Allstate reveals warning for US motorists

With summer travel activity expected to increase this year, the major US auto insurer Allstate has issued a report warning that roadways have increasingly become much riskier despite the pandemic – and even more so during the summer months.

Allstate noted that numerous roadway safety organizations, such as the National Highway Traffic Safety Administration and the National Safety Council, have detected a considerable increase in traffic fatalities during the COVID-19 pandemic these past two years. Corroborating these findings, Allstate examined its own collision data and alarmingly found a shift from below-average collision rates during the summer months before the pandemic to collision rates in the summer exceeding the monthly average by as much as 7.7% post-pandemic.

While collision totals in 2020 and 2021 were lower than previous years thanks to the effect of the pandemic on miles driven, Allstate suggests that driving activity has since picked up, and so the risk of accidents will only increase. Based on data from the insurer’s mobility data and analytics partner Arity, Allstate said that total miles driven started to exceed pre-pandemic levels as early as April 2021. And as of April 2022, national mileage is beating out last year’s records.

As traffic fatality estimates for spring 2022 are projected to be higher than 2021, Allstate believes that summer 2022 will see more of the same with the collision trend getting worse.

With collision rates on the rise, insurance costs are also expected to proportionally increase as well.

Read more: Allstate CEO says insurance premiums will have to rise further

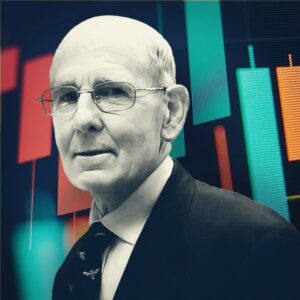

In an interview with Bloomberg earlier this month, Allstate CEO Tom Wilson stated that the insurer would have to raise its auto insurance prices this year to recoup its losses. The leader even hinted that while Allstate had already increased its premiums by 6.5% in the past six months, it may have to “go higher from there.”