Why Life Insurance Works so well for Retirement Income

Life Insurance used to generate retirement income is a slightly more advanced subject within the world of life insurance and financial planning. The stock jockeys hate it, and the life insurance agents love it. No surprise there.

But is there something that life insurance brings to the table that is truly special? Or are you better off betting your chips on the market to bring you through a prosperous retirement? The market, and other investments heralded by your broker or investment advisor seem to be the weapon of choice for generating retirement income, or at least that’s what your CFP says. But maybe, just maybe there is something we’ve neglected to think about here. And perhaps it required a little more grey matter flexing than parroting what the compliance approved brochure said about retirement income planning.

Risk, We Talk about it…a lot

Risk is a funny thing. Most people have some inherent idea about what it is and what it entails. But few of us really think about how it affects our lives, or give much thought to just how much if it exists. Perhaps this is because we want to be naturally optimistic. Or perhaps it’s simply because thinking about the number of risks we face for a task as simple as getting to work each day would make us all clinically depressed—good for Pfizer, bad for our pocket books.

In probability theory, we often learn and talk about types of risks and their measurability. Some risks are easily quantified, like the probability of loosing a bet on a slot machine in Vegas. Others are a tad more complicated to calculate, like the risk of having your house burn down tomorrow.

For risks that present a higher degree of complexity or challenge in crunching the numbers, we generally assign values to them in vague estimations. For example, I can’t tell you precisely what the probability is that my house will burn down tomorrow, but I’m confident that it’s pretty low.

When it comes to retirement planning, there are a number of risks the hopefully one day retiree will face throughout his or her journey to eventual golden girls-hood. There are some very obvious ones that anyone with a license to sell securities is likely to discuss like market risk, interest rate risk, systemic risk, and liquidity risk. And there are a few others that go beyond the typical textbook for level one financial advisor-dom like longevity risk and cash flow risk.

My goal today isn’t really to add a bunch of new types of risk to your list of doom and gloom, but rather to alter just a bit the paradigm under which we operate regarding risk.

Timing Risk, Easily Negated by Averages, or Serious Threat?

A form of risk that is up for debate among the financial planning establishment is the notion of timing risk. For the more educated on the topic of personal finance, this one is probably pretty self evident, but for the less equipped among you, I’ll assist with a little explanation.

Timing risk is simply the risk you face when entering a market. The risk involved is the idea that you’ll enter the market at an inopportune time—like when the market is really high—and you’ll lose money as a result of a market contraction (i.e. buy high sell low).

There are many in the bond and equities sales world—especially among the more mutual fund focused crowd—who would tell you that timing risk is avoidable with time and a nifty strategy known as dollar cost averaging. To these people, time averages out returns and so fearing a market entry is foolish because your forsaking opportunity to make money in the long run. Sounds like a really good pitch to sell some investment products, but I’ll admit that there is sound logic behind their averaging out argument, at least until you retire.

Retirement Timing Risk

Despite what most in the investment sales world will tell you, you really don’t have forever to wait for the market to come back, even if you are only 22 years old. Whether we like to admit it or not, there’s a relatively finite number of years between our first and last day at the office. And that 40 to 50 years will define how we finish out our lives. You only get one crack at it.

So what’s the probability that your investments will go bust?

That’s actually somewhat simpler to calculate than you might imagine—or at least it’s arguable easier than calculating the probability that I’ll be sifting through the ashes of my house tomorrow, assuming your investments are largely in stocks. But that specific question isn’t the one that I really care about, as retirement timing risk is less about the probability of a market contraction and much much more about the timing of such a contraction.

When the Market Brings you a Bear for your Retirement Party…

If the market brings you a bear for your retirement party, cry. Bear markets that strike early in retirement can be disastrous. We’ve known this for a really long time, but most of the investment world is pretty silent on the subject as it doesn’t have a really good answer for avoiding the consequences.

Here’s an example that help illustrate the point. Let’s use a hypothetical $1 million portfolio used to generate retirement income at $50,000 per year in income. This uses the 5% withdrawal rate that has been industry standard for decades.

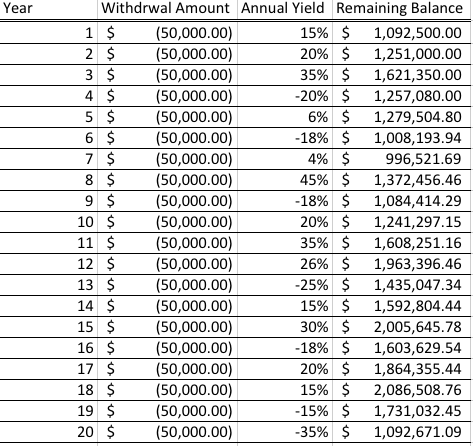

I’ve drawn up a random list of portfolio returns over a 20 year period the average return for all years is 6.85%, which is better than the last 10 years of the S&P 500, and a comfortable number according to what most major mutual fund companies tell me I can get with a well diversified bond and equity portfolio in retirement. Let’s start with the bull market scenario first.

Our first 3 years are really great market years. We see then see a few bears along the way, and towards the end we see some strong bears, but that doesn’t bother us much. We still wrap up the 20 years period with a million dollars still intact due to market appreciation. This is the sort of dream scenario found plastered on every sales brochure for every mutual fund company in existence.

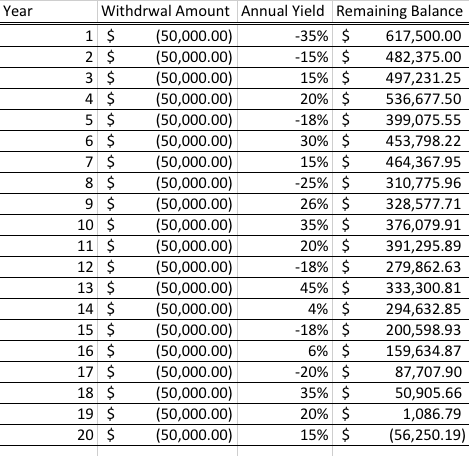

Now the bears come early.

I’ve done nothing but reverse the order of the returns, that’s it. The average return is still the same, of course, but this time we ran out of money…a year early.

This is what I mean by retirement timing risk. We can’t control when the market dips will take place, and as such we often can’t prevent a dramatically altered retirement if the market takes a bad turn around the time we’ve crossed out that last day on the calendar.

How Life Insurance Helps Negate this Problem

Life insurance is a low risk asset. We’ve mentioned this oodles of times. And while most of you will accept that for what it is, reliable, the fact of the matter is this low risk profile makes it a star student when it comes to income generation. Why? Because it’s not affected by market dips.

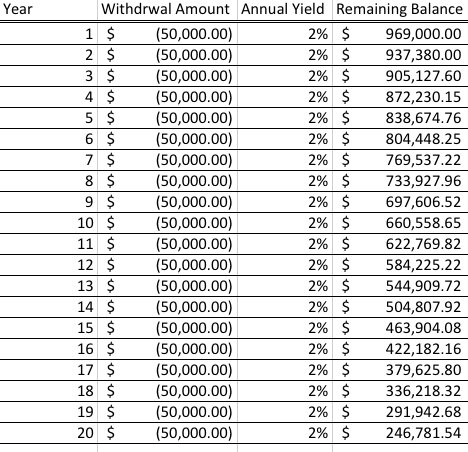

If we go back to our previous example and wipe out all of the hypothetical yearly yields and replace them with 2% returns each and every single year, our hypothetical retiree will have made it all 20 years with about a quarter of a million dollars to spare. Here are the numbers:

If you give me a million dollars and a guaranteed 2% yield indefinitely I can guarantee that you won’t be broke after 20 years if you withdraw $50,000 per year from the account. That’s mathematical fact. And the guaranteed rate on most whole life contracts is 100% better than our 2% return (and we haven’t even started talking about dividends).

Life insurance works so well for income purposes because it’s so incredibly stable. I’ve commented before that you won’t generally be excited about it, but you’ll be really happy it’s around when the rain comes pouring down.

Life insurance for income generation works, and it works well because we can eliminate so many other risks you have staring you in the face that you probably haven’t even considered. If you want to know more contact us, and if I don’t reply immediately maybe it’s because the probability of my house burning down was a tad higher than I thought.