Republicans Attack HHS Over 'Family Glitch' Health Rule Change

The term “family glitch” refers to the spouses and children’s lack of access to premium tax credits.

A resolution of inquiry is a short measure that seeks facts from part of the government. Traditionally, the House has treated resolutions of inquiry in a more relaxed fashion than bills, and parties in the minority have seen filing them as a way to get the majority party’s attention.

The New IRS Approach

Under President Biden, IRS announced in April that it would try to use a regulation to eliminate the family glitch.

The White House Office of Management Budget is reviewing the final version of the regulation and expects to post the final version by December, according to the OMB regulatory review tracking system.

The Congressional Budget Office predicted in July that the family glitch fix would increase federal spending by $44 billion, bring in $10 billion in additional revenue, and increase the federal budget deficit by $34 billion over a 10-year period.

The CBO also predicted that the measure would cut the number of people with group coverage by an average of 600,000 per year over that 10-year period; decrease the number of uninsured people by 400,000; increase the number of people with Medicaid coverage or similar coverage by 100,000; and increase the number of people with commercial individual or family coverage by 900,000.

The Republican View

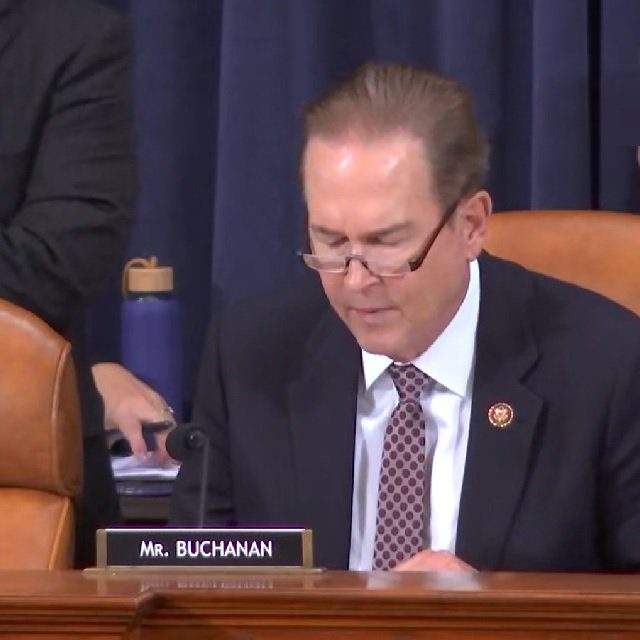

Buchanan said that he believes that career lawyers at HHS were not the ones who were mainly responsible for the change, and that pressure to change the family subsidy likely came from the White House.

Rep. Tom Rice, R-S.C. accused Biden of expanding the ACA with the stroke of a pen.

The Chairman’s View

Rep. Richard Neal, D-Mass., the committee chair, said one problem with the resolution was that it would not cut costs for working Americans, and that another was that it was based on an incorrect premise.

“To begin with,” Neal said, “the resolution is directed at the wrong federal agency. The Department of Health and Human Services is not in charge of interpreting the Affordable Care Act or provisions in the Internal Revenue Code. That responsibility lies solely with the Department of Treasury and the Internal Revenue Service.”

Pictured: Rep. Vern Buchanan, R-Fla. (Photo: House Ways and Means)