may point out that the rate-hiking peak is on the horizon, possibly in March, with money markets expecting the Fed to switch into rate-cutting mode by the end of 2023. A Bloomberg News survey found 71% of top global investors expect equities to rise in 2023.

Vincent Mortier, chief investment officer at Amundi, Europe’s largest money manager, recommends defensive positioning for investors going into the New Year. He expects a bumpy ride in 2023 but reckons “a Fed pivot in the first part of the year could trigger interesting entry points.”

But after a year that blindsided the investment community’s best and brightest, many are bracing for further reversals.

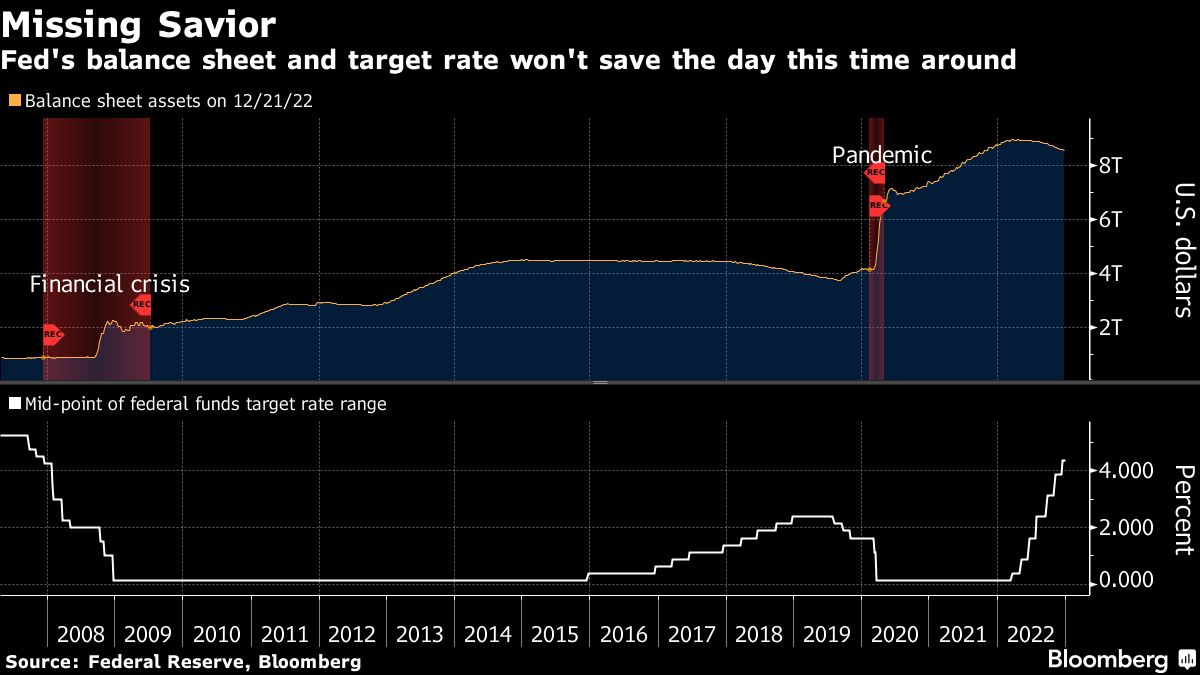

One risk is that inflation stays too high for policymakers’ comfort and rate cuts don’t materialize. A Bloomberg Economics model shows a 100% probability of recession starting by August, yet it looks unlikely central banks will rush in with policy easing when faced with cracks in the economy, a strategy they deployed repeatedly in the past decade.

“Policymakers, at least in the U.S. and Europe, now appear resigned to weaker economic growth in 2023,” Deutsche Bank Private Bank’s global chief investment officer Christian Nolting told clients in a note. Recessions might be short but “will not be painless,” he warned.

2. Big Tech Troubles

A big unknown is how tech mega-caps fare, following a 35% slump for the Nasdaq 100 in 2022. Companies such as Meta Platforms Inc. and Tesla Inc. have shed some two-thirds of their value, while losses at Amazon.com Inc. and Netflix Inc. neared or exceeded 50%.

Expensively-valued tech stocks do suffer more when interest rates rise. But other trends that supported tech’s advance in recent years may also go into reverse — economic recession risks hitting iPhone demand while a slump in online advertising could drag on Meta and Alphabet Inc.

In Bloomberg’s annual survey, only about half the respondents said they would buy the sector — selectively.