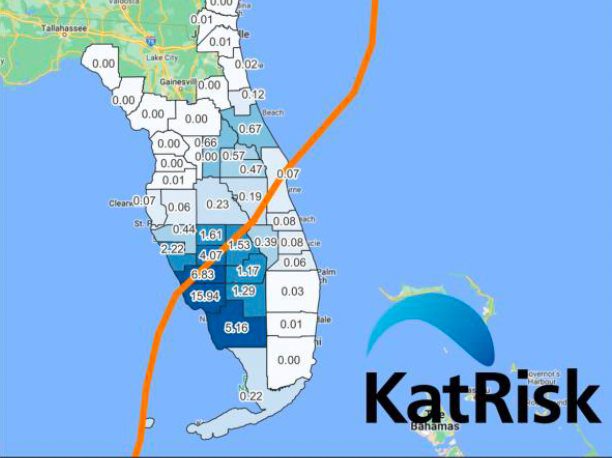

KatRisk pegs hurricane Ian insured losses at $46bn, +/- $16.1bn

KatRisk, a specialist provider of catastrophe modeling solutions for flood and wind risk, has published an estimate of wind, surge and flood related insurance market losses from hurricane Ian, pegging the total at $46 billion, but that figure could be plus or minus $16.1 billion.

KatRisk’s use of a standard deviation around its estimate implies something in a range from almost $30 billion to as high as $62 billion, so puts its figure right around where some of the catastrophe risk modellers currently stand (for example, KCC at around $63bn and Verisk at up to $57bn).

What’s interesting about the KatRisk industry loss estimate for hurricane Ian is that the flood component is higher than for other catastrophe modellers.

It’s important to note here that KatRisk’s figures include losses it estimates that FEMA’s National Flood Insurance Program (NFIP) will face.

KatRisk is intimately familiar with the NFIP’s exposure, having been the third-party catastrophe modeller on all of the flood insurers FloodSmart Re catastrophe bonds.

KatRisk’s estimate breaks down as follows:

Tropical cyclone wind ground up – $24.1bn +/- $13.8bn.

Storm surge ground up – $17.8bn +/- $7.1bn.

Inland flood ground up – $4.4bn +/- $1.6bn.

Combined – $46bn +/- $16.1 billion.

At the level of storm surge and inland flood insurance industry loss KatRisk estimates, which is including the NFIP, it is a strong suggestion that the NFIP’s share will be significant and that puts its reinsurance tower at-risk.

We’re told the NFIP’s flood insurance losses could well be into the lower layers of its reinsurance tower, which also means some of its FloodSmart Re catastrophe bonds would be likely to attach as well.

There still isn’t any clarity as to the level of losses the NFIP faces, but KatRisk’s modelling is well-attuned to the NFIP, given the work it undertakes for its reinsurance buying from the capital markets, so its figures could prove more accurate than other early estimates for water-based damages from hurricane Ian.

Also read:

– Verisk estimates hurricane Ian loss up to $57bn, warns could breach $60bn.

– Swiss Re cat bond index plummets on Hurricane Ian. US Wind down 32%.

– Well over $1bn of cat bond mark-downs expected after hurricane Ian.

– Hurricane Ian industry loss estimated close to $63bn by KCC.

– Plenum says estimated $50bn hurricane Ian to dent its cat bond funds.

– Hurricane Ian industry loss estimated up to $40bn by Fitch.

– Hurricane Ian to force a reevaluation: Millette, Hudson Structured.

– Hurricane Ian to cause Florida indemnity & FloodSmart cat bond losses: Twelve.

– Hurricane Ian Florida insured wind & surge losses $28bn – $47bn: CoreLogic.

– Hurricane Ian economic loss in Florida around $65bn: RMSI.

– Hurricane Ian: A historic hit for Florida, no matter the quantum of loss.

– Hurricane Ian to impact cat bond funds. Plenum says hit to be “limited”.

– Hurricane Ian to add reinsurance rate momentum, disrupt Florida market: KBW.

– A particularly broad cat bond mark-down this Friday?

– Cat modeller data hinted at hurricane Ian’s $50bn+ industry loss potential.

– Hurricane Ian: Rapid weakening may see losses nearer $32.5b, says KBW.