Strategic Priorities Respect Customer Time and Convenience

Published on

April 20, 2023

It’s the end of the day. If you aren’t working into the evening, there is dinner to make. There may be something you need to do with kids. You might take care of personal shopping. You may treat yourself to some television, listen to music, or read a book.

Let’s say you turn on the TV and you click on Netflix. There is a series that you’ve been watching for the last few months. You have been patiently limiting yourself to an episode per week, but tonight you “binge” on the last few episodes. The season is over. It was great. What do you have to look forward to the next time you watch TV?

What you don’t look forward to is painstakingly searching for something else to watch. That takes too much time. You quickly pick what Netflix recommends and you skim the short synopsis. Netflix has made it easy by saving you time, making it convenient, and giving you a rudimentary understanding in a matter of seconds. Oh…and it can do this because it knows you and the previous shows you seemed to like. Netflix shows are almost secondary to their service because you are at the center of every interaction.

How do companies use technology to help them lead?

Business leaders grasp the secret sauce of resilience and growth. It is a drive to please the customer that prioritizes the right technology decisions. They ask:

“What will it take to create customer experiences that are easy, thoughtful, and intuitive?”

“How can we build a company that operates with agility, flexibility, and data-driven decisions?”

It isn’t easy to do, but it is easyto understand. Today’s growth for insurers begins with picking the strategic priorities that will make a difference, then executing those priorities. In Majesco’s latest thought-leadership report, Game-Changing Strategic Priorities Redefining Market Leaders, Majesco shares valuable survey data from insurance executives regarding their company’s priorities for 2023. We then weigh insurer priorities against both individual and SMB customer opinions.

The result? A clear understanding of how insurers can move from a Follower or Laggard position into a Leader position and then keep it. In today’s blog, I look at how Majesco’s latest surveys point to operational transformations that produce customer-centric value.

How should insurers respond to the growing risk climate?

In a perfect world, insurance wouldn’t be needed. It is the risk in the world that makes insurance valuable and necessary to people and businesses.

As 2023 unfolds, we are facing a set of risks that appear new but are familiar to those who experienced them in the early 1980s. It is the return of older risks – inflation and cost-of-living crises as well as new risks with trade wars, supply chain challenges, rising medical expenses, increased costs in materials, fight for talent, significant worker retirements, widespread social unrest, and increasing crime – which many of today’s insurance business leaders have experienced.

The impact of these risks could be diminishing profitability and growth, as well as channel and customer loyalty – creating potential headwinds to insurer digital business transformation strategies and plans. Because times like these can be problematic and precarious for the future, it is more important than ever to rethink your approach and turn the headwind into a tailwind. The old proverb, “Necessity is the mother of invention” gains new relevance.

Insurers must accelerate their digital business transformation because technology and new operating models provide a foundation to adapt, optimize operations, innovate and deliver at speed as markets shift, customer needs and expectations shift, and change continues its relentless path forward. The rising importance and adoption of platform technologies, Cloud, APIs, microservices, digital capabilities, new/non-traditional data sources, and advanced analytics capabilities are now crucial to growth, profitability, customer engagement, channel reach, and workforce changes.

That’s the secret to managing risk. Risk is real. Risk is challenging. Risk, however, is our industry, our expertise, and our value. It’s up to insurers to beat the risk learning curve by learning how to cover, prevent and protect while at the same time anticipating customer preferences and needs.

Majesco’s latest consumer and SMB research has identified growing interest and demand for new products, value-added services, channels, personalization, and digital expectations. The year 2023 is poised to deliver some game-changing scenarios that will impact insurance.

Today’s question is, “Can we afford to ignore the business and technology trends that are re-imagining the value proposition for insurance and the future business model?” The answer is no…because pausing or holding back now will only create a widening competitive gap, placing insurers’ businesses at risk and placing them well behind leaders who are “putting the pedal to the metal.”

Good moves, and great opportunities to prove customer-centricity.

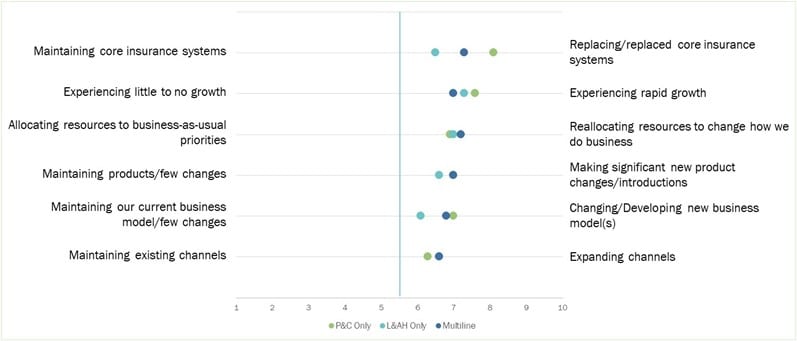

In the last two years, we are seeing the resurgence of replacing core legacy systems, reallocating resources to strategic areas, development of new products, and the rise of new business models. (See Fig. 1) What is driving this resurgence? How are they influencing sustainable, profitable growth?

Figure 1: State of the company last year, by company type

Insurers must continue to build on this momentum and focus on both operational and innovative strategies and priorities, with a customer-centric focus. And there is some movement in this direction as indicated in Figure 2. However, what is also obvious is that P&C-only insurers are outpacing L&AH-only insurers. This reflects the reality that P&C insurers are and have been ahead of the transformation and innovation curve the last 5-10 years, but it also exposes the growing pressure on L&AH insurers to keep pace with customers and distributors who are experiencing first had the value of digital transformation and expect it from every insurer, regardless of lines of business.

Further emphasizing this, our research with insurance customers – consumers and SMBs suggests insurers must shift and ratchet up their focus from an operational transformation of replacing legacy core systems to next gen Cloud solutions to generate greater value and benefits by proactively anticipating customer, channel, and partner needs and expectations.

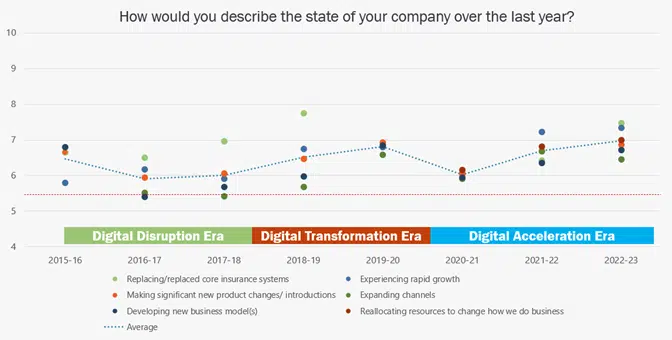

Figure 2: Trends in the state of the company ratings since 2015-16

Insurers can leverage their new foundation to create competitive differentiation, market leadership, and profitable growth. Technology enablement, cloud, ecosystems, data accessibility, AI, risks, products, and customer sentiment are pushing insurance out of tradition and into innovation faster than some may like.

But this push will give customers a better experience by cutting the time it will take to understand and purchase products and services as well as service them.

Links between transformation, customer-centricity and growth

Leaders, Followers, Laggards

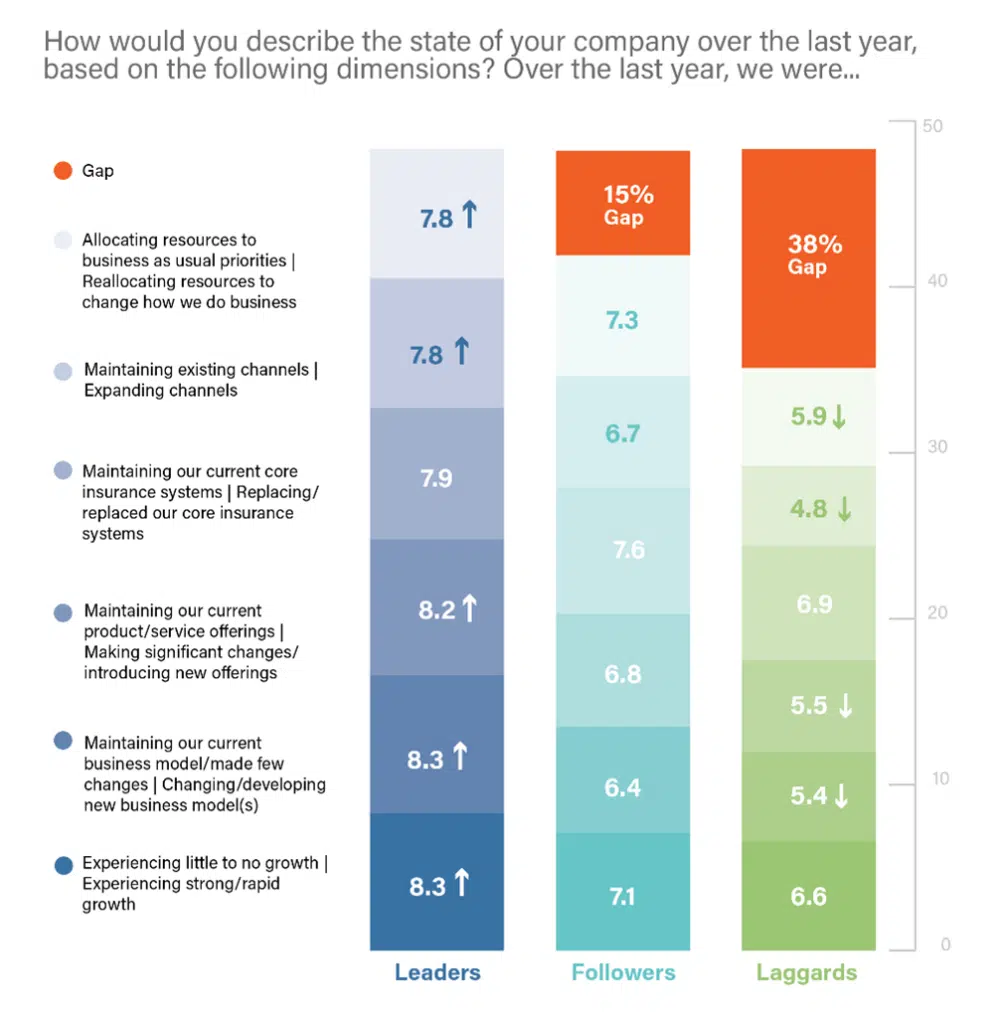

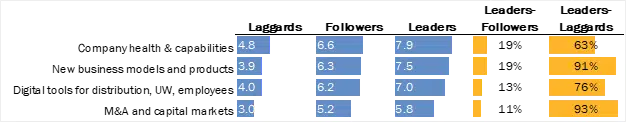

Each year, Majesco asks insurers to place themselves on a transformational scale (1-10) across six strategic priorities. When we stack the responses (See Fig. 3), it highlights the gaps between Leaders, Followers and Laggards. It also makes it easy to spot clear links between them and a focus to transform in ways that will positively impact customers.

As in previous years, Leaders continue to outpace Followers and Laggards as they describe the state of their business for the last year. Unfortunately, as compared to last year, the gaps increased slightly between Leaders and Followers from 13% to 15% and more profoundly between Leaders and Laggards from 20% to 38%.

The significant gap increase for Laggards is due to a decline in changing/developing new business models, new product offerings, expanding channels and reallocating resources – suggesting they are continuing business as is, rather than adapting to new market realities which will impact growth. Laggards must rethink their strategies and priorities and then execute on them to ensure future relevance. Leaders won’t stop expanding channels and developing new offerings to continue their focus on growth and meet the rapidly changing customer demands and expectations.

Figure 3: State of the company last year, by Leaders, Followers, and Laggards

Initiatives align with value-based improvements

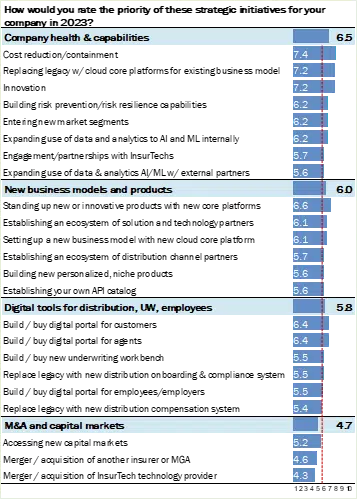

Four thematic groups emerged based on the 20 initiatives assessed in the survey, including:

Rating the highest average priority overall is Company Health & Capabilities, driven by the three highest-rated initiatives overall: cost reduction/containment (7.4); replacing legacy w/cloud core platforms for existing business model (7.2); and Innovation (7.2). (See Fig. 4) This reflects a balance between optimizing and innovating the business to meet the technology and customer demographic trends. Rethinking how insurance operates is more important than ever.

New Business Models and Products (6.0) and Digital Tools (5.8) show very healthy interest. Standing up new or innovative products on a new core solution (6.6) and digital portals for customers (6.4) and agents (6.4) reflect the need to meet new risks and customer needs and expectations as a priority for growth.

Figure 4: 2023 Strategic initiative priorities

Leaders prioritize initiatives that make a difference

Unsurprisingly, Leaders have the highest average priorities for all the initiative groups. Laggards are significantly behind in their consideration of these priorities, with gaps ranging from 63% to 93% reflected in Figure 5. What really stands out are the gaps in new business models and products (91%) and digital tools (76%), two crucial areas that address two key shifts – risks and customer expectations – putting Laggards at an increasing disadvantage in staying relevant.

Figure 5: Strategic initiative priorities of Leaders, Followers, and Laggards

Technologies to improve customer-facing capabilities

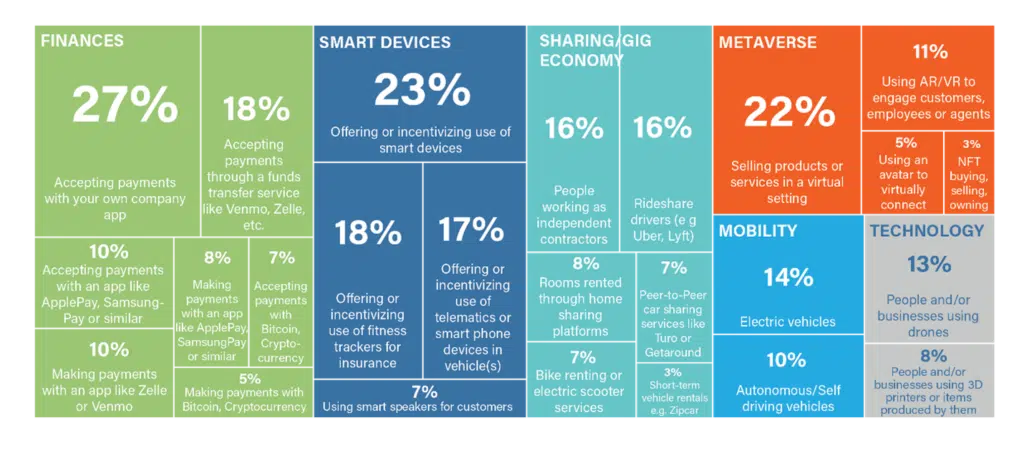

Because business models and new technologies are so intertwined, we wanted to look more closely at interest in specific technologies. Which technologies do insurers seem to think are the most crucial?

Using a list of 25 technology and business trends, we asked insurers which of them they were incorporating into their products and business capabilities. Surprisingly, insurers exhibit low activity in most of these areas. Only three are being addressed with over a 20% focus, including accepting payments with your own company app (27%, in the Finances group), offering or incentivizing the use of smart devices (23%, in the Smart Devices group), and selling products or services in a virtual setting (22% in the Metaverse group) as seen in Figure 6.

Figure 6: Technologies and trends being incorporated into insurers’ products and services

These low responses place insurers significantly out of sync with their customers (consumers and SMBs by generational group) on many of these trends and technologies, particularly given other businesses have embraced these technologies driving up customer expectations.

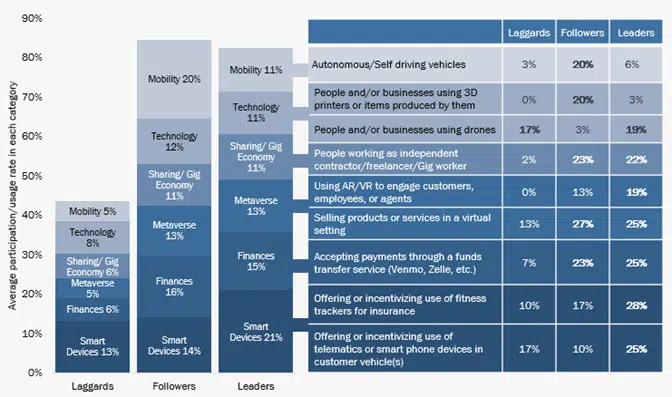

Looking at the detail behind tech priorities, however, yields some interesting data. Overall, Followers and Leaders are neck and neck across all the categories combined, with a slight edge given to Followers. However, the gap with Laggards is large, putting them at a significant disadvantage to both.

While Followers and Leaders are overall similar, there are some key differences. Followers have a strong lead over Leaders in Mobility (20% vs. 11%) whereas Leaders have a strong lead with Smart Devices (21% vs 14%), The smart devices trend is driven by two items, fitness trackers (28% vs. 17%) and telematics/smartphone devices in vehicles (25% vs. 10%). With Mobility, this is driven by autonomous/self-driving vehicles (20% vs. 6%). Leaders and Followers are demonstrating leadership in the IoT, and Telematics technologies used in vehicles or smart devices to provide new products, personalized ratings, and enhanced services.

Both Leaders and Followers have substantial leads over Laggards in all the groups except for Smart Devices, where Laggards are only 1% apart from Followers in use. Figure 7 shows the category averages for each group as well as callouts for the biggest gaps.

Figure 7: Key technology and trends gaps between Leaders, Followers, and Laggards

Strategic Priorities data in focus

The best way to understand this data is to consider it all through the eyes of the customer. For example, people working as independent contractors/freelancers or Gig workers are those most likely to need quick, easy, customized insurance solutions that ‘make decisions’ for them. Leaders and Followers are far more likely to pay attention to the technologies that they can implement to provide insurance and services “on the go.”

Selling products and services in a virtual setting might seem outlandish but think back to Netflix for a moment. What can be easier than selecting a new “product” while you’re in the midst of using a service that you enjoy? Netflix claims that 80% of viewing can be tied to its recommendation engine. Is the idea of a Metaverse channel offering any different? Today’s customer is using tomorrow’s channels ahead of the industry’s arrival. Keeping pace will require future priorities to cover future shopping, future purchase methods, and future risk mitigation.

What ties it all together is the technology behind the scenes. A new approach to core systems that Majesco is leading the industry on its intelligent core in the cloud, will give your company a better position to compete while it gives the business a cost-saving, sustainable model for future growth. This is where Majesco is focused across all our platforms and is reflected in the significant R&D to advance these solutions with our Spring 23 release to meet our customer and industry demands in a rapidly changing marketplace.

The results of this year’s report, Game-Changing Strategic Priorities Redefining Market Leaders, are exciting, enlightening, and thought-provoking. For companies that are interested in meeting customers where they buy, it will give you and your teams an excellent base for your strategic conversations throughout the year.

In insurance, we’ve accomplished our purpose when we meet new risks with an ability to help customers manage them. It is no longer an external vs. internal focus. It works when we design business models and capabilities that will serve both.