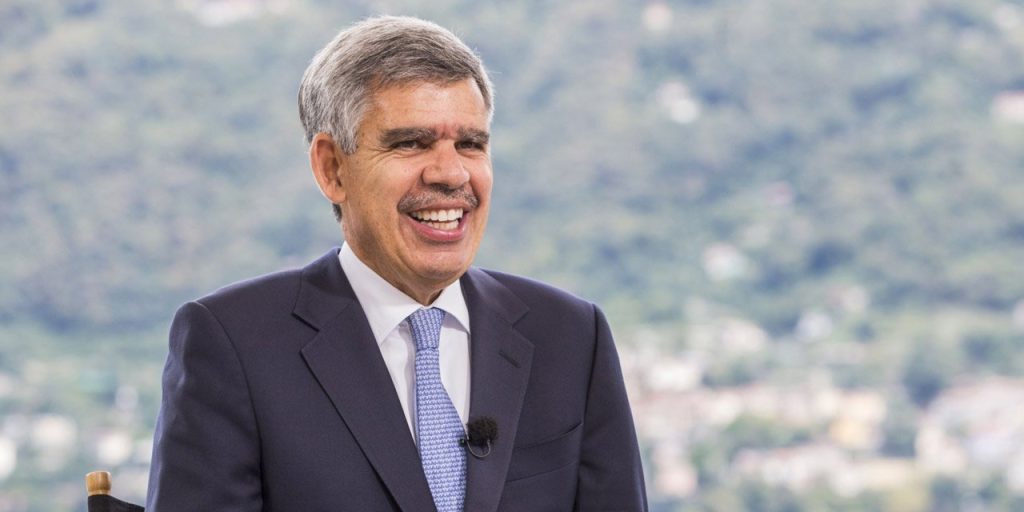

Mohamed El-Erian: 10 Insights for Advisors When There's 'No Safe Haven'

5. Stick with a heavy U.S. portfolio allocation.

U.S. assets have outperformed the rest of the world for four or five years and it makes sense for investors to stick with domestic securities for now, El-Erian said.

“Lots of people have advocated investors should fade the U.S. and they should put more money outside the U.S. And my reaction has been consistently ‘not yet, not yet, not yet,’ and those who have faded the U.S. have underperformed,” he said.

“The U.S. is by far the more resilient economy,” with very strong balance sheets, he said. “We’re much more entrepreneurial than the rest of the world” and are viewed as a safe haven, attracting money from around the world when things get tough, he added.

“I wouldn’t give up on a heavy U.S. allocation as yet. The time will come, but I don’t think we’ve fully priced in the global growth concerns that are ahead of us and if we do price them in, once again, it’s going to hit the rest of the world much more than it hits U.S. assets,” El-Erian said.

(Image: Shutterstock)