Australian flood insured loss estimate now above $1bn, says ICA

The Insurance Council of Australia (ICA) has today revealed that claims from the recent and ongoing extreme rainfall and flooding in Southeast Queensland and New South Wales has increased by 12% on yesterday’s count, raising the insured loss estimate to more than $1 billion.

Of the 67,537 claims total, the ICA says that 66% are from Queensland and 24% are from New South Wales, where claims totals are expected to rise further in the coming days as the impact of the event becomes clearer.

82% of claims received so far are for domestic property, with the remainder related to motor vehicle.

The ICA says that based on previous flood events the estimated current cost of claims is now more than $1 billion, which is up on the $900 million reported by the council yesterday.

“The impacts of this event across two States are still coming into focus, and we are particularly concerned about the community of Lismore who have been absolutely devastated,” said Andrew Hall, Chief Executive Officer (CEO) of the ICA. “An army of insurance assessors are already on-the-ground helping with claims where it is safe to do so, and we are working closely with all levels of government and community to see this happen as quickly as possible.”

“Claims handling reforms have significantly improved the customer experience, and eligible customers in urgent need can now more quickly receive an advance cash payment of up to $5,000. Customers may also be able to access temporary accommodation under their policy, although I acknowledge that this is particularly tight in Lismore and some other locations.

“This event has just reinforced the need for a national conversation about what we build and where we build it, and to that end I welcome comments by NRRA head Shane Stone today and look forward to taking up this issue with State and Federal Governments in coming months,” he added.

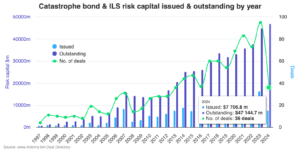

The above chart compares the current flood disaster versus last March 2021 which was ultimately seen as around an A$751 million event by PERILS AG, and another comparable cat event in the far north Queensland area, which was a roughly A$1.2 billion insurance industry loss.

As we explained previously, reinsurance is expected to trigger as Australian flood claims quickly rise, with some insurance carriers already highlighting their maximum retentions and others saying they expect to make recoveries.

Early assessments suggest that reinsurers will bear the brunt of the costs and that the toll could reach towards A$2 billion.