Elevated multiples and spreads persist in cat bond market

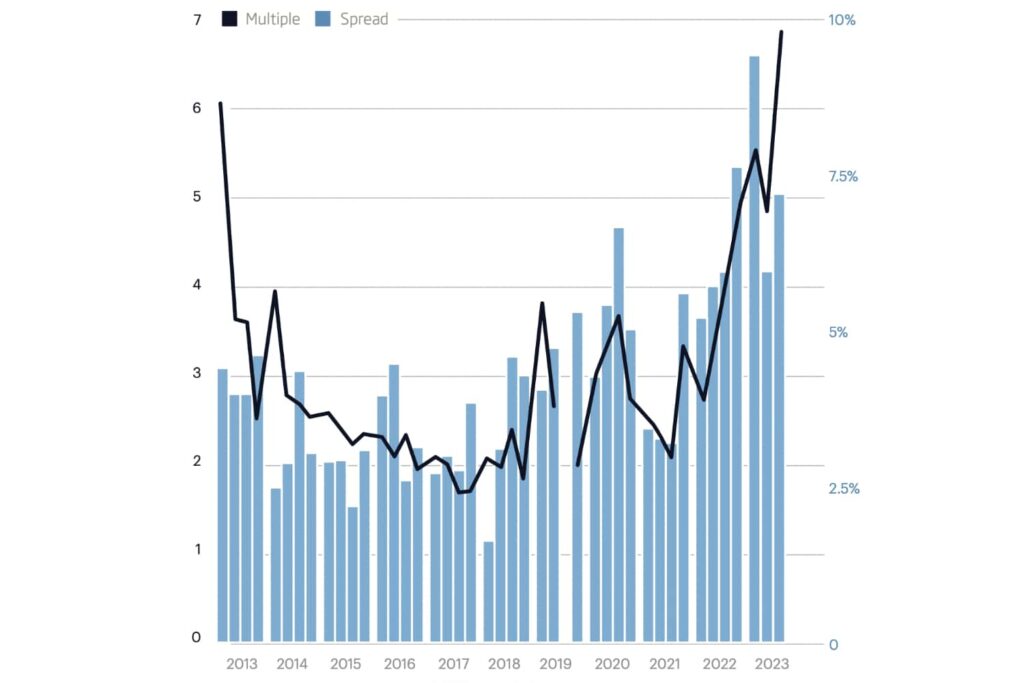

The average multiple (price coupon, or spread, divided by expected loss) of catastrophe bond notes issued has been on the rise for around two years, and in the third quarter of 2023 reached a new quarter high of 6.87, according to Artemis’ data.

At the same time, spreads have also been widening during this period, as a mismatch between supply and demand persists in a hardening phase of the reinsurance market cycle, which continues to impact insurance-linked securities (ILS) rates and returns.

In the Artemis Q3 2023 cat bond and related ILS market report, we explore the multiple and spread trend of quarterly issuance since the first quarter of 2013.

Of course, there are seasonal trends in issuance and the third-quarter is always the slowest, meaning the sample of data is less robust, but the trend of sustained higher spreads and multiples remains clear.

You can see from the chart below that while there’s often fluctuation from year-to-year to as a result of both micro and macro factors, since the end of 2021, there’s been a clear trend of higher multiples and spreads, which continued in the third quarter of this year.

The spread is the difference between the expected loss and coupon of a cat bond note, and across all deals issued, on average, reached a high of 9.41% in Q1 2023. While it fell to just below 6% in the second-quarter, it is still higher than at the end of 2021 so maintained the growth trend, and moved higher again in Q3 2023 to 7.16%, the third highest since 2013.

The average multiple of cat bond issuance was the lowest in Q3 2017 at 1.65, but since the start of 2020 has consistently been above 2. Between Q3 2020 and Q3 2021 the average multiple of issuance did decline quarter-by-quarter, but after picking up again in Q4 2021, has, for the most part, continued to rise in each quarter.

In fact, so far this year, the record for the average multiple has been broken twice, first in Q1 2023 when it reached 5.52, and then again in Q3 2023 at 6.87, the only time it has exceeded 6, according to Artemis’ data.

With market conditions expected to persist, it’s likely that the trend of higher spreads and multiples will continue into the final quarter of the year, and potentially next year as investors are likely to push for a continuation of higher risk-adjusted returns after some challenging years.

You can view pricing and other trends in our range of charts and visualisations on the catastrophe bond and related insurance-linked securities (ILS) market.

This data has been collected by Artemis over the 26 year period of the catastrophe bond market’s existence and is supported by over $156 billion of issuance we’ve tracked and collected data on since that time, all of which are detailed in the Artemis Deal Directory.

You can access all of Artemis’ catastrophe bond market reports here and analyse our data in charts and visualisations here.