How much is the payout for the Colonial Penn 995 plan?

How much is the payout for the Colonial Penn 995 plan?

You call Colonial Penn to get a quote for $15,000 in coverage and they tell you they can’t do that– you have to buy units. For a 68 year-old-male, 1 unit at $9.95 a month qualifies you for a total of $792 in life insurance coverage. Yes, $792 per $9.95 each month for one unit.

What is better term or whole life?

Term life coverage is often the most affordable life insurance because it’s temporary and has no cash value. Whole life insurance premiums are much higher because the coverage lasts your lifetime, and the policy grows cash value. Oct 6, 2021

How much is AARP life insurance a month?

AARP life insurance rates Costs average $156 per month for $100,000 in coverage, depending on factors like your age and health. Premiums increase over time in 5-year age brackets up to age 80. Dec 7, 2021

What does Suze Orman say about whole life insurance?

Suze believes that when whole or universal life insurance is looked at as a savings tool instead of just an insurance policy, the money that is contributed to a whole or universal life insurance policy could be earning a better rate of investment return elsewhere.

What happens after 20 year term life insurance?

What does a 20-year term life insurance policy mean? This is life insurance with a policy term of 20 years. If the policyholder dies during that time, the life insurance company pays a death benefit to his or her beneficiaries, often dependents or family. After 20 years, there is no more coverage, and no benefit paid.

Is whole life insurance a good retirement investment?

Whole life can be a good supplement for your retirement plans, but as noted, it should not be a stand-alone option. Compared to typical retirement investments (or even real estate), whole life insurance policies are insulated from market risk – which is good – but also tend to offer lower returns over time.

What are the limited benefits for the first 2 years with Colonial Penn?

A guaranteed acceptance life insurance from Colonial Penn can be purchased between the ages of 50 and 85, and the death benefit is limited for the first 24 months of coverage. Colonial Penn two year wait will not pay out a death benefit if you die from natural causes within the first two years of the policy.

What is basic term life insurance?

A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years – and if you die during that time a cash benefit is paid to your family (or anyone else you name as your beneficiary).

What does limited insurance mean?

Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract.

Who is the black actor on the Colonial Penn commercial?

Dennis Haysbert Born Dennis Dexter Haysbert June 2, 1954 San Mateo, California, U.S. Occupation Actor Years active 1978–present Spouse(s) Elena Simms ( m. 1980; div. 1984) Lynn Griffith ( m. 1989; div. 2001) 2 more rows

Is Colonial Life and Colonial Penn the same company?

Is Colonial Life and Colonial Penn the same insurance company? No. Colonial Life provides a range of life, and supplemental coverage plans to benefit the employees. Sep 8, 2021

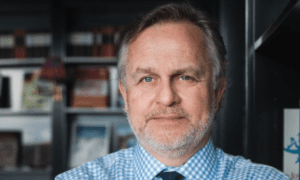

Is Jonathan Lawson real?

Jonathan Lawson was born June 3rd 1980 in Dunedin, Florida. He graduated high school in 1998 and spent the following 14 years as an infantryman in the Marine Corps where he not only served in combat, but also was a Master Instructor at the Marine Corps University.

Who bought out Colonial Life insurance?

Unum subsidiary Unum subsidiary Unum acquired Colonial Life in 1993 for $571 million.

Is Jonathan Lawson an actor?

Jonathan Lawson is an actor, known for Play for Today (1970).

What happens if I outlive my whole life insurance policy?

Most whole life policies endow at age 100. When a policyholder outlives the policy, the insurance company may pay the full cash value to the policyholder (which in this case equals the coverage amount) and close the policy. Others grant an extension to the policyholder who continues paying premiums until they pass.