Aon pegs 2022 insured natural disaster losses at $132bn

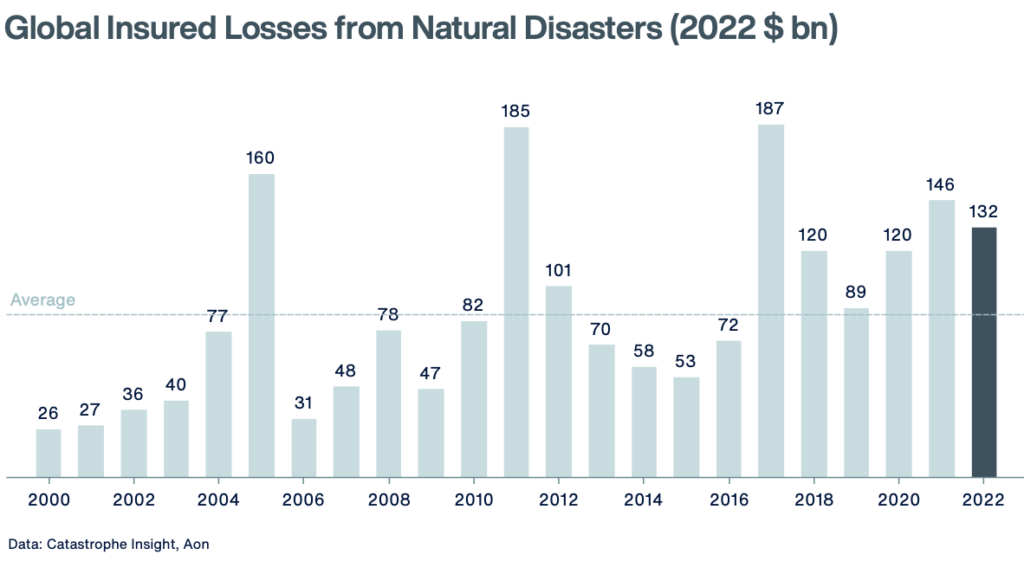

Global insurance and reinsurance broker Aon has estimated that annual insured losses from natural disasters reached $132 billion in 2022, making it the fifth most costly year on record for the industry.

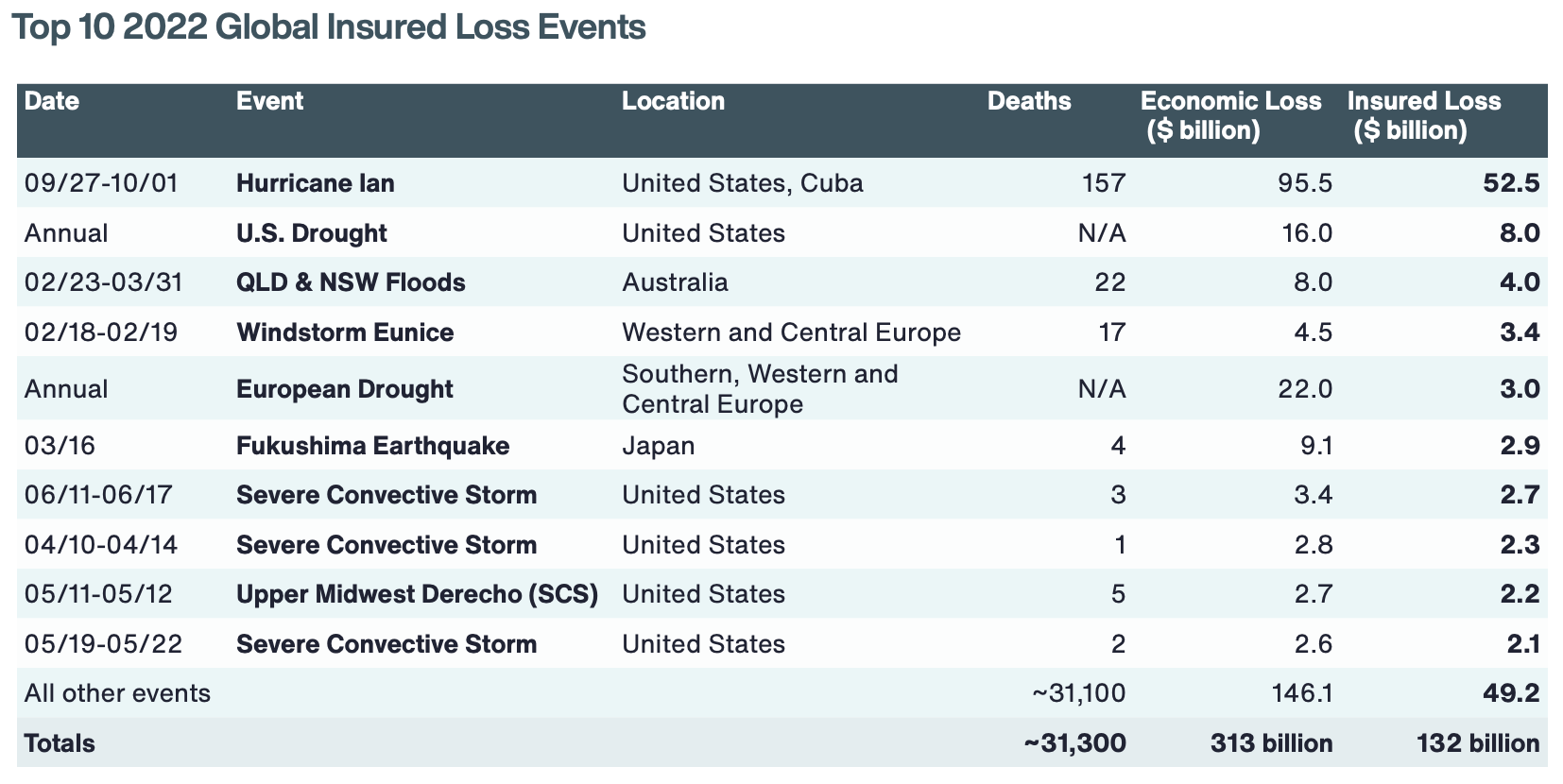

Between $50-55 billion of the global insured loss total is estimated to have come from September’s hurricane Ian in the United States, which is now the second-costliest natural catastrophe in history from an insurance perspective, Aon said.

Aon’s estimate for hurricane Ian is at the lower-end of many industry figures, which should give some more confidence to insurance-linked securities (ILS) and catastrophe bond investors, that the reserves and side pockets set are not going to worsen considerably.

Global economic losses from these natural disaster events are estimated at $313 billion by Aon, which is 4% above the 21st century average.

The protection gap, between economic and insured losses, was 58%, which Aon notes is among the lowest ever seen.

The broker said that this highlights a, “positive shift in how businesses are navigating volatility through risk mitigation, and how insurers are providing further protection to underserved communities through access to capital.”

Around 75% of insured losses came from the United States, as it remains ground-zero for catastrophe losses to the global insurance and reinsurance industry.

2022 was the third year in a row where global insured disaster losses surpassed $100 billion and Aon notes that the $132 billion total for the year was well-above the short, medium and long-term averages.

“This report explores the events and costs of catastrophes and natural disasters in 2022 that created a staggering amount of economic loss,” explained Greg Case, CEO of Aon. “But this data also highlights a tremendous opportunity for us to continue to better serve clients. By working together on scalable solutions, we will not only mitigate risk, but bring together public, private and societal forces to accelerate innovation, protect underserved communities and strengthen the economy.”

“Understanding and evaluating risk through the utilization of robust catastrophe data is essential to portfolio differentiation and successful outcomes, not just during challenging renewals periods, but as a matter of course,” added Andy Marcell, CEO of Aon’s Reinsurance Solutions. “Furthermore, through such comprehensive data analysis, the industry has a chance to transform volatility into opportunity through the development of new products to meet customer demand, while further reducing the protection gap. Forward-thinking in the insurance industry can drive the global economy forward not only through risk mitigation today, but by matching capital where it’s needed, such as via clean tech solutions and de-risking projects, which will encourage investments and build resilience for tomorrow.”

“The devastation that disasters caused around the world demonstrate the need for wider adoption of risk mitigation strategies, including better disaster management and warning systems that improve resilience,” added Michal Lörinc, head of Catastrophe Insight at Aon.

“While impacts of climate change become increasingly visible around the world, it is the socioeconomic aspects, demographics and wealth distribution that remain a major driver of financial loss.”

You can view the largest insured loss events of 2022 below:

.