Spouse Employers HDHP Plan Has Highest Contributions. Still Worth It?

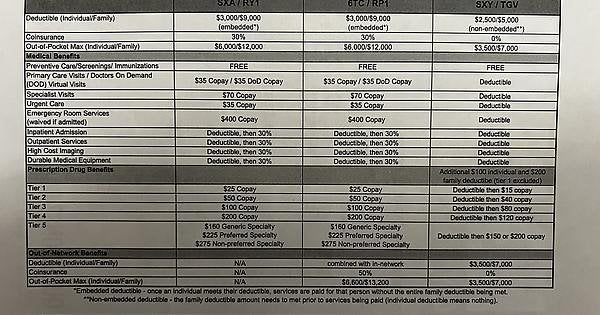

Title says it all but i’m including an image of the choices.

https://imgur.com/5QP4QXs

My spouses company is offering a new healthcare plan and we have the option to select a HDHP plan that includes an HSA. We have never had this opportunity before and the triple tax advantages it offers are appealing. However, the premium is higher than the HMO and PPO plans.

**About Us:**Me (38M) and my spouse (35F) have one child (6F) so looking at the family plans. Aside from annual routine visits we probably go to the doctor once or twice a year for a minor medical issue (sinus infection, flu) but are all generally healthy. We anticipate no upcoming medical expenses or additional family members. I can’t however, rule out a freak broken bone or similar medical emergency because the 6 year doing crazy 6 year old things.

The Plans:

**HMO Plan:**Deductible = 9,000Max Out of Pocket = 12,000Bi-monthly Premium = $90 (180 monthly or 2160 annually)

**PPO Plan:**Deductible = 9,000Max Out of Pocket = 12,000Bi-monthly Premium = $142.50 (285 monthly or 3420 annually)

**HDHP Plan:**Deductible = 5,000Max Out of Pocket = 7,000Bi-monthly Premium = $170 (340 monthly or 4080 annually)

**Our Goals:**Currently working on paying off last amount of student loan debt and working towards maxing out employer 401K’s. If going the HDHP route the goal would be to try and contribute the $7,300 max to the HSA but budgeting would be a stretch to reach the max.

Assuming we don’t have much medical spend and (hopefully) wouldn’t hit our deductible is the $4080 in premiums worth it? The employees offers no match or incentive to chose this plan aside from the tax advantage HSA.

Would I be better off going with the cheapest HMO plan and using the savings to instead max out a 401K or contribute to other investment vehicles or perhaps more quickly pay down our remaining low interest debt?

So help me make the right choice. Do we take advantage of the HDHP plan or just stick with the HMO? Am i missing some key element of how I should evaluate these offerings?