Tensions Peak between Urgent Cost-of-Living Crisis and Sustainable Climate Action: Global Risks 2023

World Economic Forum Global Risks Report 2023

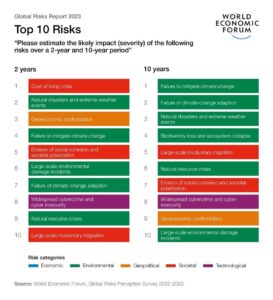

Cost of living crisis is biggest short-term risk while failure of climate mitigation and climate adaptation are largest long-term concerns

Geopolitical rivalries and inward-looking stances will heighten economic constraints and further exacerbate both short- and long-term risks

Global Risks Report urges countries to work together to avoid “resource rivalries”

Report draws on views of over 1,200 experts, policy-makers and industry leaders

Read the Global Risks Report 2023 and find out more about the Global Risks Initiative

Geneva, Switzerland (Jan. 11, 2023) – For the past 17 years the World Economic Forum’s Global Risks Report has warned about deeply interconnected global risks. Conflict and geo-economic tensions have triggered a series of deeply interconnected global risks, according to the World Economic Forum’s Global Risks Report 2023. These include energy and food supply crunches, which are likely to persist for the next two years, and strong increases in the cost of living and debt servicing. At the same time, these crises risk undermining efforts to tackle longer-term risks, notably those related to climate change, biodiversity and investment in human capital.

These are the findings of the Global Risks Report 2023, released today, which argues that the window for action on the most serious long-term threats is closing rapidly and concerted, collective action is needed before risks reach a tipping point.

The report, produced in partnership with Marsh McLennan and Zurich Insurance Group, draws on the views of over 1,200 global risk experts, policy-makers and industry leaders. Across three timeframes, it paints a picture of the global risks landscape that is both new and eerily familiar, as the world faces many pre-existing risks that previously appeared to be receding.

At present, the global pandemic and war in Europe have brought energy, inflation, food and security crises back to the fore. These create follow-on risks that will dominate the next two years: the risk of recession; growing debt distress; a continued cost of living crisis; polarized societies enabled by disinformation and misinformation; a hiatus on rapid climate action; and zero-sum geo-economic warfare.

Unless the world starts to cooperate more effectively on climate mitigation and climate adaptation, over the next 10 years this will lead to continued global warming and ecological breakdown. Failure to mitigate and adapt to climate change, natural disasters, biodiversity loss and environmental degradation represent five of the top 10 risks – with biodiversity loss seen as one of the most rapidly deteriorating global risks over the next decade. In parallel, crises-driven leadership and geopolitical rivalries risk creating societal distress at an unprecedented level, as investments in health, education and economic development disappear, further eroding social cohesion. Finally, rising rivalries risk not only growing geo-economic weaponization but also remilitarization, especially through new technologies and rogue actors.

The coming years will present tough trade-offs for governments facing competing concerns for society, the environment and security. Already, short-term geo-economic risks are putting net-zero commitments to the test and have exposed a gap between what is scientifically necessary and politically palatable. Dramatically accelerated collective action on the climate crisis is needed to limit the consequences of a warming world. Meanwhile, security considerations and increasing military expenditure may leave less fiscal headroom to cushion the impacts of an elongated cost of living crisis. Without a change in trajectory, vulnerable countries could reach a perpetual state of crisis where they are unable to invest in future growth, human development and green technologies.

The report calls on leaders to act collectively and decisively, balancing short- and long-term views. In addition to urgent and coordinated climate action, the report recommends joint efforts between countries as well as public-private cooperation to strengthen financial stability, technology governance, economic development and investment in research, science, education and health.

“The short-term risk landscape is dominated by energy, food, debt and disasters. Those that are already the most vulnerable are suffering – and in the face of multiple crises, those who qualify as vulnerable are rapidly expanding, in rich and poor countries alike. In this already toxic mix of known and rising global risks, a new shock event, from a new military conflict to a new virus, could become unmanageable. Climate and human development therefore must be at the core of concerns of global leaders to boost resilience against future shocks,” said Saadia Zahidi, Managing Director, World Economic Forum.

John Scott, Head of Sustainability Risk, Zurich Insurance Group, said: “The interplay between climate change impacts, biodiversity loss, food security and natural resource consumption is a dangerous cocktail. Without significant policy change or investments, this mix will accelerate ecosystem collapse, threaten food supplies, amplify the impacts of natural disasters and limit further climate mitigation progress. If we speed up action, there is still an opportunity by the end of the decade to achieve a 1.5ᵒC degree trajectory and address the nature emergency. Recent progress in the deployment of renewable energy technologies and electric vehicles gives us good reasons to be optimistic.”

Carolina Klint, Risk Management Leader, Continental Europe, Marsh, said: “2023 is set to be marked by increased risks related to food, energy, raw materials and cyber security, causing further disruption to global supply chains and impacting investment decisions. At a time when countries and organizations should be stepping up resilience efforts, economic headwinds will constrain their ability to do so. Faced with the most difficult geo-economic conditions in a generation, companies should focus not just on navigating near-term concerns but also on developing strategies that will position them well for longer-term risks and structural change.”

The Global Risks Report is a pillar of the Forum’s Global Risks Initiative which works to promote greater common understanding of short-, mid- and long-term global risks to enable learning on risk preparedness and resilience. This year’s report also examines how present and future risks can interact with each other to form a “polycrisis” – a cluster of related global risks with compounding impacts and unpredictable consequences. The report explores “Resource Rivalry”, a potential cluster of interrelated environmental, geopolitical and socioeconomic risks relating to the supply of and demand for natural resources including food, water and energy.

Read more about the Global Risks Report 2023 and join the conversation using #risks23.

About the World Economic Forum

The World Economic Forum, committed to improving the state of the world, is the International Organization for Public-Private Cooperation. The Forum engages the foremost political, business and other leaders of society to shape global, regional and industry agendas. For more information, visit www.weforum.org.

About Zurich

Zurich North America is one of the largest providers of insurance solutions and services to businesses and individuals. Our customers represent industries ranging from agriculture to construction and include more than 90 percent of the Fortune 500. We’ve backed the building of some of the most recognizable structures in North America — from the Hoover Dam to Madison Square Garden to the Confederation Bridge. Our North American, LEED Platinum® headquarters is located in the Chicago area. We employ approximately 9,000 people in North America and have offices throughout the U.S. and Canada. Further information is available at www.zurichna.com.

Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With about 55,000 employees, it provides a wide range of property and casualty, and life insurance products and services in more than 215 countries and territories. Zurich’s customers include individuals, small businesses, and mid-sized and large companies, as well as multinational corporations. The Group is headquartered in Zurich, Switzerland, where it was founded in 1872. The holding company, Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX Further information is available at www.zurich.com.

About Marsh & McLennan Companies

Marsh & McLennan (NYSE: MMC) is the world’s leading professional services firm in the areas of risk, strategy and people. The company’s nearly 65,000 colleagues advise clients in over 130 countries. With annual revenue over $14 billion, Marsh & McLennan helps clients navigate an increasingly dynamic and complex environment through four market-leading firms. Marsh advises individual and commercial clients of all sizes on insurance broking and innovative risk management solutions. Guy Carpenter develops advanced risk, reinsurance and capital strategies that help clients grow profitably and pursue emerging opportunities. Mercer delivers advice and technology-driven solutions that help organizations meet the health, wealth and career needs of a changing workforce. Oliver Wyman serves as a critical strategic, economic and brand advisor to private sector and governmental clients. For more information, visit mmc.com.

SOURCE: World Economic Forum

Tags: climate change, coronavirus, epidemic, Marsh & McLennan, outlook / predictions, report, top risks, trends, World Economic Forum, Zurich