How Income Protection Works in Ireland in 2022

How Does Income Protection Work?

So far, you’ve been lucky.

It hasn’t stopped working.

Like clockwork, it cranks out the good stuff.

Minute after minute, day after day, tick tock, tick-tock.

You’ve heard some scare stories.

The Kelly’s machine has been out of action for 6 months, the Flynn’s hasn’t worked for over a year.

But your machine is fine.

For now.

Someone had tried to sell you insurance for the machine, but you just couldn’t afford it at the time.

Anyway, at that time the machine was brand new, state of the art, unbreakable.

But you worry because the machine isn’t as young or robust as it used to be.

What if something happened to it?

What if it slowed down…. and stopped…. forever?

What if your money machine couldn’t produce long term?

How would you cope?

Think about it for a second.

If you had a machine in your house which spat out your income every month, would you insure it?

Of course, you would.

It would take a stupid foolhardy person not to.

You, dear reader, are a money-making machine.

You will generate hundreds of thousands, if not millions of euros in your working life.

And that’s why you need to safeguard that income with income protection cover, the costs of which we analyse here.

If you break down and are out of work for a long period, the money-making machine will stop.

What would happen then?

Income Protection: in plain English

Who doesn’t like a good duvet day?

It’s appealing: stay snuggled in bed, wrapped around your blankie – especially if you have young kids who think 5 am is a good time to stand on mam and dad’s bed to shout and roar. (Kids. Aren’t they great?)

Those fake sick days can add up – and that’s not to mention actual illnesses. There’s only so much flat 7up and hoping for the best will actually cure.

So what’s the story when you go far beyond man-flu, sickies, or a stomach bug brought into the house by your loveable-but-extremely-sneezy kids?

What happens if you’re hit by a car or you get an illness that leaves you bed-bound for months?

Income Protection might seem pretty far down the list of required insurances, but if you’re out of work for more than a few weeks, you’ll be so very glad you have it.

So what do you need to know about Income Protection – and should you actually buy it?

If you can’t explain a concept to a five-year-old, the theory goes that you don’t fully understand it.

Now, I have no idea why a five-year-old would want to know about Income Protection, but to confirm the theory let’s break it down:

If you’re out of work for more than four weeks due to any illness, injury or disability, you’ll receive a payment of up to 75 per cent of your income until you can go back to work.

Will a five-year-old understand that?

Absolutely not.

Explaining it to a five-year-old might go as follows: Mum is sick and can’t go to work, so the people in suits in big glass buildings are going to give him money to buy Match Attack stickers and food.

Moral of the story: if your five-year-old is asking about Income Protection, give him a suitcase and a little hat and send him on his way, because he’s secretly 40 and there was a terrible mistake at the hospital.

What does income protection cover me for?

Everything.

Unlike serious illness cover, income protection covers you for ANY illness, injury or disability that stops you from doing your job.

You’re covered for absence from work due to a serious illness like cancer. But you’re also covered for a simple accident that keeps you out of work. Let’s say you slip and hurt your back – you’re covered.

You’re covered if you’re out of work due to any illness, injury or disability.

In a previous article, I looked at the alternatives to income protection.

As you can tell, I don’t think any of the alternatives provide peace of mind should you be unable to work long-term.

And if you’re thinking of relying on sick pay from work, this blog on how much sick pay you are entitled to in Ireland will be an eye-opener.

A robust Income protection plan is the only way to properly safeguard your income.

By the way, income protection = salary protection = income continuance insurance = disability insurance.

How much income can you insure?

You can insure up to 75 per cent of your income.

This takes a little explaining so listen up down the back.

Let’s say you’re an employee earning €80,000 and you’re entitled to state illness benefit of €230 per week (€10,816 per year).

The maximum you can receive in total from the state, your employer, and from your insurance company is 75 per cent of your income

That breaks down into €10,556 illness benefit from the state with the balance of €49,444 from your insurer.

€10,556 + €49,444 = €60000 (75% of €45,000).

Now, there are tax implications. Any pay-out is classed as income so you’re taxed at your marginal rate at the time of the claim.

It could so happen that you get the higher rate of tax relief on the premium but you’ll only pay the lower tax rate on your claim

And it’s still an awful lot more appealing than trying to survive on the €203 the state pays.

Can you claim income protection if you lose your job?

No, income protection covers your inability to do your job due to illness, accident or disability.

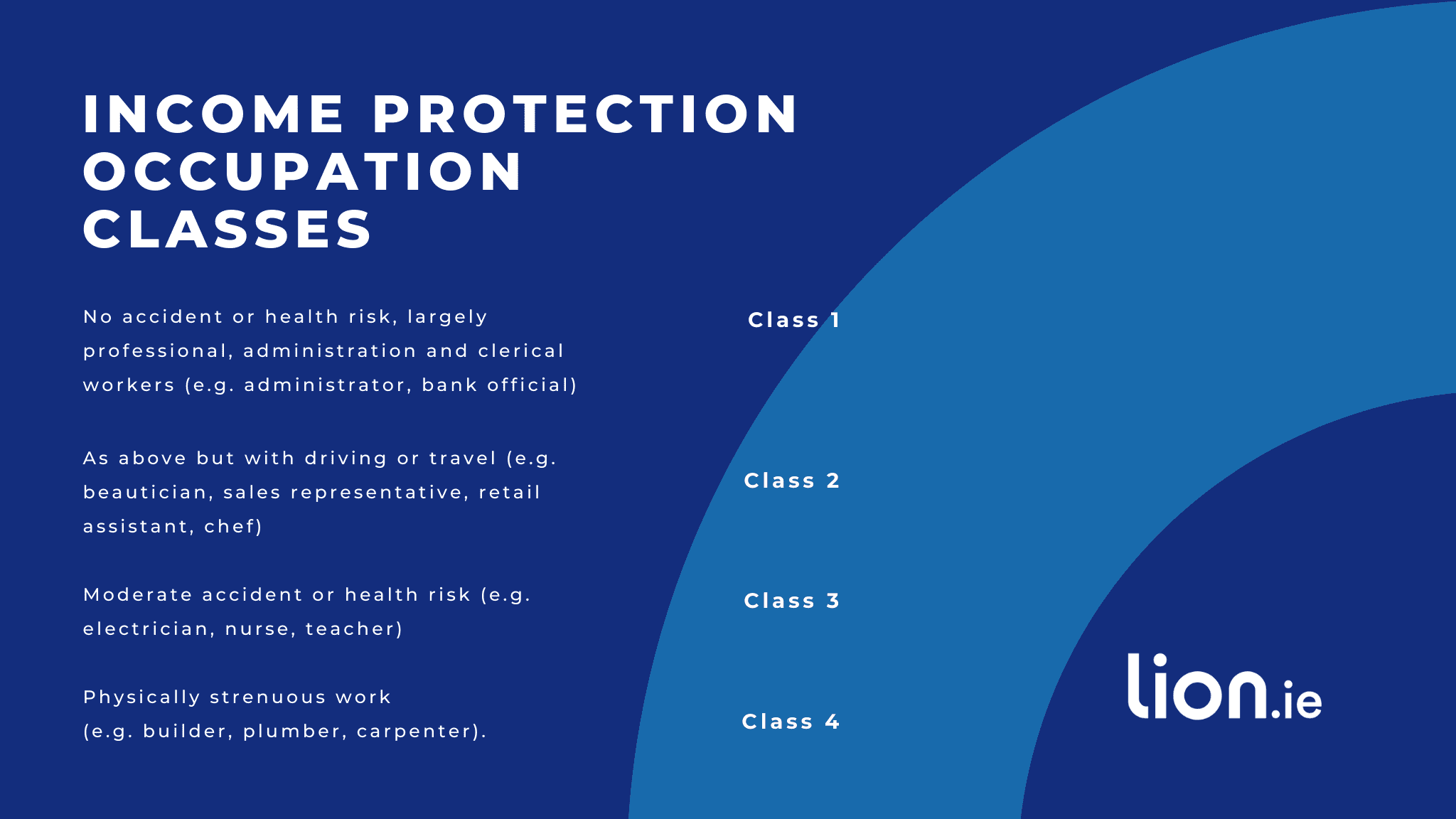

What are income protection occupation classes?

If your occupation is Class 1, you will pay less than someone who is a Class 2. If your occupation is Class 3 or 4, you may want to look at Wage Protector which is a more affordable type of income protection.

Why can I only insure up to 75% of my income? Why not 100%?

You must have some incentive to return to work.

Can I insure my pension contributions using income protection?

If you’re lucky enough to be a company director, you can take out an additional 33% to cover your pension contributions.

Let’s say your taxable income is €100,000.

You can insure up to 75% of this as income replacement = €75,000 and also 33% to cover your pension contributions = €33,000.

Depending on the insurer, it will pay €108,000 gross to your company if you make a claim.

Is income protection really worth having?

Car worth €50,000 – insured.

House worth €500,000 – insured.

Smartphone worth €1000 – insured.

Dog worth…priceless, to be fair – insured

Income worth €2,500,000 – NOT INSURED

Why?

I think I know…

Because you think it’s a scam and the insurers never payout?

Do you think you can’t afford it?

Or are you afraid you don’t qualify for some reason?

These are all valid points (I asked the same questions before I took out my policy)

So let’s go through them one by one.

1. Do insurers pay income protection claims?

Yes they do and they now publish their claims figures – see a previous article I wrote on life insurance claims.

The insurers paid 95% of income protection claims in 2017.

2. Can you afford income protection?

Maybe you can’t afford to insure the full 75% of your income…. with a 4-week waiting period…. that pays out until you’re 70.

But if you tweak the figures, you’ll figure an amount of salary protection cover that suits your budget.

Insuring 50% of your income with a 26-week waiting period until age 60 beats leaving yourself exposed by having no income protection at all.

Have a read of this article to find out ways you can reduce your premiums to a more affordable level

3. Do you even qualify for income protection?

More than likely yes.

The main reasons people don’t qualify are:

high-risk occupations (pilot, garda, trapeze artist, international man of mystery)

previous severe health issues

If you’re worried about a pre-existing condition, please complete this questionnaire and I’ll discuss it with my underwriters on a no-name basis.

So they’re the reasons you’re hesitating.

Here’s why you shouldn’t:

Because income protection keeps a roof over your head

What would happen if you were unable to work long-term due to illness? Your income would stop.

How would you pay your mortgage?

The bank would have some sympathy, but that wouldn’t stop them from trying to evict you.

Imagine if you had a magic wand you could wave to stop the bank from repossessing your home.

Your income protection policy is that magic wand. It’s your promise to the bank that you’ll be able to pay your mortgage once your income protection payouts kick in.

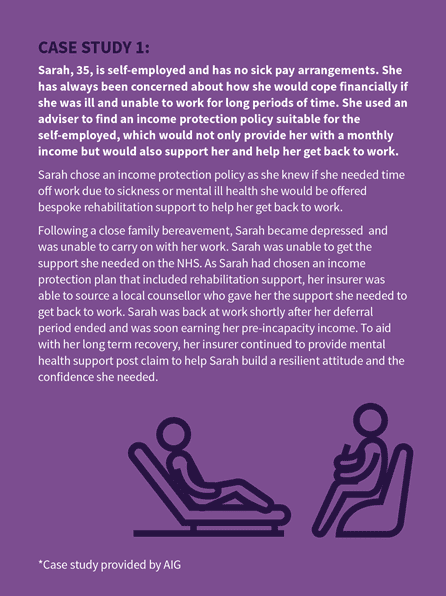

If you’re still on the fence about the need for income protection, have a read of this case study from the UK. Some of my providers also offer the support services mentioned here. You’re not just insuring an income, you’re making sure you’ll get the help you need to get you back to work.

For me, it’s the most important insurance you can buy. Your income is your biggest asset. Truthfully, tell me how effed would you be if your income stopped for one year, how about 3 years?

And the terms and conditions are very straightforward, unlike serious illness cover, where you have to contract a specific, defined illness to claim.

See more on income protection v serious illness cover

Income protection will payout for ANY illness, injury or disability that prevents you from doing YOUR job.

So once you’re unable to work due to an identifiable illness, your policy will pay you until you get back to work or until you reach retirement.

Take a minute to imagine your life if your income stopped before you decide whether income protection is really worth having.

What does Income Protection NOT cover?

Income protection does not cover

Redundancy – if you leave a job or get made redundant.

Maternity Leave – having a baby is not a medical condition, so you’re not covered. However, you can make a claim if you can’t get back to work due to a pregnancy-related complication.

Illnesses or accidents that stop you from working temporarily but you’re back at work before serving your deferred period, e.g you break a leg and are out of work for four months, but your deferred period is six months.

If you’re not working at the time of a claim – if you fall ill between jobs, you’re not covered. Make sure to update your policy if you are between jobs.

Working abroad – if you move from Ireland, your policy is no longer valid

Will The Insurer Continue To Pay Income Protection if I’m Dismissed?

Yes, if your employer is evil enough to fire you while you are out on an income protection claim, at least your insurer has your back:

What happens to income protection if you’re dismissed?

What exclusions will prevent your policy from covering your income loss?

Exclusions vary between insurers so please be careful when it comes to choosing which provider you go with.

The cheapest isn’t always the best.

The following exclusions are common to all providers:

Pre-existing medical conditions you were aware of before taking out a policy

Disabilities or illnesses as a result of a criminal act

Self-inflicted injuries

Normal pregnancy and childbirth

Alcohol or drug abuse

War

Failure to follow medical advice

How sick do you have to be before income protection will payout?

A common theme I’m seeing from clients is the confusion between serious illness cover and income protection.

They’re 2 totally different products – it looks like we, as an industry, have made a balls of differentiating them.

Serious illness cover – pays out a lump sum should you contract a specific illness as defined on your policy.

e.g certain types of cancer, stroke, heart attack – so must be seriously ill for a successful claim.

Income protection – pays you an income for as long as you cannot work due to ANY illness or injury

e.g backache, stress – once the illness prevents you from doing your job, your policy pays out.

Serious illness cover exists to clear debt/pay medical bills.

Income protection can provide you with an income for the rest of your life to continue living as you do now.

Is there a limit or time frame on how long your income will be fully covered when you are unable to work and does its scale back as time goes on?

You pick the limit or time frame.

You can cover your income for 10, 20, 27, 32 (however many years you like) up to a maximum age of 70.

So if you buy an income protection policy to age 65, your policy will pay you a replacement income until you hit 65.

The income you receive doesn’t scale back.

If you insure yourself for €5000 per month, you’ll receive a taxable income of €5,000 per month until your policy ends.

In fact, you can add “claim escalation” to your policy – this means your payout increases by 3% every year you are out on a claim.

If I had income protection cover and I unexpectedly lost my job, would they pay me the equivalent of my lost income?

This is important.

Income protection does not cover redundancy.

It pays out if you’re unable to do your job not if you lose it.

You can get redundancy coverage as part of mortgage payment protection but we don’t offer that product. It’s gotten bad press for a reason.

If I have income protection from my employer, can I get another one as part of mortgage protection which will pay my mortgage while I cannot work?

You can have as many income protection policies as you like, but you must stay within the 75% of income rule.

So let’s say you earn €100,000, and you have a policy for €50,000 (50% of your income) through your employer.

You can take out an additional policy for the remaining 25% of your income i.e €25,000

If I have income protection, can I also get social welfare/illness benefits?

Yes, if you are entitled to a social welfare payment, you will receive it in addition to your income protection payment.

What if I relapse? Will income protection pay out again?

If I were to become ill with, say, stomach cancer. I recovered and returned to work after two years. Then sometime later, I got prostate cancer, or I had a bad car accident and was badly broken up (or some other thing). Does the policy payout again for another “thing” happening to me?

Yes, income protection can payout multiple times.

If you return to work and relapse with the same illness, you don’t have to serve the waiting/deferred period again.

You have to serve the deferred/waiting period if it’s a new condition.

What is the main advantage of having a separate income protection policy compared to life insurance and mortgage protection?

Mortgage protection – leaves a lump sum to your bank to clear your mortgage on death.

Life insurance – leaves a lump sum of money to your loved ones to replace your income should you leave them before your time.

Income protection – pays out while you are still alive. It provides a replacement income should you be unable to do your job due to illness or injury.

From a selfish point of view, income protection is the only one you will benefit from.

Life insurance and mortgage protection are for the ones you leave behind.

My question is income protection for the self-employed – am assuming it’s a non-runner?

No, not at all; in fact, income protection is essential if you’re self-employed because you don’t qualify for any state benefit.

But didn’t the government change all this a few years back?

I’m afraid not, the only thing that changed was access to the Invalidity Pension and you have to be permanently incapable of work to qualify.

It was a sop to the self-employed, but if you dig deep, it’s pretty worthless.

Medical criteria

An invalidity Pension is a payment for insured people who are permanently incapable of work because of an illness or incapacity. To qualify, you must: Have been incapable of work for at least 12 months and be likely to be incapable of work for at least another 12 months (you may have been getting Illness Benefit or Disability Allowance during that time)

Or

Be permanently incapable of work (in certain cases of very serious illness or disability, you can transfer directly from another social welfare payment or from your job to an Invalidity Pension).

So you can’t get it for 12 months, and you have to prove you can’t work for 12 more!

If you’re self-employed and you don’t have income protection, you’re a lunatic.

Read more here about income protection for the self-employed

How much will income protection cost me?

Surprisingly less than you think.

It depends on your

Occupation

Age

Health

Smoker/non

Amount of cover

Waiting period

Retirement age

Income tax bracket

Read this piece on the factors that influence the cost of income protection.

Does the cost of income protection change with age, and what guarantee does I have that the modest premium I now pay will not increase to an unsustainable amount in future?

If you choose a policy with a fixed premium, your premium will not change as you age.

However, if you choose a reviewable premium policy, your premium could increase every five years.

Here I compare reviewable and guaranteed premium income protection.

Should we both get income protection? (Particularly if one partner earns more than the other)

Ask yourself:

what if the lower paid partner couldn’t work long-term, would you be in trouble financially?

If the answer is yes, then you both need income protection.

But if the answer is no and affordability is an issue, then insure the higher earner only.

Sadly I have seen cases where the higher earner had to give up work to care for the lower earner, so it was a double whammy; both were hit with a reduced income.

The lower earner’s income protection policy was a lifesaver; without it they would have had to rely on the carer’s allowance and illness benefit only.

This is an extreme case, but it happens.

With income protection, as with all insurance, you prepare for the worst but hope for the best.

I was always wondering what insurance company should I have my policy with or maybe it does not matter because all insurance companies work the same way. If they are all different how would I know what company to take policy from?

Great question – that’s where I come in.

I know how income protection works in Ireland.

And I know the ins and out of all five income protection providers in Ireland so I can recommend the one that suits you best.

Each insurer has its own little quirks like these:

Aviva – can insure a homemaker

Irish Life – no minimum cover- suitable for lower incomes

New Ireland – guaranteed payout even if your income falls

Royal London – terminal illness benefit

Zurich Life – fairer occupation classes.

I’m currently on maternity leave. Can I get income protection?

Not now, but once you’re back at work, you can apply.

You can keep your income protection while on maternity leave, but it doesn’t pay out for maternity as pregnancy isn’t a “health issue”.

However, should an event during pregnancy stop you from returning to work (e.g childbirth complication or Post-Natal Depression), you can make a claim.

I’m self-employed; what if I cannot work, but I can still pay myself? Can I claim?

You can claim, but the insurer will reduce your payment by any income you receive from your employer, be it in the form of income or shared profits.

Before you take out income protection, make sure you will have an income shortfall to protect if you can’t work.

Can commission and overtime be included or is this not taken into account as it varies monthly?

This depends on the insurer.

Some will take a percentage of overtime/commission/bonus into account.

But if it’s a guaranteed bonus or your Statement of Earning can show it has been consistent over a number of years, some insurers will consider it all.

How do I pay? Monthly or yearly? Is it cheaper to pay annually, and is it by direct debit?

You can pay monthly or annually. The insurer will offer a small discount (3,4%) for annual payments). You can pay by direct debit or cheque/credit card.

If I have this for many years, for how long is the price likely to remain as per the quote?

Your price is fixed from the start unless you buy reviewable income protection. In that case, the insurer fixes your premiums for 5 years and reviews it every 5 years.

Can you claim tax relief on income protection?

Yes, you can claim tax relief on your premiums at your marginal rate of tax. If you’re a 40% taxpayer, you can claim 40% tax relief.

It’s a simple process to claim tax relief on Revenue’s MyAccount.

In effect, if your quote for income protection is €100 per month, it will only cost you €60. To help make this crystal clear we show both quotes on our website.

What’s the process for getting started? Do I just fill out some forms and pay or do I need to get medical or similar?

It depends on how much cover you are applying for.

If you’re under 35 you can apply for up to €1000 cover per week without having to do a nurse medical.

Under 40, you can apply for up to €900 per week without a medical.

Under 45, up to €800.

Under 50, up to €700.

Under 55, up to €500

And under 60, you can apply for up to €400 income protection per week without having to do a nurse medical.

If your cover is below the limits above, you can get cover based on an application form alone.

If I leave Ireland, can I transfer my salary protection to the country I move to? (I have no plans to do so – but you never know)

Yes, but if you make a claim while abroad, the insurer will limit the number of payments and will require you to return home now and again for medical tests.

What happens to my income protection if I change jobs?

If it’s a personally held policy, you can take it to your new employer even if you change occupation from an accountant to an acrobat. Just make sure your new income is strong enough to support a claim. If you’re getting a pay rise, you can increase your cover.

However, if you’re part of a group income protection scheme, this will end when you leave your job.

I assume that this only covers me for disability/injury etc. If I get in a position whereby I can’t find work any more (seems unlikely but you never know) I’d still have no way of getting social security etc. Is that correct?

Correct, income protection insures you against the inability to work due to illness/injury/disability, not redundancy/lack of work.

Do you have any case studies from people who have made an income protection claim?

Can I have two income protection policies?

You can have as many policies as you like as long as the total cover does not exceed 75% of your income.

So if you have a personal policy or a policy through your employer for 75% then that’s your limit, you can’t have a second policy.

However, if your other policy insures only 50% of your income, you can take a second policy for the 25% shortfall.

What if I have a second source of income outside my main occupation?

If it’s unearned income (e.g rental) then the insurer isn’t too bothered.

However, if it’s earned income that continues while you are out on claim, then the insurer may reduce your payout by that continuing income.

e.g someone who works in an office but also has farming income that continues while they are claiming income protection.

How do I increase my income protection cover?

You can increase your income protection in three ways:

1) Add inflation protection. Your cover will go up by 3% every year and your premium by 3.5%.

To make sure you receive the inflated payout, your income will have to increase over time too.

An example will clear things up:

Let’s say you earn €60,000 and you’re a PAYE employee who is eligible for an illness benefit of €10,556 per year.

You insure the maximum amount possible:

(€60,000 x 75% = €10,556) = €34,444 and add indexation which will increase your cover by 3% each year.

In 5 years, your cover has risen to €40,000.

You fall ill and make a claim.

The insurer will request proof of your income over the preceding 12 months when you make a claim.

If your income has remained at €60,000 then the maximum the insurer will payout is €34,444 (€60,000 x 75% – €10,556)

Your income would have had to risen to €67,408 to get the full €40,000. (€67,408 x 75% – €10,556) = €40,000

In other words, if you are adding inflation protection, you must be confident that your income will increase in the future.

Otherwise, you are in danger of over-insuring yourself.

Adding inflation protection will not increase your initial premium.

You don’t have to answer health questions.

The rate of inflation isn’t identical at all of the providers:

2) Every 3 years, you can increase cover by up to 20% of your initial cover

Your premium increases pro-rata. You can do this up to 5 times over the life of your policy, thus doubling your original cover.

The insurer will not ask you health questions – your health is fixed when you took out your policy.

3) Apply for an increase in cover whenever you get a pay rise

You must answer health questions for the additional amount.

How do I plan for increasing my future income protection payout if I am out on a claim long-term?

You can add “claim escalation/escalation in claim” to your policy from the outset.

This will increase your payout by 3% every year you are out on a claim, but, as with the indexation option, above, your income must be able to support the increased payout

How would you go about choosing the termination age of cover i.e. 55/60/65? Just pick the age you would like to retire?

It should match the ceasing age on your contract of employment.

If this isn’t on your contract, most people choose 68 as that’s when you’ll be eligible for the state pension under current rules.

But the way things are going, soon you’ll have to wait until 70 to get the pension!

Is my payout fixed even if I’m out of work long-term?

Yes, unless you added claim escalation when you took out your policy. If you did, your payout will increase by 3% every year you are unable to do your job.

Claim escalation will increase your initial premium.

Over to you…

As you can see there is an awful lot to income protection so Please, please, PLEASE take advice before you sign up/

How to choose an income protection broker.

If you don’t have an advisor, I’d love to help.

Complete our short income protection questionnaire below, and I’ll be right back with a no-obligation recommendation and some quotes.

Or if you’d like a quick chinwag first, please schedule a call here

Nick McGowan

lion.ie | making life insurance easier