Annuity Payout Rates Are on the Move

If there is higher variation in rates, there is a bigger benefit to shopping around. If the payout rates are relatively tightly clustered, then the benefits to searching for the highest rate are likely less significant.

We’ve been exploring the potential benefits of MYGAs for over a year and a half and recently received data from Blueprint Income that includes daily payout rates for MYGAs available on their platform from Sept. 24, 2018 to May 19, 2022.

This dataset provides us with an opportunity to better understand how insurance companies are responding to the rising rate environment. If we focus on five-year terms (the most common term available), we see that average rates across all providers have risen recently along with the rise in corporate bond yields, grouped by financial strength rating.

Charts via David Blanchett and Michael Finke

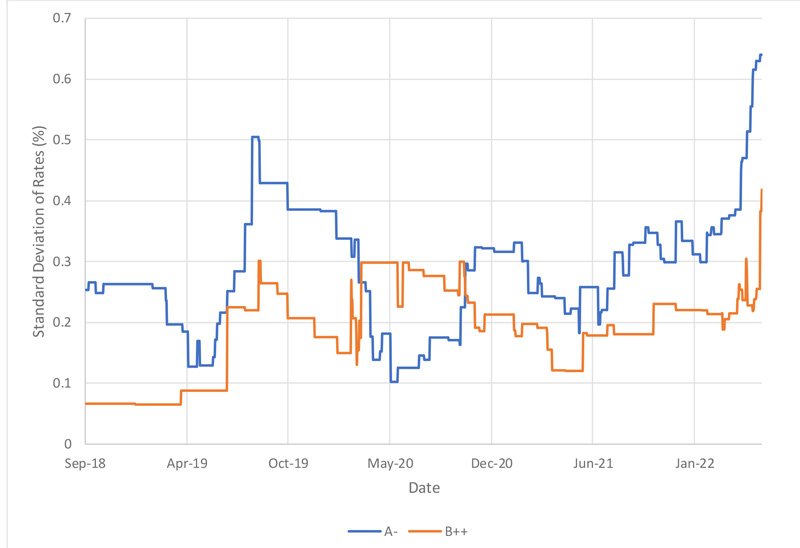

Perhaps even more striking is a notable increase in the variation in MYGA payouts recently. This effect is demonstrated in the next chart, which includes the standard deviation of payout rates among those with either A- or B++ AM Best Financial Strength Ratings. We choose to focus on only these two rating groups because they have the most provider data available, increasing from five and seven providers at the beginning of the period, respectively, to seven and 17 providers at the end of the period, respectively.

The standard deviations for the payout rates for both groups are at the highest level recently that they’ve been over the entire course of the dataset. The spike in the variation across quotes suggests that it is incredibly important to shop around among MYGA providers to get the best possible rates.

This spread effect appears to be at play with other products, such as immediate annuities, an effect noted recently in another piece for ThinkAdvisor. We hope to explore this more in future research, but we think that it is especially important for investors and financial advisors to actively shop around today before purchasing an annuity to ensure they are getting the best possible rate.

David Blanchett is managing director and head of retirement research for PGIM DC solutions, an adjunct professor of wealth management at The American College of Financial Services, and a research fellow for the Retirement Income Institute. Michael Finke is professor of wealth management at The American College of Financial Services.