Life Groups Calls on States to Review Agent Exam Difficulty

What You Need to Know

The ACLI is teaming up to ask for change with two competing producer groups: NAIFA and Finseca.

The group is proposing changes that could reduce some of the barriers that now keep otherwise qualified candidates from entering and staying in the industry.

They presented evidence that licensing exam pass rates vary widely by ethnicity, and from state to state.

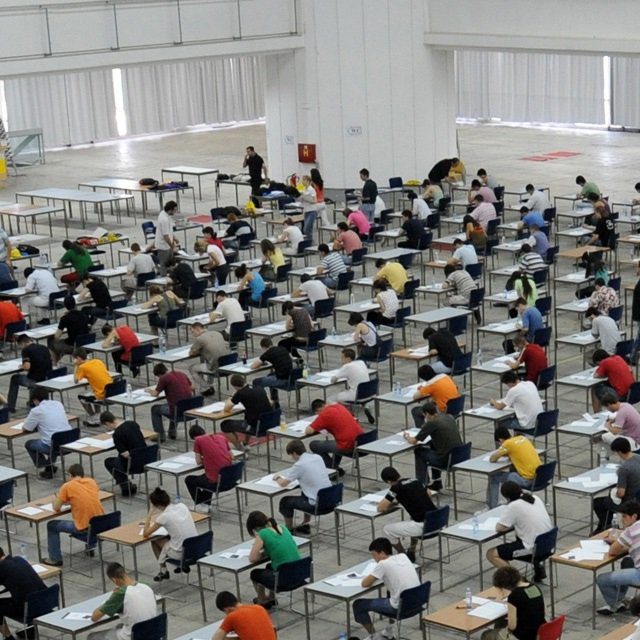

Life and annuity industry groups are asking states to update agent licensing rules, make training programs more convenient, and make licensing exams more convenient and easier to pass.

The American Council of Life Insurers has joined with two rival producer groups, the National Association of Insurance and Financial Advisors and Finseca, to send state lawmakers, insurance commissioners and other policymakers a new 10-page position paper, “A Workplan to Identify & Remove Unnecessary Barriers to Producer Licensure.”

The groups contend that better licensing rules would expand the supply of agents, brokers and other insurance producers, as well as increase producer diversity.

What It Means

Efforts to make the insurance producer community more diverse could soon make becoming an agent easier.

If you’re a financial advisor without an insurance license, you might be more likely to get a license and set up clients’ life and annuity arrangements yourself.

Financial professionals who are already licensed could face more competition, and concerns about whether the new people really know what they’re doing.

Training program and licensing exam vendors might face new pressure to update their products and services to a new licensing environment.

The Proposal

In the United States, state regulators have jurisdiction over producer training, licensing exam and license retention requirements.

The ACLI, NAIFA and Finseca have asked states to:

Update background check procedures

Eliminate or reduce mandatory training course requirements

Increase access to online exams

Allow use of exams and educational materials in languages other than English

Look into the possibility that some licensing exams may simply be too difficult

The trio says the changes could lower some of the barriers that now keep otherwise qualified candidates from entering and staying in the industry.

“This will not only support individuals of underserved and underrepresented communities but will also serve to encourage insurers and agency leaders to provide access to protection and savings products for all individuals,” the groups say.