Pick Up the Phone: Older Clients Want to Hear From You

What You Need to Know

Assured Allies tries to keep people with long-term care insurance independent.

Those people might be your LTCI clients.

The company sees one thing as the secret to holding down claims.

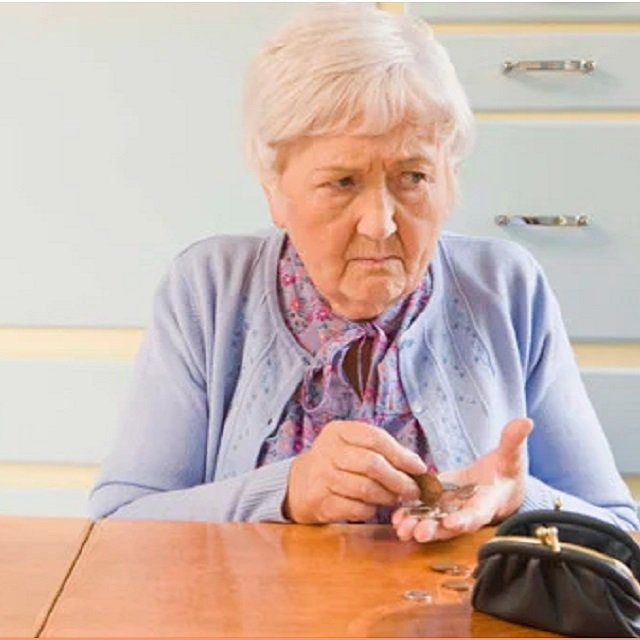

Your older clients might be less interested in meeting you face-to-face than they were before the COVID-19 pandemic started, but they might be more interested in talking to you on the telephone.

Dr. Afik Gal, a co-founder of Assured Allies, a Boston-based long-term care insurance claim prevention company, talked about older Americans’ communication preferences in an email interview.

LTCI insureds have been less open to meeting with Assured Allies team members in their homes for in-person assessments than Assured Allies had expected.

But “they are more open to participating in online surveys, and video- and phone-based data collection efforts,” Gal said. “We also observed, especially at the peak of the pandemic, that older adults actually wanted to speak with us, and for longer durations, in part due to their feeling of isolation.”

Even now, when many older adults have started to ease up on social distancing, Assured Allies sees strong LTCI-insured engagement with its outreach efforts. The response rate to its direct mail efforts, for example, is over 20%.

What It Means

The people Assured Allies is talking to are the kinds of conscientious, relatively affluent people who might have bought their LTCI coverage from you, or who may have bought other types of insurance policies or annuities from you.

If they are happy to talk to Allied Allies team members, they might be happy to get a pleasant, low-pressure call from you, too.

The History

Gal and Roee Nahir started Assured Allies in 2018, to use a risk-scoring system they developed to predict how people will age and to try to improve how people will age.

In late 2020, the company began working with LTCG — a company that administers LTCI for many insurers — to use its risk-assessment and risk-management strategies to try to hold down LTCI claims.

The company and LTCG are hoping that the Age Assured program can use care management services, fall prevention services, caregiver training and other services to improve the insureds’ quality of life now and to lower the risk that the insureds’ will need LTCI benefits later.

That means keeping the insureds from suffering dementia, or from needing help with major “activities of daily living,” such as going to the bathroom.

Here are some lessons Gal said he has learned from his work on the Age Assured program.