Cat bond spread widening drives ILS fund underperformance in May

The widening of spreads in the catastrophe bond market drove underperformance across much of the insurance-linked securities (ILS) market in May 2022, with funds invested into private ILS and collateralized reinsurance structures faring best.

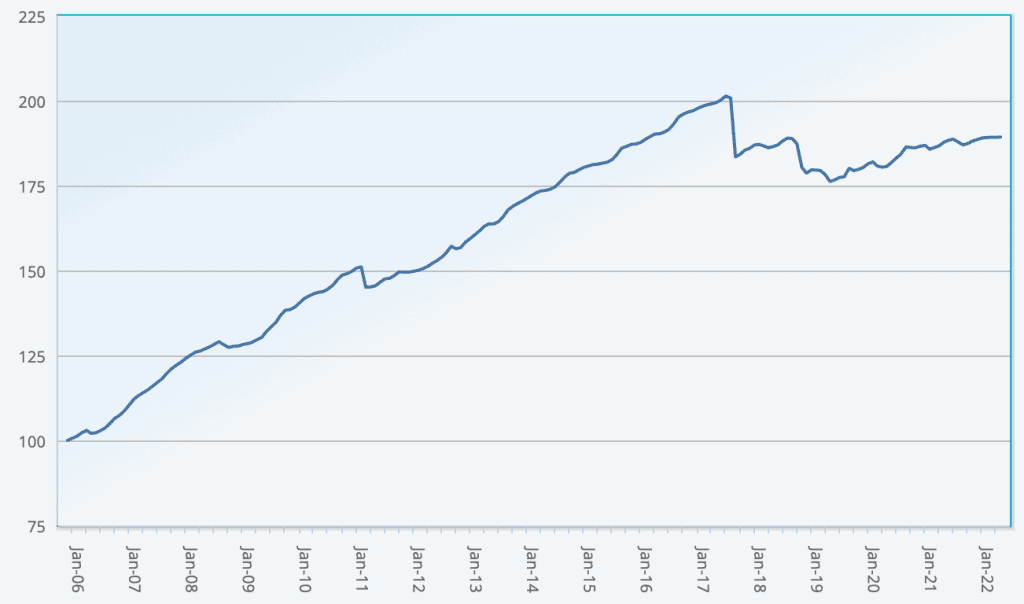

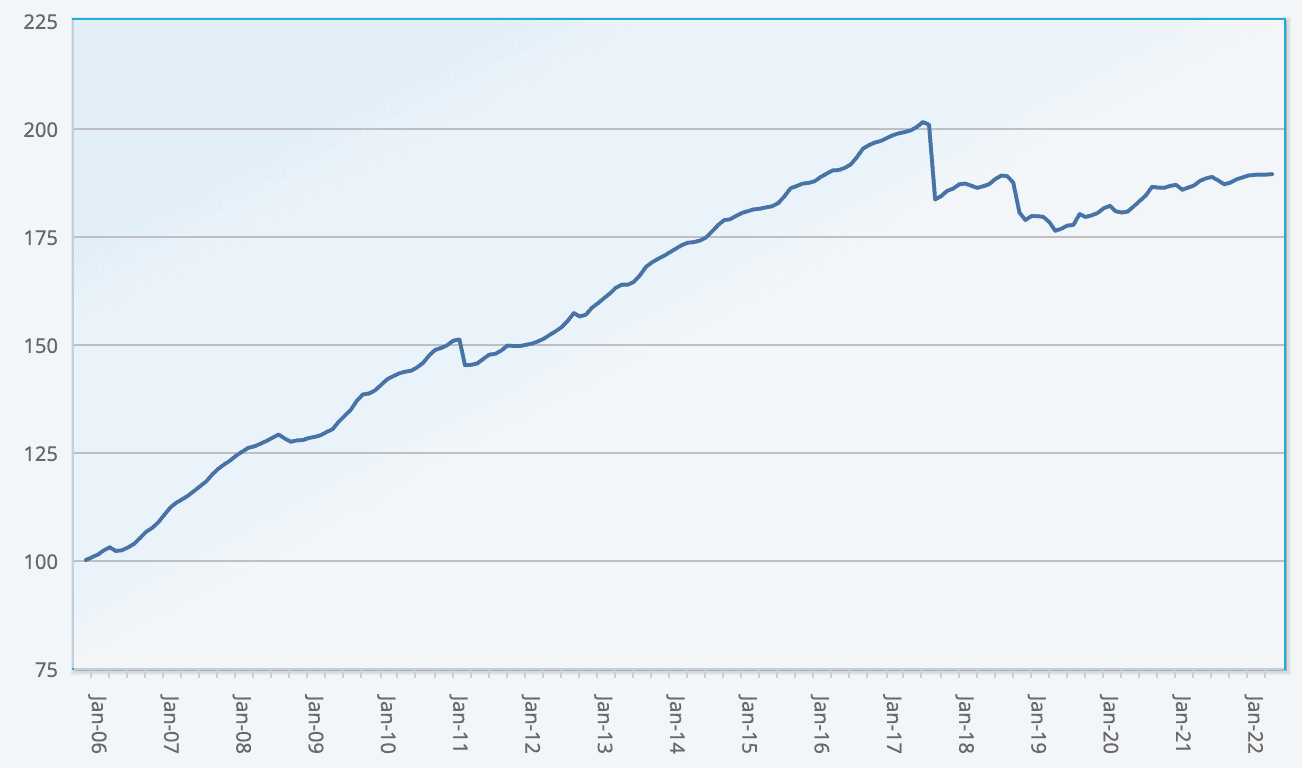

The average return of insurance-linked securities (ILS) funds was 0.05% return for May 2022, according to the Eurekahedge ILS Advisers Index.

May saw some of the fastest widening of spreads the catastrophe bond market has seen, with significant implications for pricing in the primary and secondary markets, as well as for forward return potential.

“Cat bond spreads widened further in May,” ILS Advisers explained, adding that, “Cat bond prices lost -0.70% in May, resulting in a -0.10% total re- turn for the Swiss Re Global Cat Bond Index.”

This pressure on pricing has served to dampen ILS fund returns, across any holders of catastrophe bonds it seems.

Pure catastrophe bond funds were down as a group for May 2022, losing -10% for the month, according to the Index.

Conversely, the subgroup of ILS funds that also invest in private instruments, such as collateralized reinsurance and retrocession, performed better, delivering a positive 0.16% return across the group in May.

Driving home the impact of the spread widening on the ILS fund market, ILS Advisers reports that 11 of the ILS funds it tracks for the Index were negative for the month of May 2022, while 13 ILS funds were positive.

The spread of performance across the group was not that wide, considering, as the seasonal returns of private ILS funds was only set to begin around this time of year.

So the gap between worst and best performing ILS funds for May was between -0.5% and +1.4%, ILS Advisers said, a far narrower range than seen in April.

The effects of spread widening are expected to also be seen in June’s results for the ILS Index, as while some stabilisation was seen, the price pressure did continue.

As the spread related price pressure effects unwind over the summer, catastrophe bond funds should find themselves positioned for a strong period of performance, given the higher returns of new issues, as well as secondary market buying opportunities presented during the pressured last few months.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.